14 billion dollars of bitcoin and Ethereum options that are expired today

Today, Bitcoin (BTC) options and ETHEREUM (ETH) (ETH) options (ETH) approximately $ 14.21 billion.

Market monitors monitor this event in particular because it has the ability to influence short -term trends through the size of the contracts and its virtual value.

14.21 billion dollars from Bitcoin and ETAREUM options expires

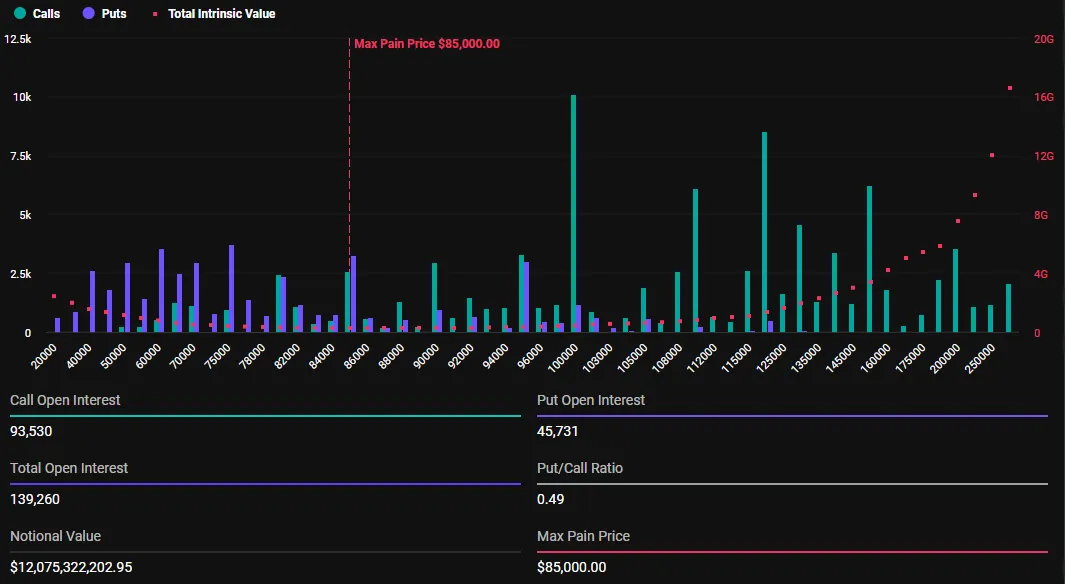

The default value of BTC options, which ends today, is $ 12.075 billion. According to Deribit data, Bitcoin options ending the validity of 139,260 are the ratio of its position to 0.49. This percentage indicates the spread of purchase options (PUTS).

Data also reveals that the maximum pain point for these expiration options is $ 85,000. The maximum pain point is the price in which the original will cause the largest number of financial losses for my holders.

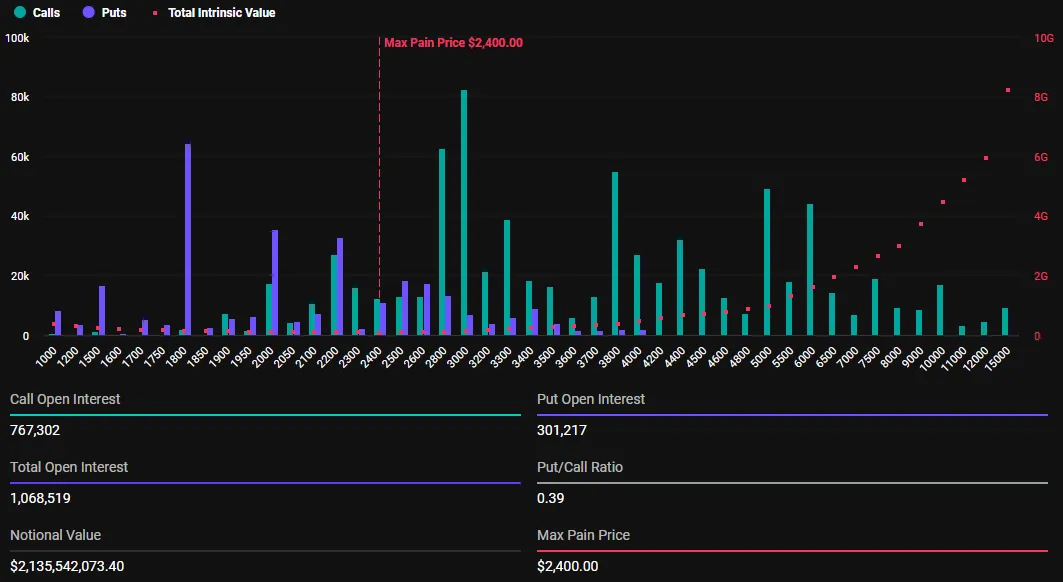

In addition to Bitcoin options, 1068,519 ETHEREUM options have been set until their validity ends today. These validity options value are $ 2.135 billion, a summons of 0.39, and a maximum pain point of $ 2,400.

The number of Bitcoin and ethereum options that ends today is much higher than last week. Beincrypto reported that the BTC and ETH options that ended last week were 21,596 and 133,447 contracts, respectively. In the same tone, they had theoretical values of $ 1.826 billion and 264.46 million dollars, respectively.

This remarkable difference comes because the expiration options for this week are for this month and a quarter, as this was the last Friday of March. Deribit options expire on Fridays because it is in line with traditional financial market practices (Trafi) and provides a fixed schedule for traders.

In many global markets, including stocks and derivatives, the dates for the completion of contracts for options are usually determined for the end of the trading week – on Friday – to unify timing and facilitate settlement operations.

Deribit has adopted this agreement to maintain familiarity for traders who move from Trafi to encryption markets and to ensure the peak of liquidity and market activity at a time -foreplay.

“Not only a Friday day; it’s one of the largest expiration per year. More than $ 14 billion has been set in BTC and ETH options to be able to end its validity at 08:00 UTC. How do you think that Q1 will wrap?” Defibit Impose In Thursday’s publication.

An implicit fluctuation tends to end the validity of the quarterly options

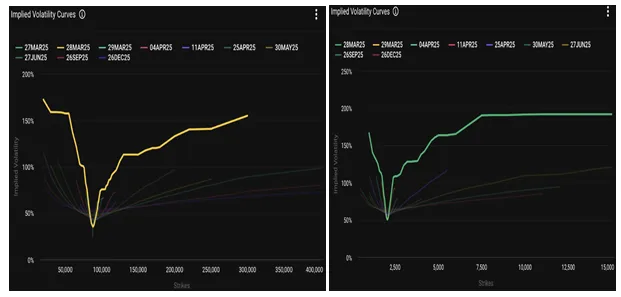

In fact, the expiration of today’s options ends in the first quarter (Q1) at the expiration of the options. As it happens, analysts in Deribit, the exchange of cryptocurrencies, are noticed, implicit fluctuations (IV) for BTC and ETH, indicating market expectations for price fluctuations.

Specifically, the Bitcoin curve indicates a strong bias towards high prices (bullish deviation) as calls are priced much higher than prices. On the other hand, the curve of the stroke fluctuations from Ethereum suggests a less directional bias but still reflects high fluctuation. These hints to the expected price movement on the date of the expiration of $ 14.21 options.

“Graphic 1- $ BTC: BTC shows some dangerous bullish deviation, price calls are higher. The graph is 2- $ ETH: ETH curve, but the volume is still high in all areas. Both markets indicate or after movement,” male.

This indicates that both Bitcoin and Ethereum markets expect or after that. Elsewhere, analysts at Greeks.live highlight the current market morale, citing caution from the dominant investor point of view on Bitcoin.

Specifically, they suggest that most traders expect to re -test low price levels between $ 84,000 – 85,000 dollars. Bitcoin trading for $ 85,960 to this writing, indicates a possible and short -term drop.

However, some traders note that bitcoin is stuck in a narrow and extent trading style, which implicitly limited volatility unless there is outbreak. Against this background, the Greeks are shed. It highlights the main technical levels.

“The main resistance levels that are monitored are 88,400 where a large negative sale was observed, and possible support in 77,000, that is, a merchant called the specified bottom,” analysts books.

Greek analysts also Monitor This implicit fluctuation is under pressure due to the separate delivery, indicating significant deviations in the IV brand. This indicates opportunities for merchants to exploit these fluctuations through manual or automatic strategies.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.