New Bitcoin whales add more than 20000 BTC to their holdings

Since its closure at a low level of $ 78,620 on March 10, Bitcoin (BTC) has returned to return and is currently heading to the top gradually.

The leading cryptocurrency increased by 1.2 % over the past week, as the data in the series indicates a new wave of accumulation of whales.

The high demand for Bitcoin whale, with investors purchasing the decrease

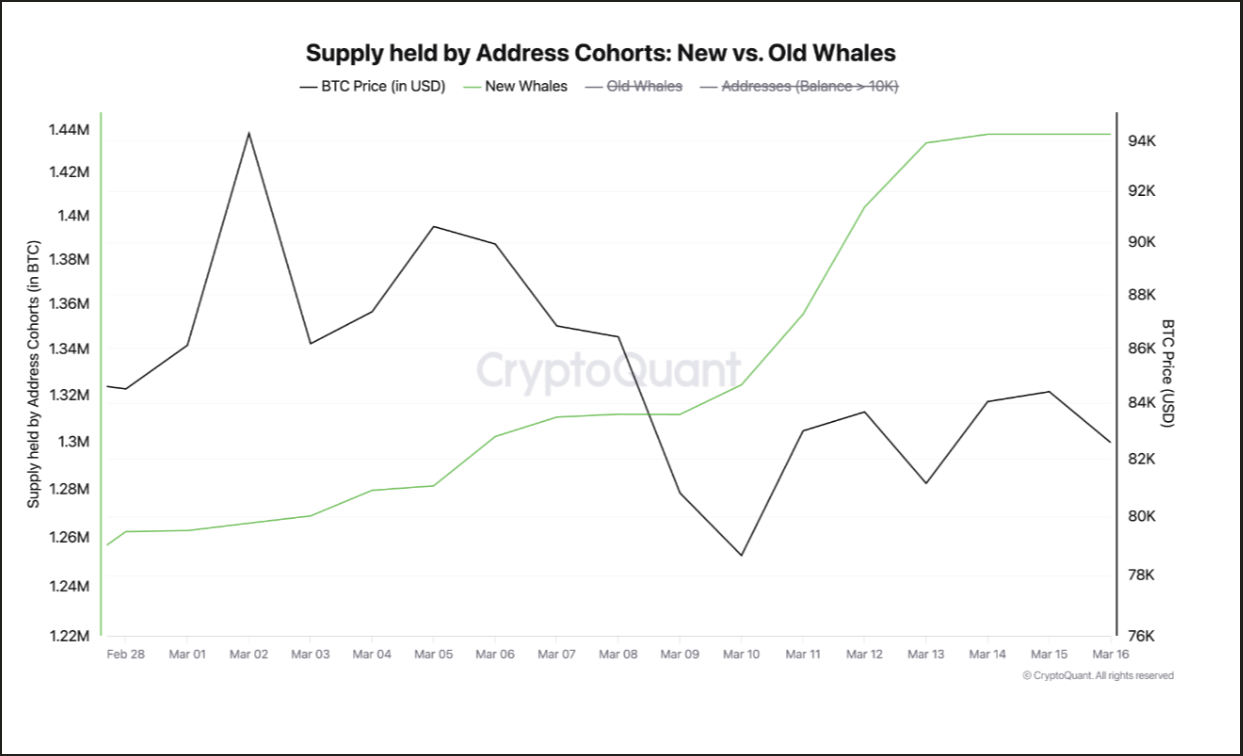

In new a reportThe major Cryptoquant analyst Onsin found that a new wave of bitcoin whales appeared. These big investors carry at least 1,000 BTC governorates and have average acquisition age for less than six months.

“Data confirms on the series that since November 2024, this portfolio collectively gained more than a million BTC, as it has placed themselves as one of the most influential market participants. The pace of its accumulation has accelerated significantly in recent weeks, where more than 20000 BTC accumulated this month only.”

When the new whales show interest in BTC like this, they indicate the emission of bullish confidence in their long -term performance. The last BTC decreased to its lowest level in many years fueling this accumulation, as it represents a major opportunity for whales that is looking to “buy” and sell them at a higher price.

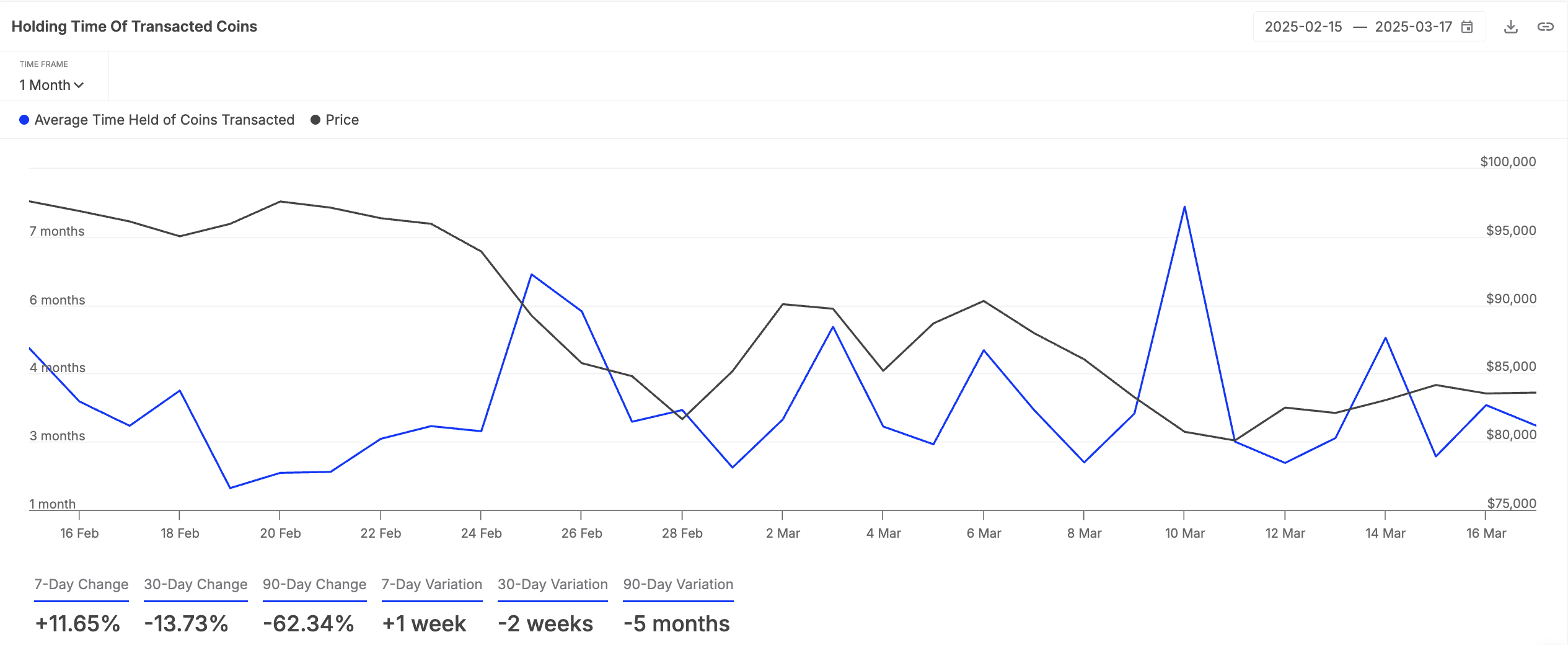

Moreover, BTC holders increased the time of the metal currencies last week, highlighting the gradual return in the budget feelings towards the currency. According to InTothheblock, this has increased by 12 % over the past seven days.

The time to keep the average client currencies is measures the length of the corridors that are kept before selling or transferred. When this extends, it reflects a stronger condemnation of investors, as investors choose to maintain their coins instead of selling.

This can help reduce the pressure pressure as the offer gradually dries in the BTC market, which increases the value of the currency in the short term.

Bitcoin at a crossroads: a bounce to $ 89,000 or a decrease to $ 77,000 after that?

Although the BTC’s elderly ray index continues to spread the red graph bars, their sizes have gradually decreased over the past few days.

This indicator compares the purchase pressure with sales to determine the prices of the original price. When their bars decrease in height, it indicates that the declining pressure weakens.

This indicates that BTC sellers lose momentum, and buyers may intervene gradually. If this trend continues, the downward trend may slow down in BTC. Its price can recover and climb about $ 89,434.

On the other hand, in the event of strengthening the pressure pressure, the king’s currency risk declining to $ 77,114.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.