HEDERA is 4 % while the bears are dominated: What is the following for HBAR?

HEDERA (HBAR) shows twice as much as they decrease 4 % on Thursday. The market ceiling is now near the 8 billion dollar sign. Modern technical indicators indicate that sellers may control, especially since the strength of the trend begins to shift.

The DMI and Ichimoku cloud indicates a market that has been discovered in monotheism but tends to land a little. With a major resistance, which threatens to develop the development patterns, the next step for HBAR may be it is very important.

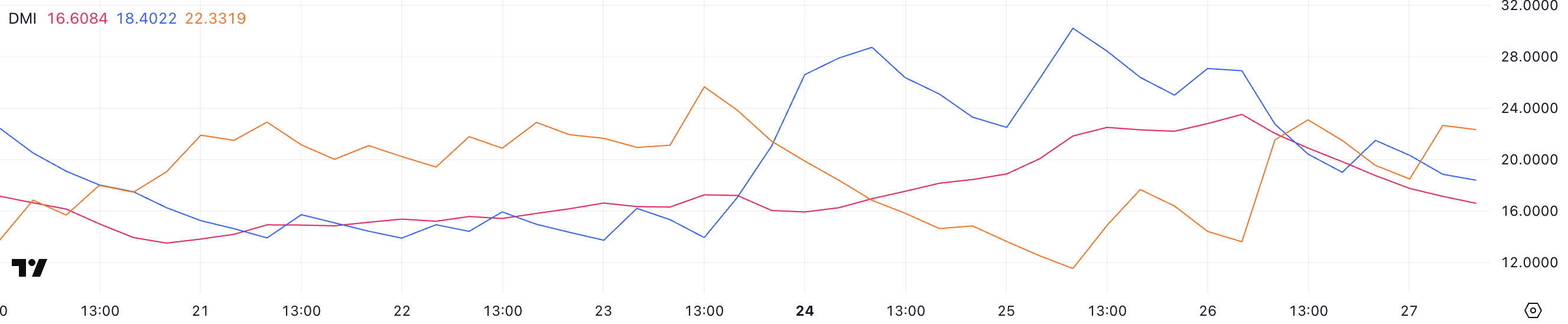

HBAR DMI shows sellers in control

HEDERA (DMI) plan explains that the average trend index (ADX) is currently sitting at 16.6, a noticeable decrease from 23.5 yesterday.

ADX is a major indicator used to measure trend strength, and that a drop like this indicates that the momentum behind any modern step – urinary or landing – weakens.

ADX less than 20 years old indicates that there is no clear direction or a side movement, which is in line with the last HBAR unification stage that has been observed over the past few days.

ADX does not point itself to the direction of the direction, just its strength. In general, values that are less than 20 indicates a weak or not present direction, 20-25 indicates a potential emerging trend, values above 25 indicate a strong direction.

Besides ADX, DMI’s +DI (positive trend index) and -di (negative trend index) gives an insight into the direction. Currently, +Di at 18.4, decreased from 26.9 yesterday, while -Di rose to 22.33 from 13.61.

This face in directional strength indicates that the declining momentum is increasing while the bullish momentum fades.

Besides ADX, this may mean that although sellers acquire the upper hand, the general trend still lacks condemnation. This enhances the idea that HBAR is likely to remain in the term unless the penetration is confirmed by a new direction.

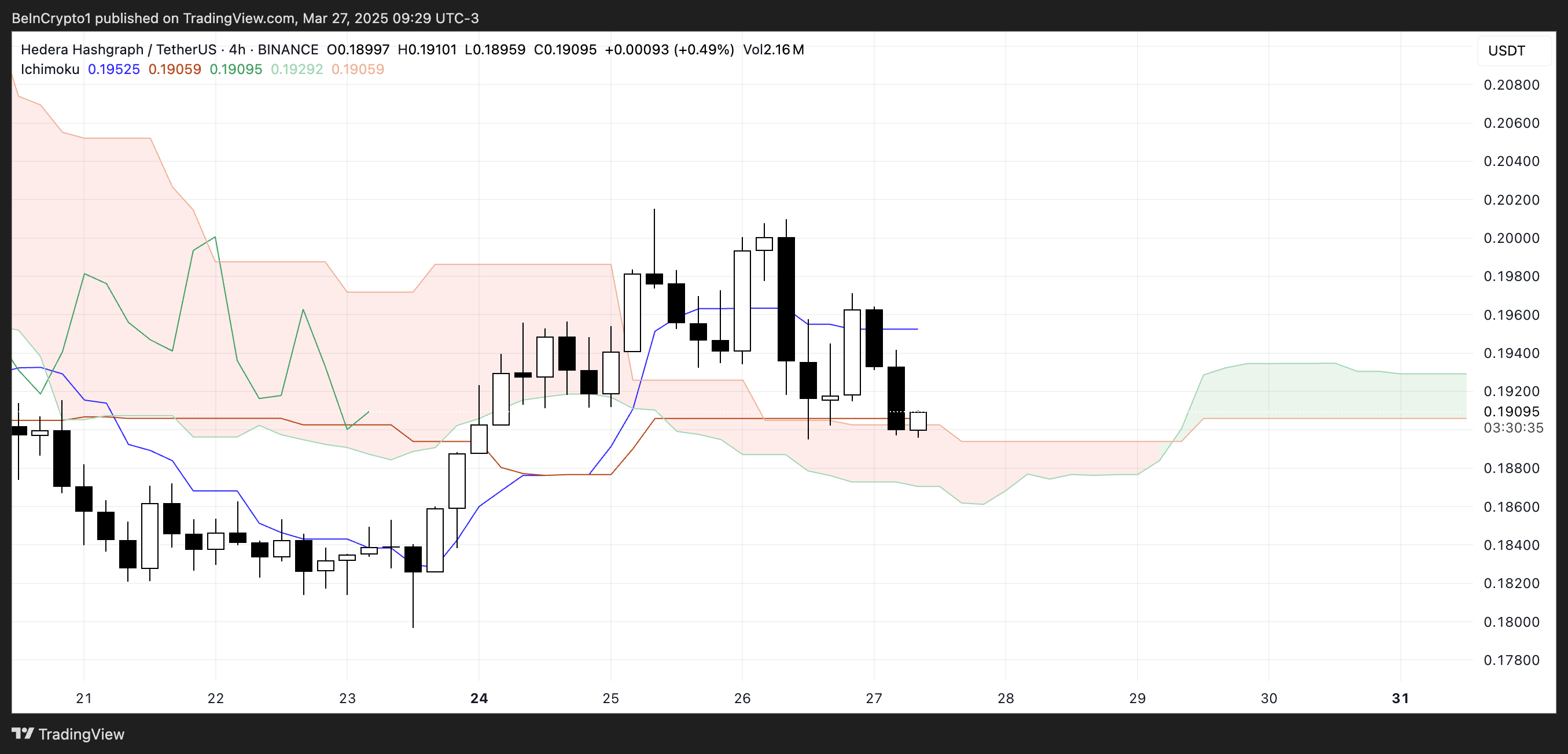

The Hedra Ichimoku cloud indicates that there is a declining trend that can arise soon

HEDERA’s Ichimoku cloud plan reveals a market in a balance, with the price hovering near the lower border of the cloud. Modern candlestick shows a clear frequency in this field, which reflects continuous monotheism.

Kijun-Sen (blue line) has turned, indicating losing momentum and a potential stop in the direction. Likewise, Tenkan-Sen (the red line) tends down, indicating the pressure pressure in the short term.

Nevertheless, the front cloud turned into an upward development, indicating a potential shift in feelings – but this is still not certain unless HBAR was able to create a clear chapter over the cloud.

The cloud itself – Komo – raises relatively flat and gentle, which enhances the current monotheism.

The high cloud usually indicates poor support or resistance, which makes it easier for the price to move, but it is difficult to trust any penetration unless accompanied by a strong and momentum size. Chikou Span (the delay line) seems intertwined in the previous work, also indicating the lack of clarity in the direction.

In general, Ichimoku signals indicate the frequency on the market, with a slight down decline in the short term and the possibility to develop the direction if buyers can control.

Can Hedra break more than $ 0.20?

HEDERA recently faced strong resistance, and was struggling to excel at a level of $ 0.199 – after twice in the past few days. This frequent rejection created a roof that proves that it is difficult to breach.

Meanwhile, EMA lines are tightened, and there is a possibility of waving on the horizon to form death, which would indicate a potential transformation in the decline. If this intersection is confirmed, the downward pressure may accelerate. This would lead HBAR to re -test the next main support level near $ 0.184.

The collapse below will open the door for more negative aspect, which is likely to extend the movement towards the lower support zone about $ 0.179. If this support is also lost, HBAR may decrease to less than $ 0.17 for the first time since November 2024.

However, if the momentum can wear, the bulls still have an issue. If the HEDERA price can restore strength and form a sustainable bullish trend, the third challenge of resisting $ 0.199 may be on the table.

A successful collapse above this level is likely to move towards the next resistance area by about $ 0.21.

And if the bullish momentum continues to build, there is a possibility to transfer a period of about $ 0.258.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.