DeepSeek Nvidia and Crypto Miner shares fall by more than 10%

Since DeepSeek, a new Chinese AI protocol, was publicly launched last Friday, cryptocurrency mining stocks have seen a notable decline.

Essentially, DeepSeek was created as a hedge fund side project, with significantly reduced hardware access. Regardless, its success has broken through the logic of pre-existing AI research.

DeepSeek destroys Nvidia stock

DeepSeek, the new AI protocol from a Chinese hedge fund, is wreaking absolute havoc on Nvidia and other leading mining stocks. Nvidia achieved record-high revenues last November and earlier this month predicted AI customers would become a multi-trillion-dollar industry.

However, the arrival of Deepseek has caused a major collapse in the broader AI market.

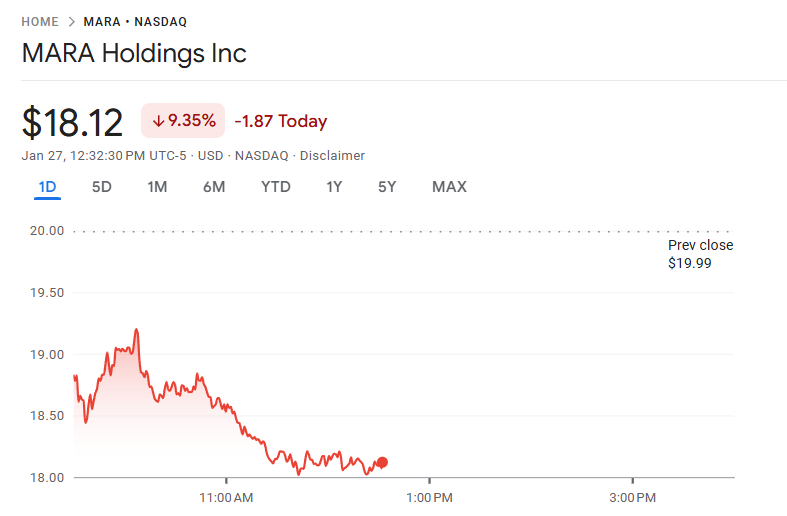

The arrival of Deepseek didn’t just hurt Nvidia; It also caused significant declines in mining stocks such as Marathon and Riot control. These companies require heavy use of Nvidia hardware.

Both companies had performed well before this, purchasing huge amounts of Bitcoin last month. Cipher Mining, another publicly listed Bitcoin mining data center, saw its shares drop 25% today.

but, According to For tech journalist Ed Zitron, the massive valuation of AI-driven companies has been artificially inflated:

“The AI bubble was inflated based on the idea that we needed bigger models trained and running on bigger and bigger GPUs. And along came a company that undermined the narrative — in both objective and questionable ways — and now the market has panicked over $200 billion wasted on capital expenditures.” for artificial intelligence,” Zitron claimed.

He explained that DeepSeek’s great performance as an AI is not the factor that hurts Nvidia or these other companies. Instead, the bigger concern is that DeepSeek is a side project run by a hedge fund, and it achieved these results using significantly lower capital investments.

The project’s success suggests that the American approach to artificial intelligence research is flawed.

AI investors are rethinking their approach

Last week, President Trump announced a new joint research initiative in artificial intelligence that would bring up to $500 billion in funding over the next four years. This could involve huge investments in data centers and power plants to force the issue of AI research.

DeepSeek built its model with limited access to Nvidia chips, but it still excels.

If all this is true, why does the market reward the resource-intensive approach favored by OpenAI and other major AI developers? Is this investment even necessary? Most investors are currently asking these questions.

Overall, this Chinese newcomer has reached the heart of the entire US AI development sector. DeepSeek may have proven that processing power is not the key to AI research, severely undermining Nvidia.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. This news article aims to provide accurate and timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.