Chainlink is preparing to recover if support is $ 13 – experts set out optimistic goals

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

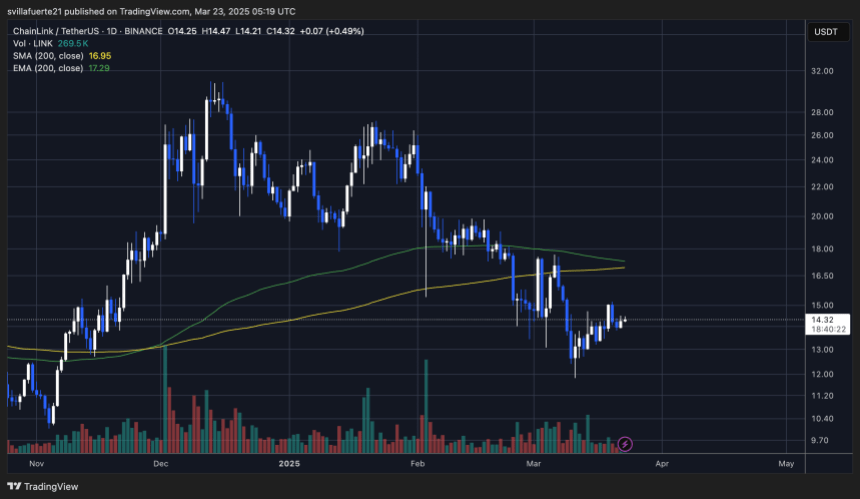

ChainLink (Link) offers signs of strength, circulating 27 % above March 11 and climbs to a possible recovery if the wider market conditions improved. Despite the recent fluctuations and constant uncertainty in the macroeconomic economy, LINK managed to better adhere to its land than many altcoins, giving hope to investors who believe that the worst may have ended. While some analysts remain careful and warn from the downside, others see this unification as a healthy reset before the next stage.

Related reading

Supreme analyst Ali Martinez visions on X participated, noting that Chainlink is currently testing a critical support level of about $ 13, which is compatible with the lower limits of a long -term price channel. According to Martinez, if Link keeps this area, historical patterns indicate that a strong recovery can follow it.

With market morale remains, all eyes are on Link’s ability to maintain this support. A successful defense can put the chainlink chain as one of Altcoins leads the next gathering. Currently, merchants are closely watched, waiting to know if this price procedure represents the beginning of a new upward trend.

Chainlink holds decisive support like Bulls Eye A Breakout

After losing the $ 17 support zone to $ 18, he fought the bulls to regain control. ChainLink trades at a pivotal level as it tries to restore high prices amid uncertainty in the market and fluctuations. LINK has decreased by more than 61 % since its reach to the highest level in mid -December, about $ 30, reflecting the domestic morale in the broader market fueled by macroeconomic instability and risk behavior from investors.

However, there is increasing optimism that the link can be prepared to recover. Martinez visions Highlighting that ChainLink is now sitting at the main support level at $ 13, which represents the lower boundaries of a well -defined trading channel.

Martinez suggests that holding this area can pave the way for a large gathering. If LINK emphasizes a stronghold over $ 13, the historical price procedure indicates that the move towards the medium -range goal of $ 25, with a possible extension of about 50 dollars if the upscale momentum strengthens.

Related reading

The coming days will be very important as bulls must defend the level of $ 13 to prevent more from the negative side. The apostasy from this region can lead to the renewal of the investor’s attention and the acceleration of momentum, which leads to the identification of sites as one of the altcoins that leads to a broader recovery in the market. Currently, all eyes are on whether Link can retain the line and install it with its upward structure.

The connection of the main resistance prices battles

ChainLink is currently trading at $ 14.30, and sits a little less than the decisive resistance area whose direction can be determined in the short term. The level of $ 15 has become a major battlefield for bulls and bears. If LINK is able to break this resistance by force, analysts expect a rapid move towards the $ 17 region – an important important level that was previously acting as strong support before the last declining direction.

The last price procedure shows that the bulls are preparing some momentum, especially after wearing a $ 13 area. However, the market remains fragile amid uncertainty in the macroeconomic economy and the feeling of cautious investor. The confirmed interruption is likely to attract more than $ 15, more purchasing benefits, putting the way for a short -term installation.

On the other hand, if LINK fails to restore $ 15 and face rejection in this resistance, this may be restored towards low support levels. The decrease of less than $ 13 would weaken the ups and exposes the distinctive symbol to the additional passive side, as it behaves the 12 dollar sign as the next possible support zone.

Related reading

The next few sessions will be crucial for the link. Traders closely monitor if the bulls can build enough momentum – or if the bears will restore control and pay the price to a decrease.

Distinctive image from Dall-E, the tradingView graph