Today’s encryption price: Bitcoin’s fate depends on macro data, and the cake increases 40 %

Bitcoin was unified within a narrow range ranging between 82,060.62 dollars – 84,693.29 dollars as the price seemed to settle before the main economic data set for the release this week.

The total ceiling of the encryption market has remained relatively stable throughout the day, after a slight decrease during the early Asian trading hours.

At the time of the press, it amounted to $ 2.81 trillion, a decrease slightly over 1 % over the past 24 hours.

The marketing of the market towards the territory of fear in 32, with silent bitcoin trading activity and no gains appear.

Altcoins has mostly witnessed limited gains, as the total maximum market in the sector slightly slipped throughout the day.

What is the price of bitcoin not rising?

Bitcoin merchants remained cautious amid economic uncertainty.

With the Donald Trump tariff that has already caused chaos across both Crypto and traditional markets, Bulls faced difficulty in restoring support of $ 84,000.

Also, some caution stems from the anticipation of the main economic data, with the last policy decision in the Federal Reserve to focus.

First, on March 17, the latest retail sales data will be released in the United States, allowing traders a view of consumer spending trends.

Then, on March 19, the Federal Reserve is scheduled to announce the interest rate decision, without any expected changes.

Although the same decision may not shake the markets, investors will closely see the updated economic expectations from the Federal Reserve and Federal Reserve’s comments Jerome Powell on hints on future policy movements.

In Europe, all eyes are located in the inflation report in the euro area, also on Wednesday, which is expected to decrease slightly to 2.4 % but remains 2 % higher than the European Central Bank.

Meanwhile, the Bank of England is scheduled to meet on Thursday, as traders are increasingly betting on a reduction rate later this year.

The current possibilities indicate a 75 % chance of the reduction in May and 55 % in August. However, continuous wage growth can keep the Al -Nabakh Bank cautious.

Moreover, the products circulating in Bitcoin exchange a lot of pressure for sale, which increases market morale.

According to investors withdrew $ 1.7 billion from Crypto etps last week, thus reaching a total external flow for five weeks to $ 6.4 billion, according to Coinshares.

Will the price of bitcoin rise?

Currently, analysts remain divided into the next step for Bitcoin in the short term.

One of the main stimuli that can affect the price of prices is the head of the Federal Reserve Jerome Powell.

While it is widely expected that the Federal Reserve will maintain rates unchanged, the Powell’s tone of future policy may push fluctuations.

If he is hinting at quantitative alleviation or a more distinctive position, he may see the origins of risk, including bitcoin, a rapid recovery.

Kyle Dooops believes that Powell is likely to maintain things “as mysterious as possible”, making it difficult for the markets to get a clear direction.

However, “if Powell whispered” QE “in the next FOMC, the market will move quickly.”

The following Bitcoin step can be likely to be a decrease to $ 78,000

The next step that Bitcoin is likely to be a decrease to 78,000 dollars, according to the circulating captain, who believes that this level as the seizure of the main liquidity before any major emerging step.

However, as soon as this shake is completed, about $ 109,000 is expected to be erupted by mid -April.

Analyst Marzel also expects a similar decline, believed to be “good” for long -term recovery. (see below.)

See this following $ BTC The price transition to $ 72,000, IMO will be useful for support and continuing in the upward trend.

The Trader Crypnuevo Fellow also sees the bullish capabilities, noting that liquidity is often stacked above the current range.

According to the analyst, 85.4 thousand dollars – 87.1 thousand dollars is a major goal for bulls in the short term, making the move towards this region “more than possible” next week.

Merjin Trader has made another emerging case by Merjin Trader, which laid a boys’ cross mark on the RSI in Bitcoin, a momentum index.

According to Merjin Trader, every time this bullish intersection occurred on the weekly graph, Bitcoin historically witnessed strong gatherings within three to five months, with average gains of about 56 % – sometimes exceeding 90 %.

If this pattern continues, Bitcoin can be set for another equivalent height by July or August, which may pay the price about $ 120,000.

At the time of writing this report, Bitcoin was trading at $ 83,423 without any gains per day.

A slow day for altcoins

The best of limited gains witnessed limited gains, as the largest distinctive codes engines, mostly led by the noise of society.

Epic Cash (EPIC), the most important winner in the entire encryption market, has had a privacy -focused privacy, which gathered more than 344 % in the past 24 hours after the exchange list, the maximum market of $ 28.2 million only.

Meanwhile, the total maximum Altcoin market decreased by 0.68 %, and the Altcoin season index remained unchanged at 20.

Senior winners for today are:

Pies

Pancakeswap (Cake) increased by 40.5 % during the last day to $ 2.52 at the time of writing this report, up to the maximum market to more than $ 760 million.

It is worth noting that the gains accompanied a leap in the trading volume, which increased by 367 % to more than 819 million dollars.

source: Coinmarketcap

Today’s gathering came when Pancakeswap ranked first in the decentralized exchange market, with $ 1.64 billion in 24 -hour trading volume, exceeding UISWAP and Raydium.

The increase in trading activity follows huge investments worth $ 2 billion in the technology investment company in Abu Dhabi MGX, which enhances the investor confidence in projects related to Nabanis, such as Pancakeeswap.

In addition, the increasing noise around Meme currencies has fed more decentralized exchanges (Dexs), and increased fungal pies.

Binaryx

Over the past 24 hours, Binaryx (BNX) has gained 8.8 %, as it erupted from the scope of uniformity from $ 0.7 to $ 1.3 with a rise in the highest level ever at $ 1.97.

The maximum market was sitting at $ 620 million with nearly a daily trading volume, which hovers more than $ 560 million.

Over the past 24 hours, Binaryx (BNX) has gained 8.8 %, as it erupted from the scope of uniformity from $ 0.7 to $ 1.3 with a rise in the highest level ever at $ 1.97.

The maximum market was sitting at $ 620 million with nearly a daily trading volume, which hovers more than $ 560 million.

source: Coinmarketcap

Most of her gains are largely attributed to Hype Hype after Binaryx announces the brand rename to four (shape) and review the corresponding symbol code.

In addition, there was a noticeable accumulation of BNX symbols by whales, before swaping the next distinctive symbol to be held on March 21, 2025, with a transfer rate of 1: 1 from BNX to the shape.

The main exchanges, including Binance, expressed their support for this transition, indicating a smooth process for the owners of the distinctive symbol.

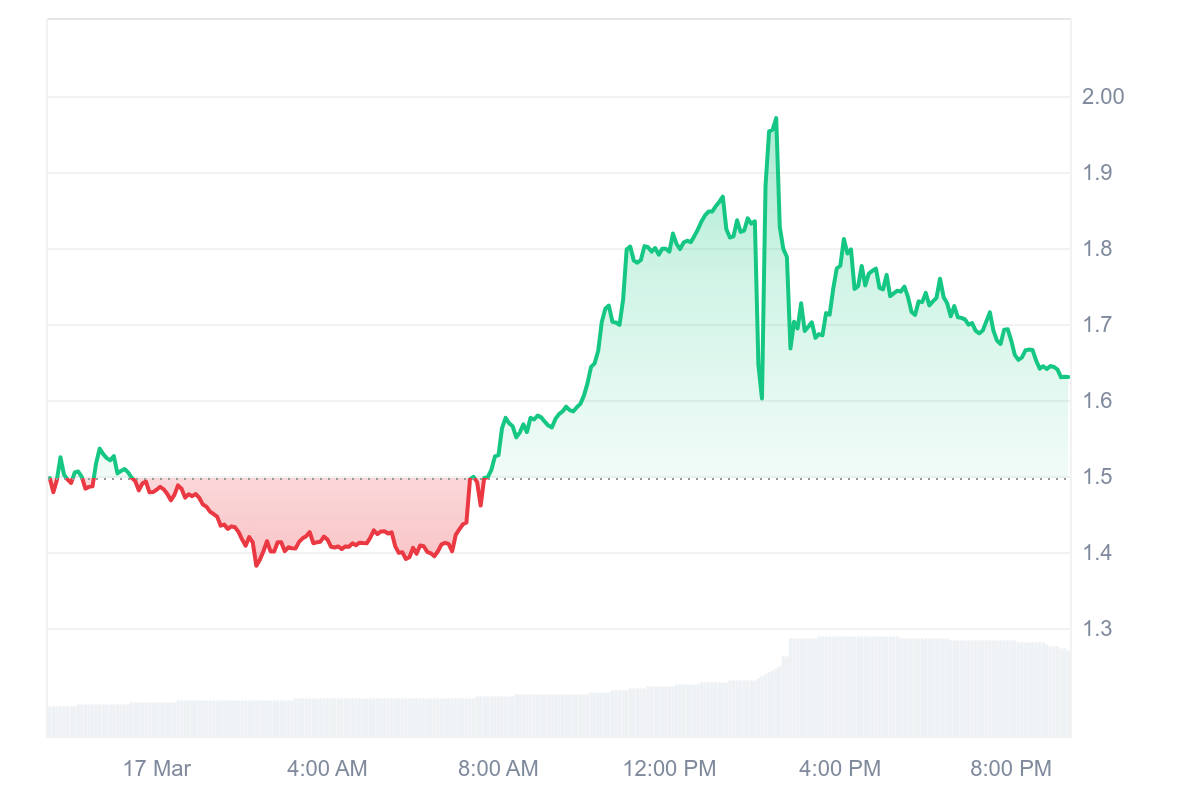

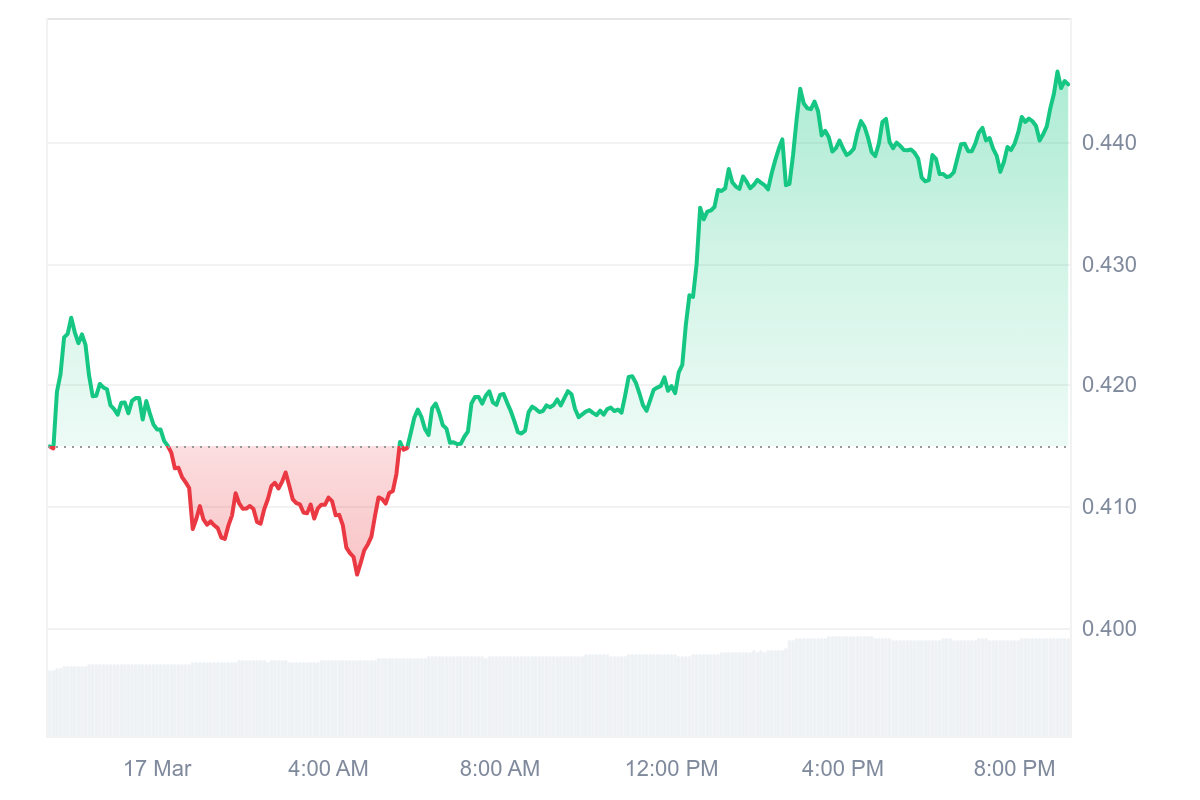

Dow curve

Curve Dao (CRV) increased by 7.2 % over the last day to the highest weekly level of $ 044 at the time of the press.

The maximum market was sitting at 578 million dollars, while the daily trading volume increased by 47 % to $ 117 million.

source: Coinmarketcap

While any specific stimuli of the last price gains were clear at the time of writing this report, CRV had recently crashed over the downward trend line, which may have been seen as a buying signal for merchants.

Post -encryption price: Bitcoin’s fate depends on macro data, and Cake Cake 40 % first appeared on Invezz