What do you mean for wealth?

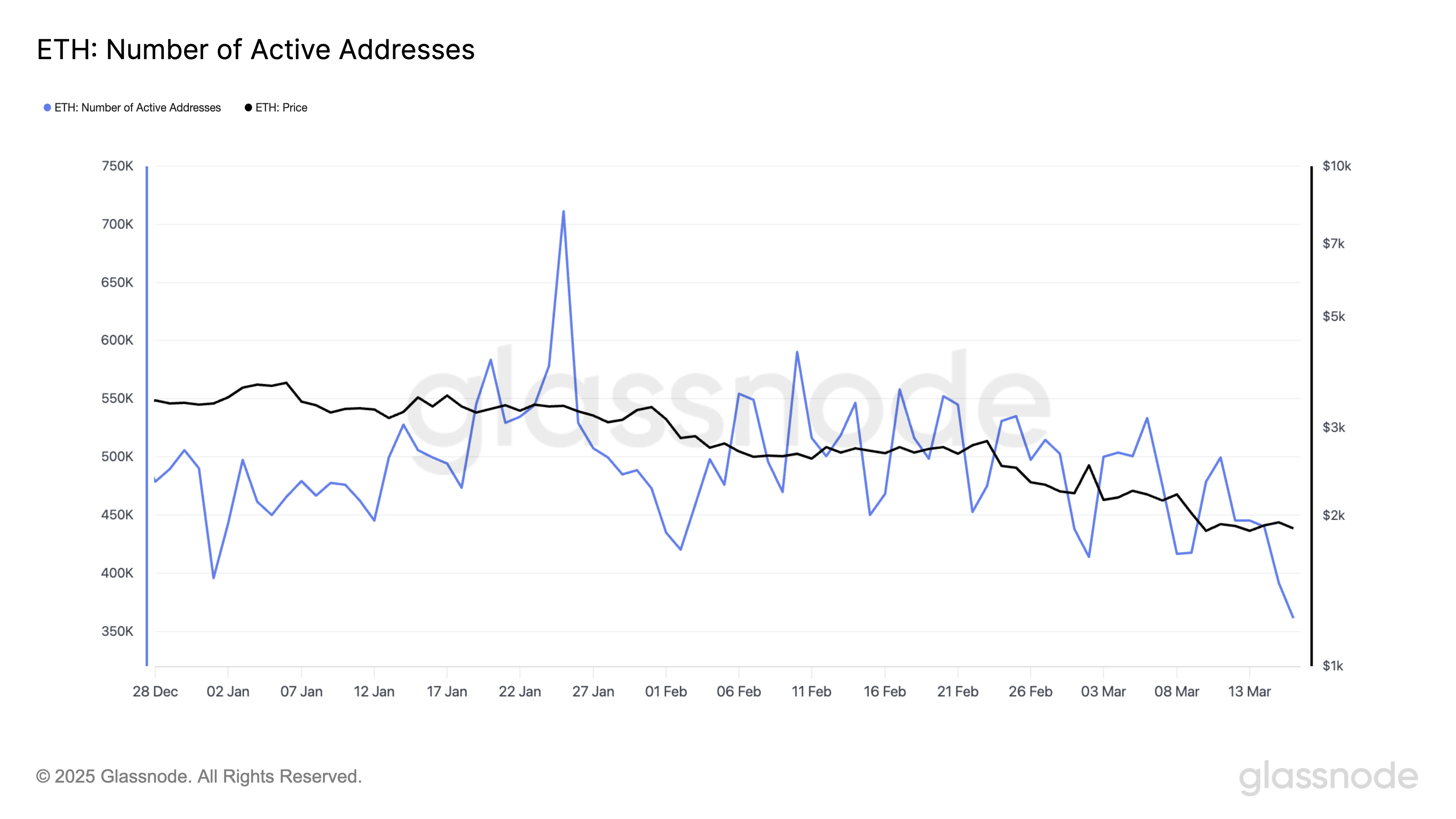

The user’s activity on the ethereum network continued to decline, indicating the weakening of the Blockchain Layer-1 (L1) demand.

On Sunday, the daily active headlines and new wallet creations decreased to their lowest levels of the year, highlighting a sharp decrease in participation in the series.

Ethereum network activity collapses to YTD levels with inflation risk growth

According to Glassnode, the number of daily addresses of the active titles that moral transactions involved in the lowest level in 361,078 fell on Sunday.

This projection indicates a decrease in the user’s participation and reduce the activity on the chain. It often leads to a decrease in transactions, which reduces the burning ETH amount and make the original more enlarged.

If this trend continues, it may reduce investor confidence, reduce the network dependence, and increase the declining pressure on the ETH price.

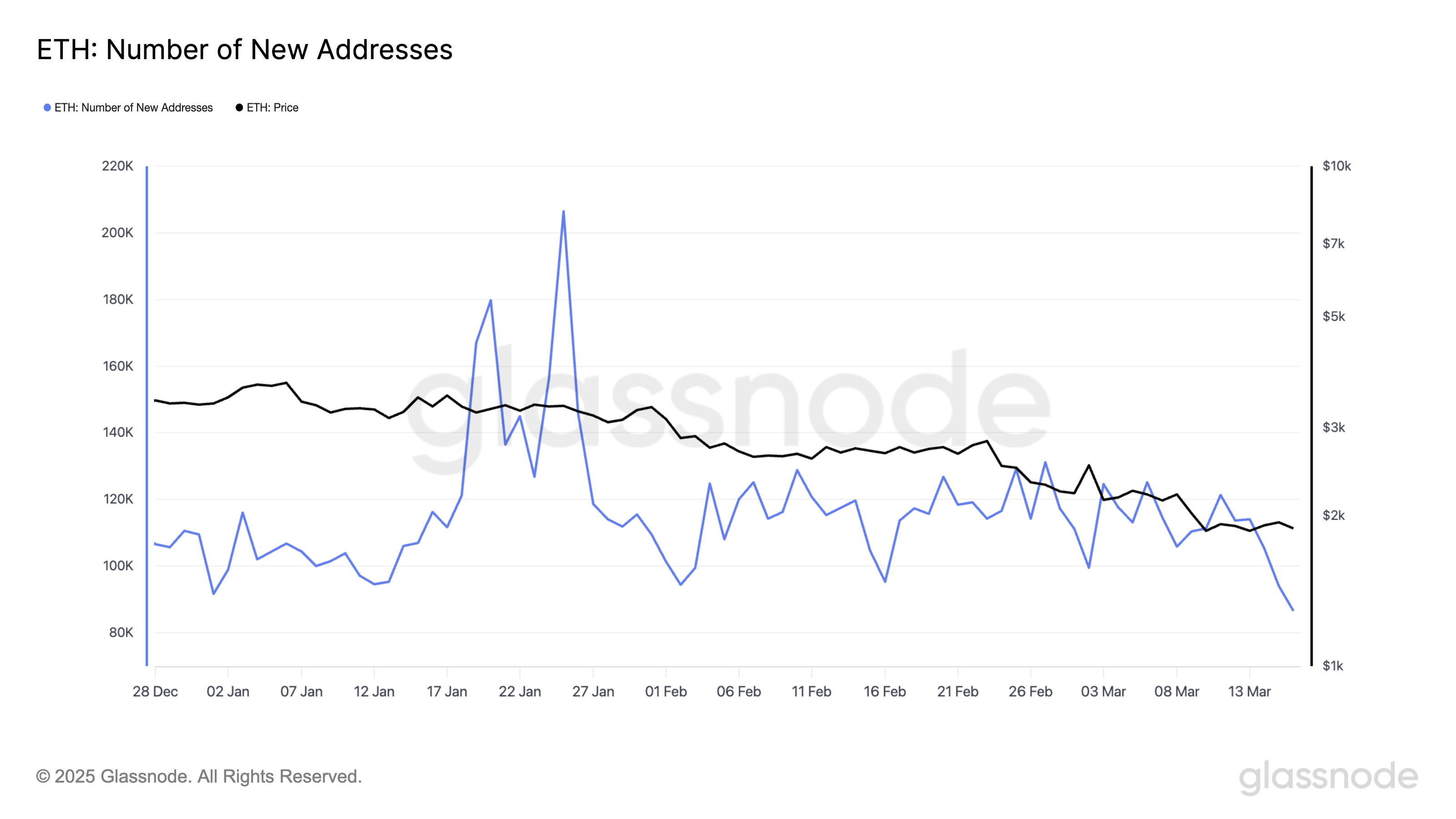

Moreover, the new demand faded on the ethereum network. Per Glassnode, the total number of new portfolios created for the ETH Trading 86,539 titles on Sunday, which represents the lowest daily number since the beginning of the year.

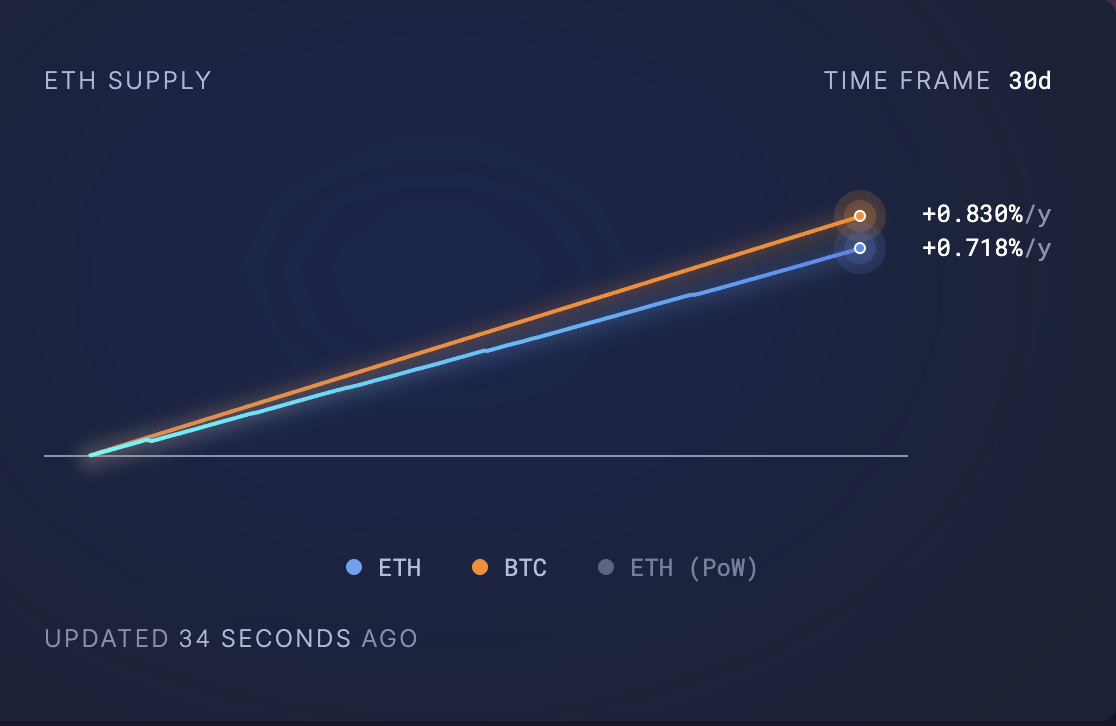

This decrease in the participation of the network has increased from ETH inflationary pressures, with the total circulating offer that exceeds 120 million souls. In the past thirty days, 71,172 ETH has been added, worth more than $ 135 million at the current market prices, to the trading bid of the currency.

With fewer transactions and interactions that occur in the chain, the lack of demand increased to accommodate the increasing supply of the declining pressure on the ETH price.

ETH is close to excessive sale levels where the request fades – what is the next for altcoin?

The impact of the decrease in the activity on the ethereum network on the demand for altcoin in recent weeks, which has led to a decrease in prices. ETH is currently trading at $ 1898, indicating a drop in the price of 30 % during the past month.

The declining trend that was observed in the ETH (RSI) relative index on the daily chart captures the weak purchase pressure among the market participants. At the time of the press, this momentum index is in 34.70.

The RSI index measures the conditions of the asset market and its excessive rotation. It ranges between 0 and 100, with values higher than 70 indicates that the original is the peak in the height and the cause of a decrease. On the contrary, under 30 values indicate that the original has been sold and may witness a recovery.

In 34.70, RSI from ETH indicates a great sale pressure. It indicates that there is room for further decreases before the currency becomes high and witnesses a positive correction.

If this price continues to decline, the ETH risk decreases to $ 1758.

On the other hand, if the demand marches, the ETH price may collapse more than $ 1924 and climb about $ 2224.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.