Solana holds a bullish style – experts set $ 140

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Solana (SOL) was subjected to intense sale pressure, as the price failed to restore the main resistance levels after weeks of fear -based market. The bulls lost control when Sol decreased to less than $ 180, a previously decisive support level. Since then, a declining feeling has dominated, with a high speculation about the potential Sol bear and the broader Altcoin sector.

Related reading

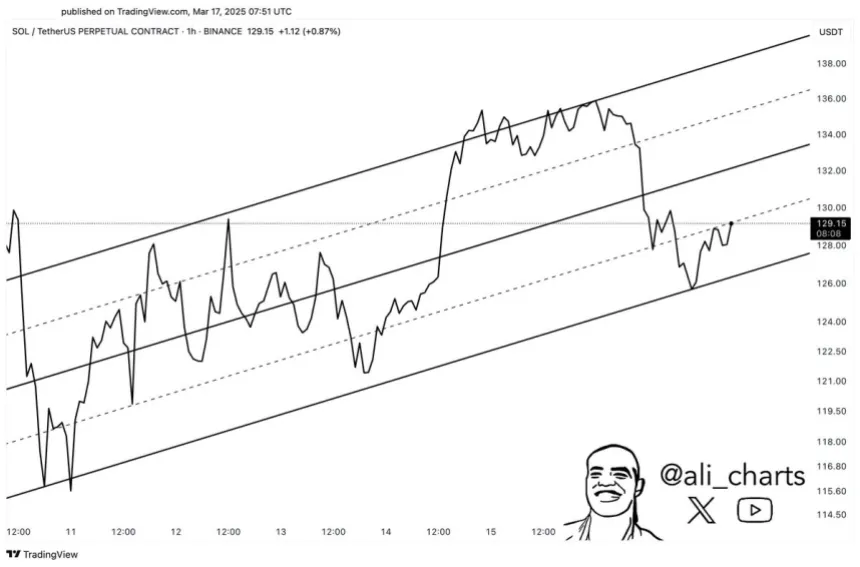

Despite this negative view, there may be a glimmer of hope for the Bull’s rituals. Supreme analyst Ali Martinez participated in a technical analysis of X, and revealed that Sol formed a bullish channel in the short term. This pattern indicates that if Solana bears this composition, it may follow the increase in high price levels.

In order for this bullish scenario to play, Sol must keep the lower direction line of the channel and pushing the upper resistance. The outbreak of this pattern can indicate a strong recovery, which may reflect the declining direction that dominated the market for weeks. However, if Solana fails to maintain this structure, the risk of additional additions is still high. The next few days will be crucial in determining the Sol direction in the short term.

Solana faces risks amid fluctuations

Solana has faced uncompromising sale since it reached the highest level ever at 261 dollars in January, as it has now decreased by 61 % from that peak. Hopes also fade in the huge bull race, speculation about the potential growth market continues to grow. The broader macroeconomic environment remains unsuccessful, as the concerns of the trade war and economic uncertainty are pushing not only the encryption market but also in the US stock market.

Investors are now looking for signs of reflection, and technical indicators indicate a possible recovery in the short term. Martinez analysis on x It reveals that Solana is a bullish channel and looks forward to climbing from the base of the channel to the upper resistance at $ 140. If this style continues, Sol can pay about $ 140 and even higher levels, indicating a relief rare.

For this bullish view of its achievement, Solana must maintain support for the current trend line and penetrate the main resistance levels. If Sol fails to hold this channel, it may face an additional aspect, which enhances fears of the long bear market. The next few days will be very important in determining whether Solana can restore momentum or continue its downside.

Related reading

Solana is struggling while fighting bulls to restore momentum

Solana (Sol) is currently trading at $ 129, after unification days between $ 136 and $ 111. The price procedure is still inaccurate, as the bulls are struggled to restore control after weeks of pressure.

For a possible reflection, Sol must separate from the level of resistance of $ 140 and pay it about $ 160, a major level that would indicate a shift in the market structure. If Bulls succeed in restoring these price points, the strongest recovery phase may begin, which may attract new buyers to the market.

However, if Solana fails to obtain $ 125 support, this may lead to a wave of pressure pressure, and send the price to a decrease in demand areas. It can offer a break down this Sol level to a decrease of about $ 110 or even less, which enhances fears that the current declining trend has not yet ended.

Related reading

The following few trading sessions will be decisive in determining whether Solana can restore momentum or if there are other declines in the future.

Distinctive image from Dall-E, the tradingView graph