Abu Dhabi invests $ 436 million in the United States of America

The sovereign wealth fund in Abu Dhabi in Abu Dhabi took a bold step in the Bitcoin Market, where he invested $ 436 million in Bitcoin exchange funds listed in the United States (ETFS).

This acquisition, which was revealed in a file on February 14, with SEC, highlights the increasing interest of the National Fund with digital assets.

Abu Dabi Al -Maabadala has become the seventh largest holder of Black Rock Bitcoin ETF

Mobala presentation He explains that her investments are directed to Blackrock’s ISHARES Bitcoin Etf (IBIT), where she got more than 8.2 million shares in the fourth quarter of 2024. This represents a new site for the fund, where no previous IBIT holdings were reported in previous deposits.

After this acquisition, the Bloomberg analyst ETF James Sevart indicated that Mobala is ranked seventh, the largest known holder of IBIT.

The fund joins the elite list of institutional investors, and major companies such as Goldman Sachs, Millennium Management, and symmetry investments.

Meanwhile, the founder of the Binance Changpeng Zhao indicated that MUBADALA is only one of the sovereign wealth boxes of Abu Dhabi. he Proposal Other state -backed investment entities may also be exposed to Bitcoin’s investment funds.

Market monitors also indicated that Mbadala’s investment is in line with the batch of the broader Emirates to establish itself as a major center for innovation in the United Arab Emirates. Over the years, Abu Dhabi has placed itself as a major destination for companies looking for supportive investment conditions.

This has led to the introduction of the progressive regulations that attracted the main industry players looking for an appropriate jurisdiction for encryption.

Global Bitcoin adoption race

Mbadala investing reflects an increasing trend between global institutions that seek to be exposed to bitcoin.

This shift comes at a time when politicians consider the possibility of strategic encryption reserves. Some in the United States government suggested that Bitcoin could be part of this initiative.

The American Senator Centeh Lomes stressed the importance of Mobala’s development, indicating that a global race for bitcoin was exposed.

“I told you that the race was running. It is time for America to win,” Lummis books On x (previously Twitter).

The legislator submitted the Bitcoin Act for 2024, and suggested the creation of the American Bitcoin Reserve. The plan includes selling part of the Golden Government’s possessions to finance the purchase. If a year, he will secure a million bitcoin, or approximately 5 % of the total offer.

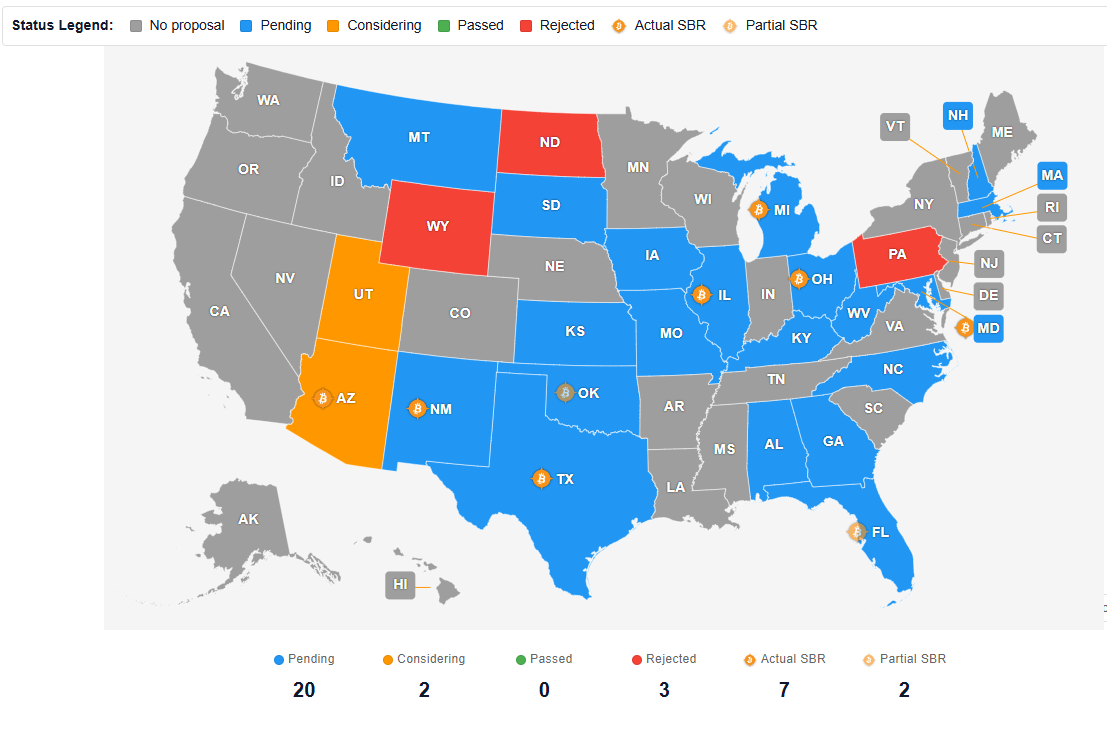

While the federal government’s position is still inaccurate, many American states have taken independent steps to integrate bitcoin into their financial policies. I have proposed more than 20 states or legislation to facilitate encrypted currency investments.

Industrial leaders look at these developments as a brand on a global race for bitcoin adopting. Dennis Porter, CEO of the Satoshi Law Fund Assure The American countries lead this shift. Given this, analysts expect the country to appear as a leading homeland.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.