Dogecoin in Make-AR Break Point after testing a multi-year trend line

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Dogecoin (Doge) closed last week to a bullish note after testing critical technical levels that could determine its next directional step. The weekly chart on Binance (DOGE/USDT) reveals that Doge is currently being traded higher than the RERRERERDRING 0.786 Fibonacci at $ 0.167. This decline is drawn from its lowest level ever at $ 0.0805 to the peak of $ 0.4844.

Dogecoin confirmed a reflection?

The prominent technical development is the interaction with the long -term dusty trend line, and extends from the highest level in May 2021 ever. Dog recently re -testing this trend as support after his breaking in November 2024.

Last week, a candle was printed a hammer -like formation, characterized by a real real body near the top of the range and remained much lower. While the candle also displays a modest upper tail, the dominance of the lower shadow signals absorbed by buyers is less aggressive to sell the direction line and pushed the price back above the level of 0.786 Vibonacci – a strong upward signal.

Related reading

However, this week could be the same importance last week. A weekly closure above $ 0.167 looks necessary to confirm the momentum. Otherwise, another test of the multi -year trend line can become the moment of making or superior to the price of Dogecoin.

It is worth noting that momentum indicators are still neutral. The weekly relativity index (RSI) closed about 39, reflecting the defeated purchase power and highlighting that Dog is still working without the 50 neutral mark.

EMAS (EMAS) intermediate averages provides a higher layer resistance than the current price.

EMA is 100 weeks at $ 0.17284, which is placed above the current Doug range, while EMA is 50 weeks at 0.21427 dollars. EMA for 20 weeks, which is the most urgent resistance during previous gatherings, is now located at $ 0.24805. Support in EMA is strengthened for 200 weeks about $ 0.13621, a level that is likely to serve as a last defense line that should last below the multi -year trend line.

Related reading

The price procedure in recent weeks also shows DOGE through the landfill or the formation of the channel, with the acceleration of the collapse towards the meeting of the level of 0.786 Vibonacci and the re -testing of the disputed trend line. Nevertheless, the market responded with a strong purchase attention in the distinctive red support area.

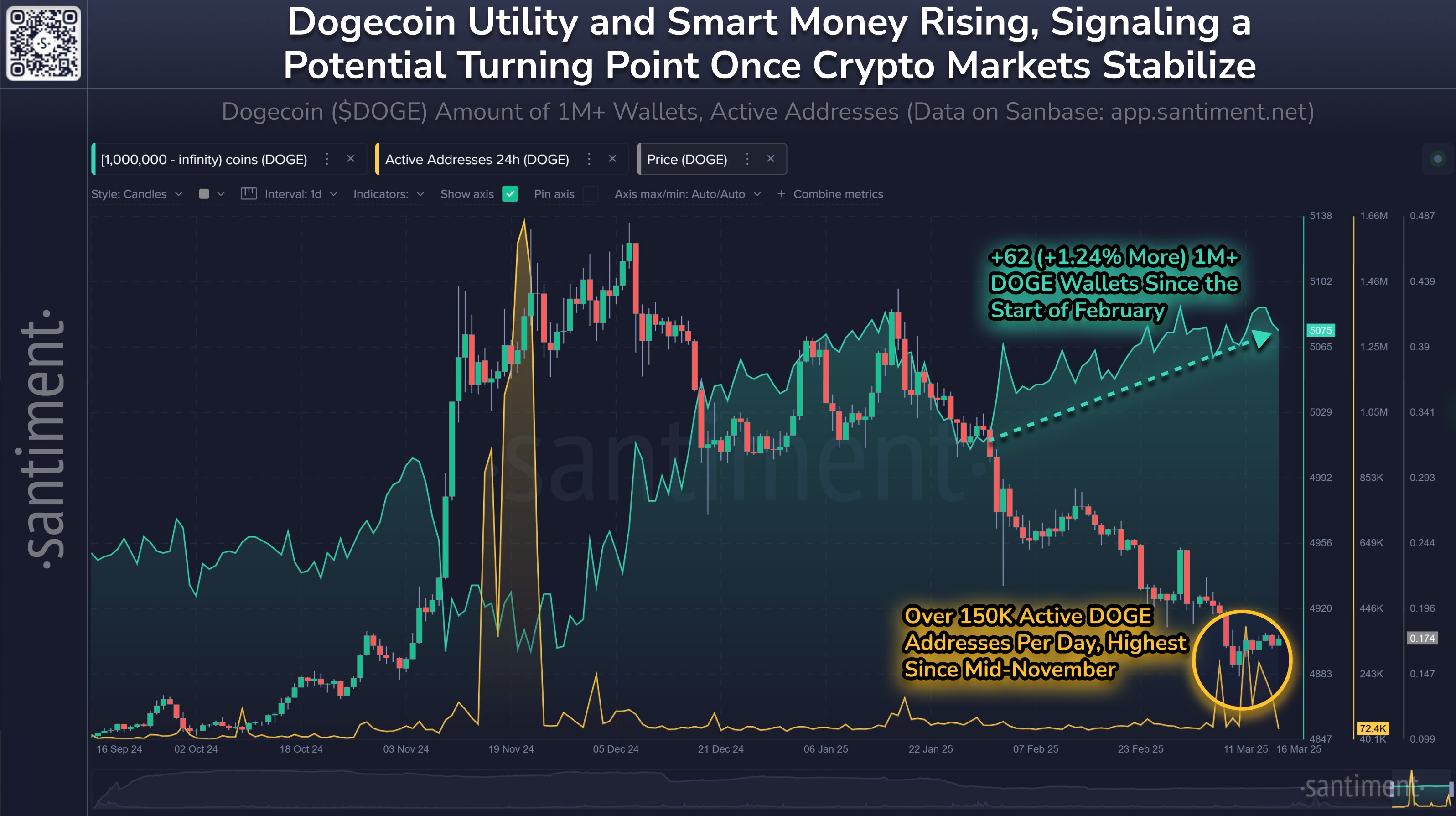

The data on the chain increases the context of the last price procedure. The analysis company, which was informed of Santiment via X today, has reported that Dogecoin, like most Meme currencies, was severely affected during the continuous decline at the market level. However, Santiment pointed out a bullish deviation on the side of the network.

Company States: “Dogecoin, like most Meme currencies, has been removed while recovering at the level of coding 2.

In addition to this feeling, the encryption analyst Dan Chipiro Tadawul Stuck Via X: “Doge similar to Pepe, but it has already regained the level of elections after its sweep. I think these are major levels to continue viewing on many of these alts. Surveying and restoring some relief in the short term refers to this level and these levels can provide a clean level of revival after that.”

This is in line with the technical observation that may be the measures taken by Dog in the recent prices, a liquidity sweeping liquidity process, followed by recovery higher than support-a short-term upcoming reversal pattern in the encryption markets.

Distinctive image created with Dall.e, Chart from TradingView.com