Dogecoin faces a 1929 model: Bloomberg McGLONE

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Mike Mcchelon, the largest basic commodity strategy in Bloomberg, has released a flagrant caution for Dogecoin holders and the broader encryption community by conducting comparisons with historical cases to increase the market. In a series of recent publications published on X, McGlone summoned in 1929 and 1999-the famous ages of the collapse of the stock market and the Dot-Com-to ensure the dangers of “movement of speculation” in digital assets.

Dogoin 1929 mirrors similar

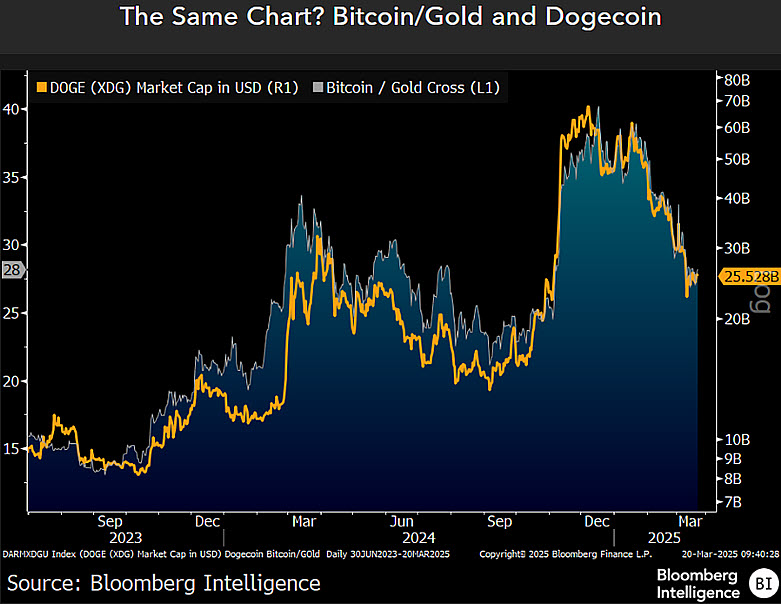

he It was customized Dogecoin in particular, focusing on its exposure to the potential market men, also indicating gold as a beneficiary if the appetite continues to deteriorate. “Dogecoin, 1929, 1999 may show the absurdity of origins and gold-the percentage of the ounce of gold that is almost equal to Bitcoin trading with Dogecoin.

Related reading

The graph below shows the extent of the maximum Cryptocurrency, the bitcoin ratio to gold. The tracking of these two standards indicates that the more the relative value of Bitcoin to gold is a transformation experience, the Dogecoin track is sharply centrally, which exposes it to the same market forces that historically challenged the very speculative assets.

The wider McGlone thesis is endless with Dogecoin. In another post, about his attention to the idea of gold of $ 4,000 an ounce, and linking this possibility for dynamics in the bond market and potential declines across the risk sectors, including cryptocurrencies.

“What gets gold to $ 4000?

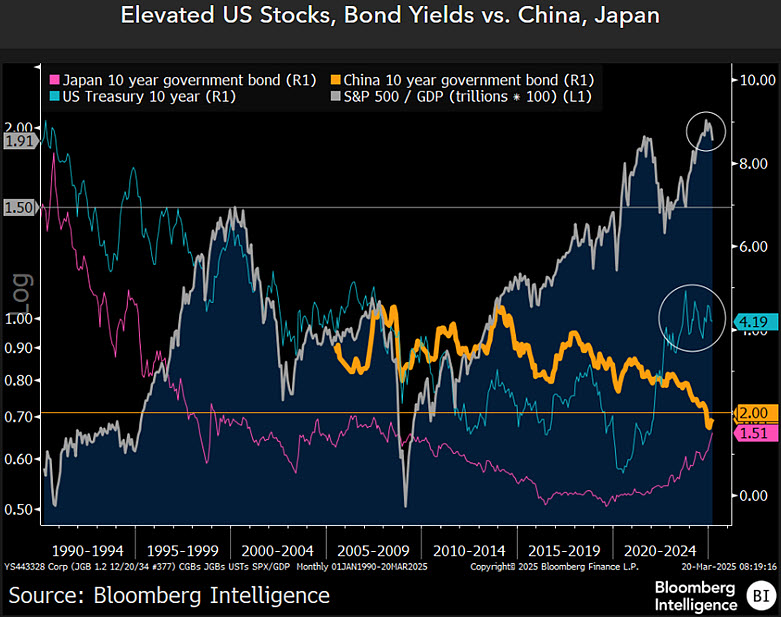

He stressed that if the US stock market will remain under pressure, then the bond yield is ultimately decreased by a relatively 2 % or less revenues in China and Japan. Such a scenario, from the McGlone point of view, adds the rear winds to gold because the shift from a cabinet with relatively high returns to low -yielding government bonds abroad can push investors towards alternative havens.

Related reading

The McGlone graphs shared its analysis of mutual demand for risk assets. One optical, entitled “High American stocks, bond returns against China, Japan”, displays the constant difference between US Treasury revenues, which hover over the 4.19 % mark, and relatively subject to Chinese and Japanese government bonds, which are close to 2 % and 1.51 %, respectively.

The drawing also depicts the S&P 500 market in the market to GDP, which is still historically high despite the recent fluctuations. McGlone’s conclusion is that the constant pressure on stock markets, along with global bond rates that are less than US revenues, can accelerate rotation to gold if investors see a slowdown in “expensive” asset classes, including risk assets such as Dogecoin.

It transformed the broadcast of the broader Altcoin market, where McGlone referred to Ethereum as a leading indicator on whether the general trend has turned into a decline in digital assets. “Will the trend refuse?

At the time of the press, DOGE was traded at $ 0.16663.

Distinctive image created with Dall.e, Chart from TradingView.com