Global M2 tightens Bitcoin’s grip – what’s the following?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

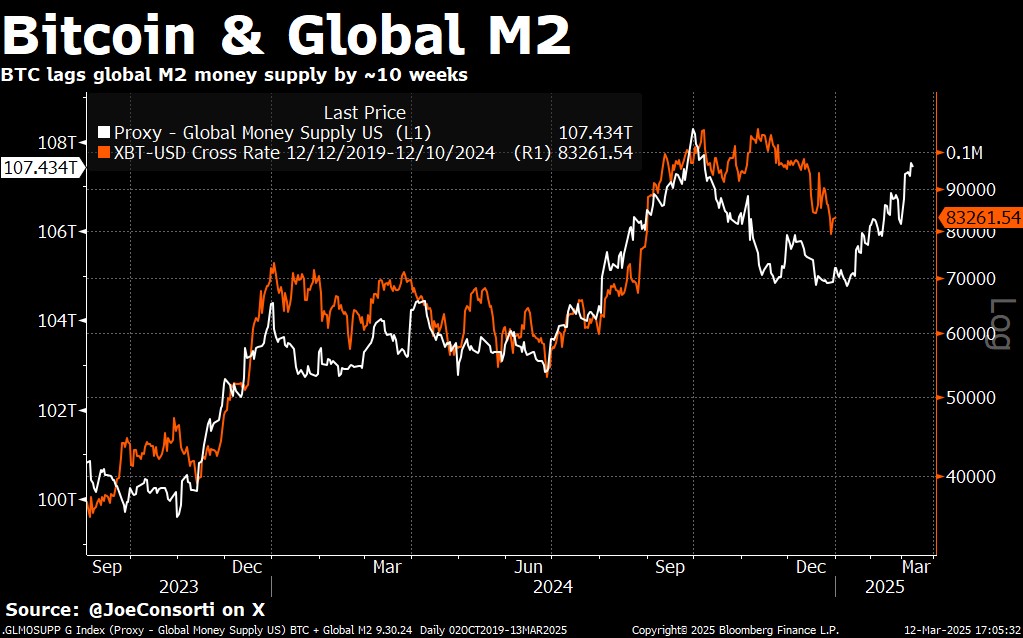

The narrow relationship of Bitcoin with Global M2 has returned to the spotlight, indicating that the broader monetary conditions remain a major force behind the encrypted currency market path. Recent price procedures show that Bitcoin is close to the landfill from the M2-which is almost delayed 70 days. This periodic movement sheds light on the continuous Bitcoin response to fluctuations in liquidity, even if other basic factors, such as the newly announced American Bitcoin Strategic Reserve, continue to obtain the main headlines.

Global M2 Link and inefficiency of Bitcoin market

In his last research Note“Bitcoin’s attachment to Global M2 has been tightened again”, indicating that the price is still oscillating due to the trends of cash. After a few months of difference – which was partly heading by a strong US dollar – Pitcoin fell to $ 78,000, reaching $ 8,000 from the expected path M2.

Reduce the global M2 index, which partially reflects the power of the strong dollar. Despite this clouds, Bitcoin appears to follow the general liquidity scheme that was followed during this session, indicating that the price of Bitcoin still depends on the major total forces such as expansions and the central bank. “Although this relationship is not a direct mechanism for the cause and the result, it continues to provide a large useful framework,” he writes.

He added: “Ready -made meals? Bitcoin is still the final monetary origin in a world where the width of the money is expanded, the ability of the public budget, and the credit permanent M2 globally in US dollars, and more accurate measures for money supply and liquidity to the scene.

Related reading

Although the total conditions are familiar to the market, the market’s reaction to the SBR advertisement was confusing. After US President Donald Trump announced plans to accumulate Bitcoin through the “neutral budget” mechanism, the price decreased by 8.5 % in less than a week. Consorty described the sale as “an irrational reaction that highlights the main shortcomings in pricing the geopolitical importance of Bitcoin.”

Executive Order 14233 imposes treasury and trade officials on the development of American BTC holdings – currently in 198,109 BTC – without the cost of new taxpayer or supervision of Congress. This is a blatant contradiction with the previous adoption at the government level, such as the legal tender for El Salvador, which coincided with the increase in bitcoin. Consorty attributes the contrast to the short -term profits and the “news sale” mentality, adding that “the volume of the sale indicates a complete price failure in the long -term effects.”

Despite the decline in SBR, the technical signals of Bitcoin indicate a possible local bottom formation. The cryptocurrency fell to $ 77,000 before the bounce, filling a low -sized gap in the range of 76,000 to 86,000 dollars. The buyers took over, and they created a hammer candle on the weekly graph.

Related reading

The hammer’s candlestick usually indicates a reflection, especially when they appear at the level of support specified for the cycle. According to Consorti, “a historical precedent indicates that Bitcoin is these patterns in the turning points of the cycle … The last time we have seen the exact price structure during the end of the tail to unify the summer of Bitcoin 2024, two months before its height from 57,000 dollars to 108,000 dollars.”

The prominent trend amid these price fluctuations is the increasing dominance of bitcoin, even during market shrinking periods. ETH/BTC has recently sank to 0.0227 – its lowest levels since May 2020 – which leads to intensification of doubts towards Altcoins. Meanwhile, the institutional demand for ETHEREUM has decreased similarly, as evidenced by a decrease of 56.8 % in the assets under management (AUM) for ETHEREUM against Bitcoin.

“This course belongs to Bitcoin, and all future courses will only increase this reality,” confirms a consorte. It suggests that Altcoins are fighting a hard battle, as it acquires the novels that focus on bitcoin is a global traction.

At the time of the press, BTC was traded at $ 82,875.

Distinctive image created with Dall.e, Chart from TradingView.com