Bitcoin signals exceeding 90,000 dollars and adopt the upscale cycle

Bitcoin (BTC) has increased more than 4 % in the past 24 hours and more than 5 % in the past seven days, trying to recover 90,000 dollars. The last price recovery comes amid the improvement of technical indicators that indicate an increased bullish momentum.

Traders closely monitor whether Bitcoin can recover $ 90,000 and build a stronger basis for more upward trend. Many trend indicators, including DMI, Ichimoku Cloud and EMA, indicate that a possible outbreak can be formed.

BTC DMI is now shown in full control

The Bitcoin DMI chart shows a significant rise in momentum. The ADX (average trend index) rose to 18.24 today, with a noticeable increase from 9.2 yesterday, indicating that the current trend force is adopting.

ADX’s reading below usually indicates that the market is weak or related to the extent, so this height can be An early mark on the developing direction.

While ADX itself does not indicate the direction of the direction, it measures the total strength, and suggests today reading that the momentum began to pick up.

ADX is a widely used technical indicator that helps traders measure the strength of the market. In general, the ADX value of less than 20 references indicates that there is no clear direction, while the above readings indicate a strong direction.

Besides ADX, Di (positive trend index) and -di (negative trend index) provides an insight into the direction. Currently, +Di +rose to 34.7 from 16.57 yesterday, while -Di decreased to 11 from 21.17.

This wide gap between +Di and -Di indicates that the momentum ascending is gaining dominance, as it seems that buyers are overwhelming sellers. If this trend continues, this may indicate an additional rise in the BTC price in the short term, as the market turns towards the most crucial ups and Bitcoin Etfs designs signs of recovery.

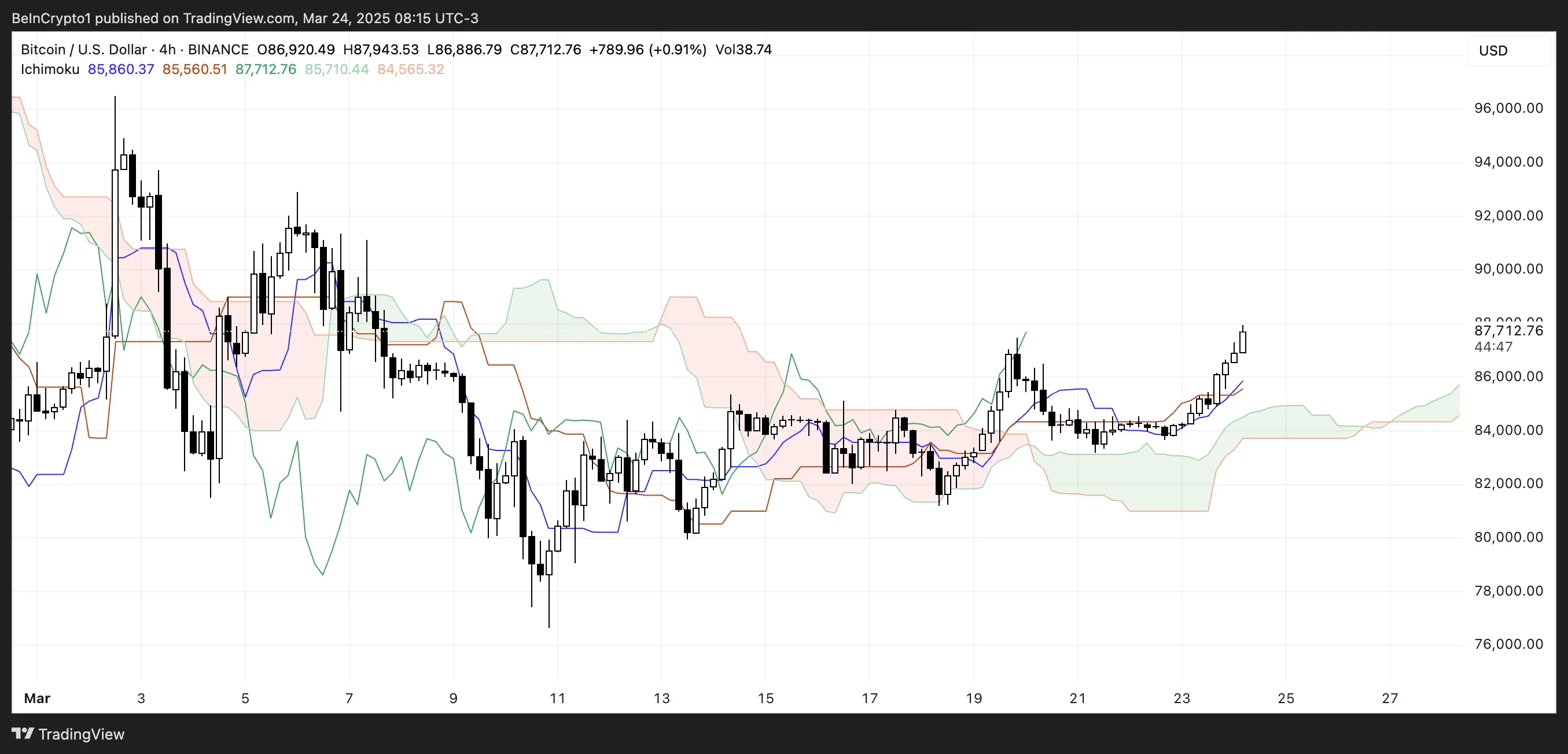

Bitcoin Ichimoku Cloud offers a bullish preparation formed

The Ichimoku cloud scheme for Bitcoin shows the Tinkan-Sen (Blue Line) and Kijun-Sen in a bullish style. Tinkan-Sen moves the fastest above the slower Kijun-Sen, indicating a momentum.

These lines were passed after a period of separation, indicating the strengthening of the directional conditions.

The formation of the cloud (Kumo) has changed from red to green in the right part of the scheme, which represents a shift from the decline to the upward feelings. It broke the price of the price above the cloud after testing it as support several times throughout mid -March.

This appearance is above the cloud signals that may become the previous resistance support. The thickness of the changing cloud throughout this period reflects the change of market volatility and condemnation in the direction of the direction.

Can Bitcoin restore $ 100,000 before April?

EMA lines from Bitcoin currently display mixed signals. Although the broader trend remains declining, the averages of short -term mobility began to turn up, and the last golden cross indicates that the upscale momentum is built.

If this momentum continues and additional gold intersections occur, the bitcoin price can target the main resistance levels. The first main resistance is located at 92,920 dollars, and a successful collapse can witness that BTC pays about 96,484 dollars.

If the upward trend is strengthened, Bitcoin will test 99,472 dollars. She has the ability to break more than $ 100,000 for the first time since February 3. This can be driven by 5 American economic events that can affect bitcoin morale this week.

However, the ascension scenario depends on the constant purchase pressure. If the bullish momentum fades and the broader downtom direction resumes, Bitcoin can first re -test the support level at $ 85124.

The rest at the bottom of this level may open the door for a decrease in about $ 81,187, with more negative side that is likely to lead to BTC’s return to less than $ 80,000.

In a stronger declining scenario, Bitcoin can reconsider $ 76,642, which enhances the declining bias.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.