How Corporate Investors Dropped $58 Billion After Trump’s Inauguration Bitcoin Price Dropped

- Bitcoin price sank below $99,000 for the first time in ten days on Monday.

- Bitcoin’s current $40.9 billion transaction volume from whale wallets shows a reduction in trading activity of $58 billion since Trump’s inauguration.

- NetFlows BTC Barge Holder has also declined since Thursday, as a whale sell-off of 566 BTC was observed 48 hours before the market crash.

Bitcoin’s price fell below $98,500 on Monday, its lowest level in 12 days since January 15. On-chain data trends show how whale investors’ movements after Donald Trump’s inauguration may have caused the crypto market to collapse.

Bitcoin price fell 6% to hit a 12-day low

Bitcoin saw a sharp pullback after multiple bullish events surrounding Trump’s inauguration pushed the crypto markets to all-time highs. During the open, Bitcoin briefly reached a new all-time high of $109,000 on January 20, before pulling back to find support at the $105,000 level for most of the week.

Bitcoin work

Many enthusiasts, who had expected that a prolonged consolidation at $105,000 could develop into a major breakout above $110,000, were disappointed when markets turned negative with the US (US) opening on Monday.

As shown in the chart below, Bitcoin price fell by 6% over the past 24 hours, reaching a 12-day low of $98,522.

Whales reduced Bitcoin demand by $58 billion after Trump’s inauguration

Recent market reports suggest that the broader downtrend has been triggered by investor concerns about AI sector valuations.

This follows the launch of Deepseek, a large, cost-effective language model by China-based developers, which has disrupted the valuation structures of major AI companies.

On-chain data reveals that large corporate investors have significantly reduced their short-term exposure to Bitcoin, likely in anticipation of increased volatility under a Trump presidency.

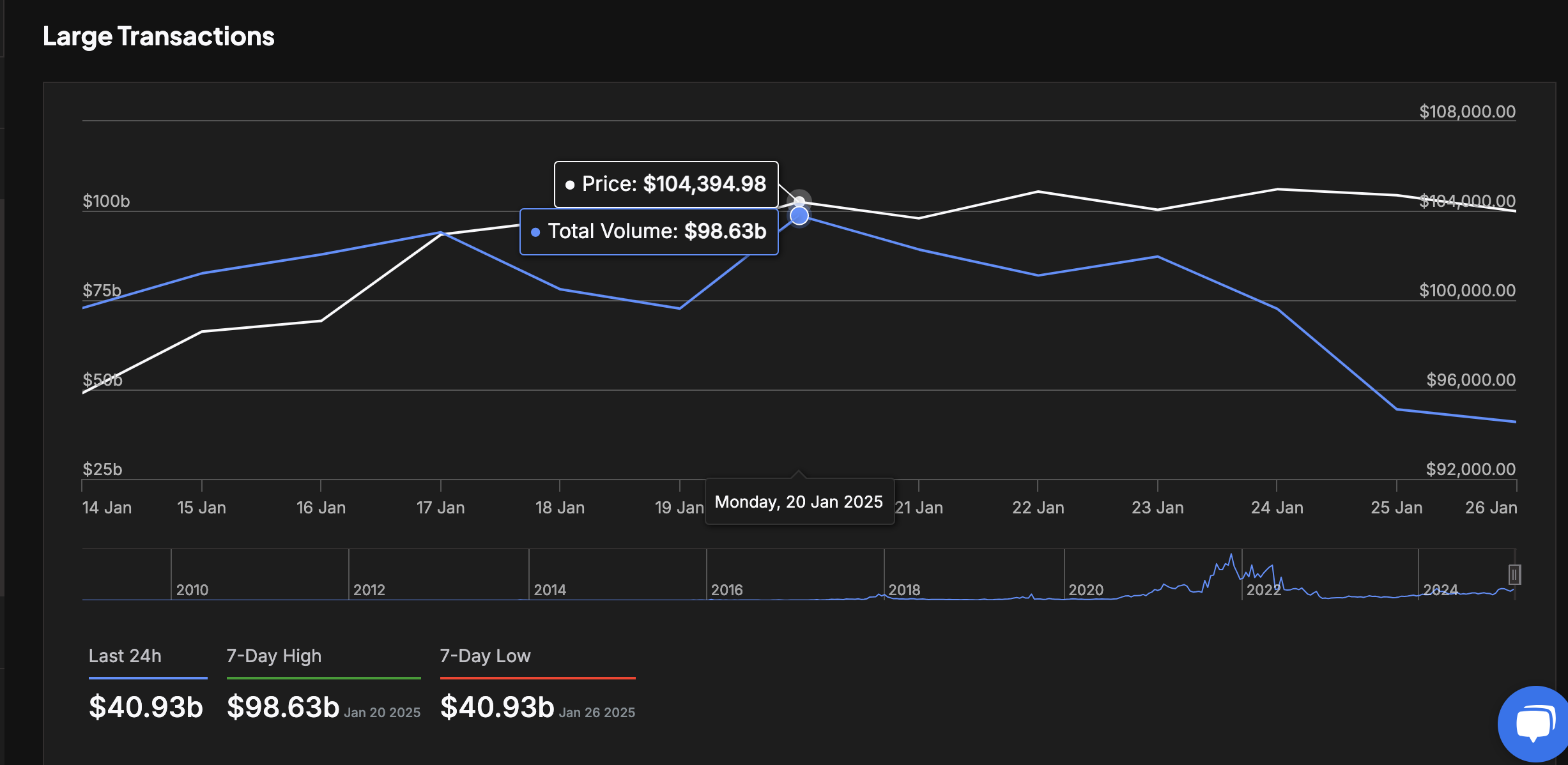

Supporting this trend, IntotheBlock’s high transaction volume chart tracks the dollar value of transactions exceeding $100,000, providing a window into companies’ trading activity around important market events.

Bitcoin large transactions vs BTC price | Source: IntotheBlock

The chart highlights that on January 20, Bitcoin network whale transactions peaked at $98.3 billion, driven by the opening extinction.

However, as the media speculated on Trump’s memes and politics, whales immediately scaled up their BTC trading activity.

Since its market peak on January 20, the volume of large transactions has fallen to $40.9 billion, according to the latest IntotheBlock data updated on Sunday.

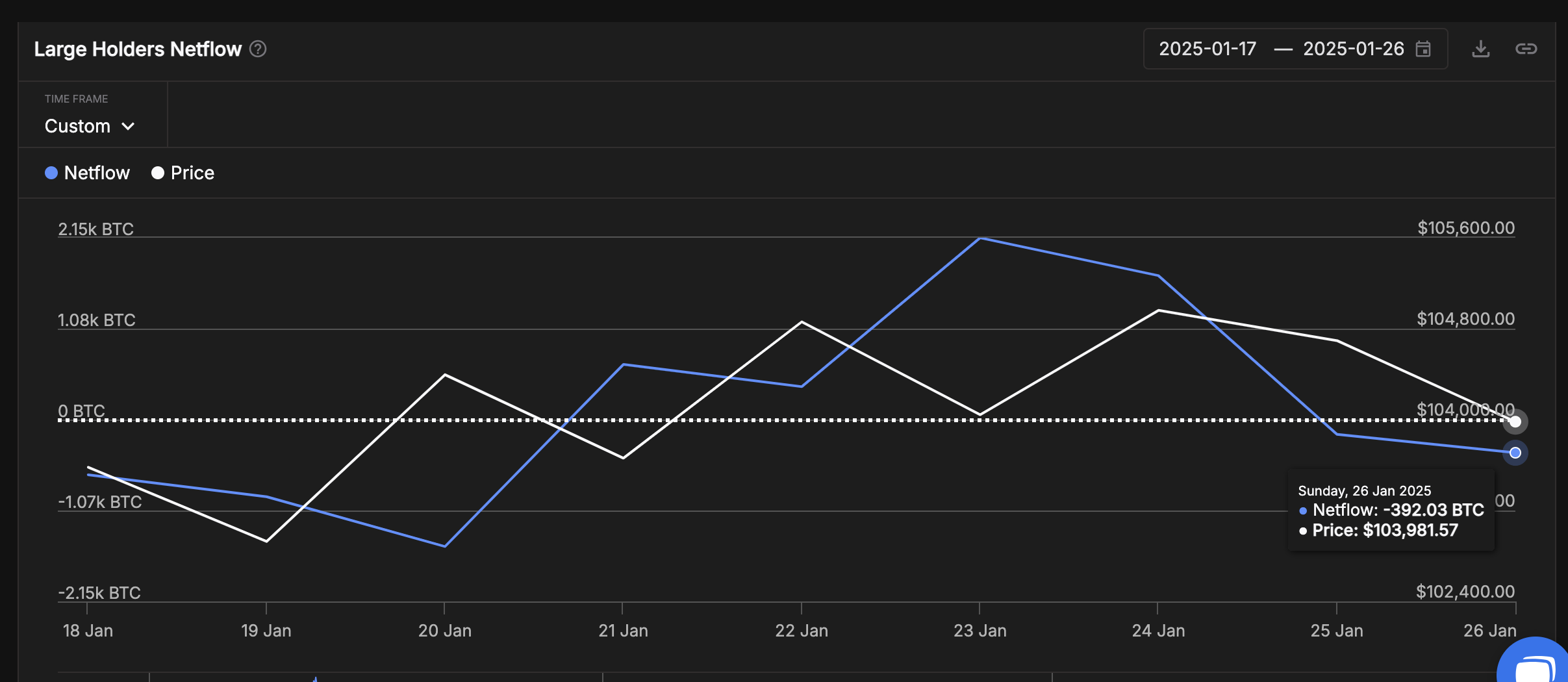

Bitcoin big holder netflows | Source: IntotheBlock

Bitcoin big holder netflows | Source: IntotheBlock

Likewise, the large NetFlows BTC has also fallen since Thursday, with a whale sell-off of 566 BTC ($55.5 million) before the market crash began on Monday.

Bitcoin consolidated above $103,000 during Trump’s first week in office. The early days of his administration were marked by strategic moves, including the launch of $Trump and Melania Meme tokens, Gary Gensler’s formal departure from the Securities and Exchange Commission (SEC), the acquisition of WLFI and an executive order creating the Department of Government Efficiency (DOGE).

While these external stimuli sparked positive sentiment among retail traders, none of them fundamentally improved the underlying network value of major cryptocurrencies.

The $58 billion drop in whale transactions suggests that many corporate investors have scaled back their exposure to Bitcoin after Trump’s inauguration, likely anticipating the risks of a market correction.

Bitcoin Price Prediction: Recovery Hopes Alive If $97,500 Support Holds

On the bright side, with many corporate investors clearly avoiding the majority of the $860 million in downside on Monday, there could be a lot of whale capital sitting on the sidelines waiting to find strategic re-entry opportunities around currently dangling prices.

Technical indicators on the BTCUSD DAILY PRIDS chart confirm this position.

The recent bearish momentum, highlighted by successive red candles, shows a 6.28% decline in two days, with the price currently at $99,814.97.

Parabolic SAR points above price action indicate a continuation of the downtrend unless the price reclaims $109,588, the nearest resistance level.

The Relative Strength Index (RSI) at 48.75 shows a neutral to leave position, indicating no strong buying momentum but not yet selling conditions.

A bullish recovery could emerge if the $97,500 support level holds, as historical bounces from this level often attract.

If this scenario plays out, BTC could reclaim $103,260 to confirm the start of another bull market phase.

Conversely, a bearish continuation will occur if $97,500 fails.

A break below this support could trigger accelerated selling, targeting $94,000 or lower, as the RSI drops into bear territory, signaling selling conditions.