Expedia collection options: A look at what big money thinks – Expedia Group (Nasdaq: Expe)

Investors with a deep pocket adopted a declining approach to the Expedia Group ExpeAnd this is something that the players should not ignore. This important step revealed today, tracking public options records in Benzinga. The identity of these investors is still unknown, but this essential step in Expe usually indicates that something is about to happen.

We recorded this information from our notes today when the Benzinga 20 options scanner highlighted unusual options for Expedia Group. This level of activity is out of the ordinary.

The general mood is divided between these heavyweight investors, with 15 % of oblique climb and 60 % decline. Among these noticeable options, 11, with a total of 625,679 dollars, and 9 calls, up to 432,188 dollars.

What is the target price?

When analyzing the size and open interest in these contracts, it seems that the big players are looking for a price window from $ 75.0 to $ 200.0 for the Expedia Group during the past quarter.

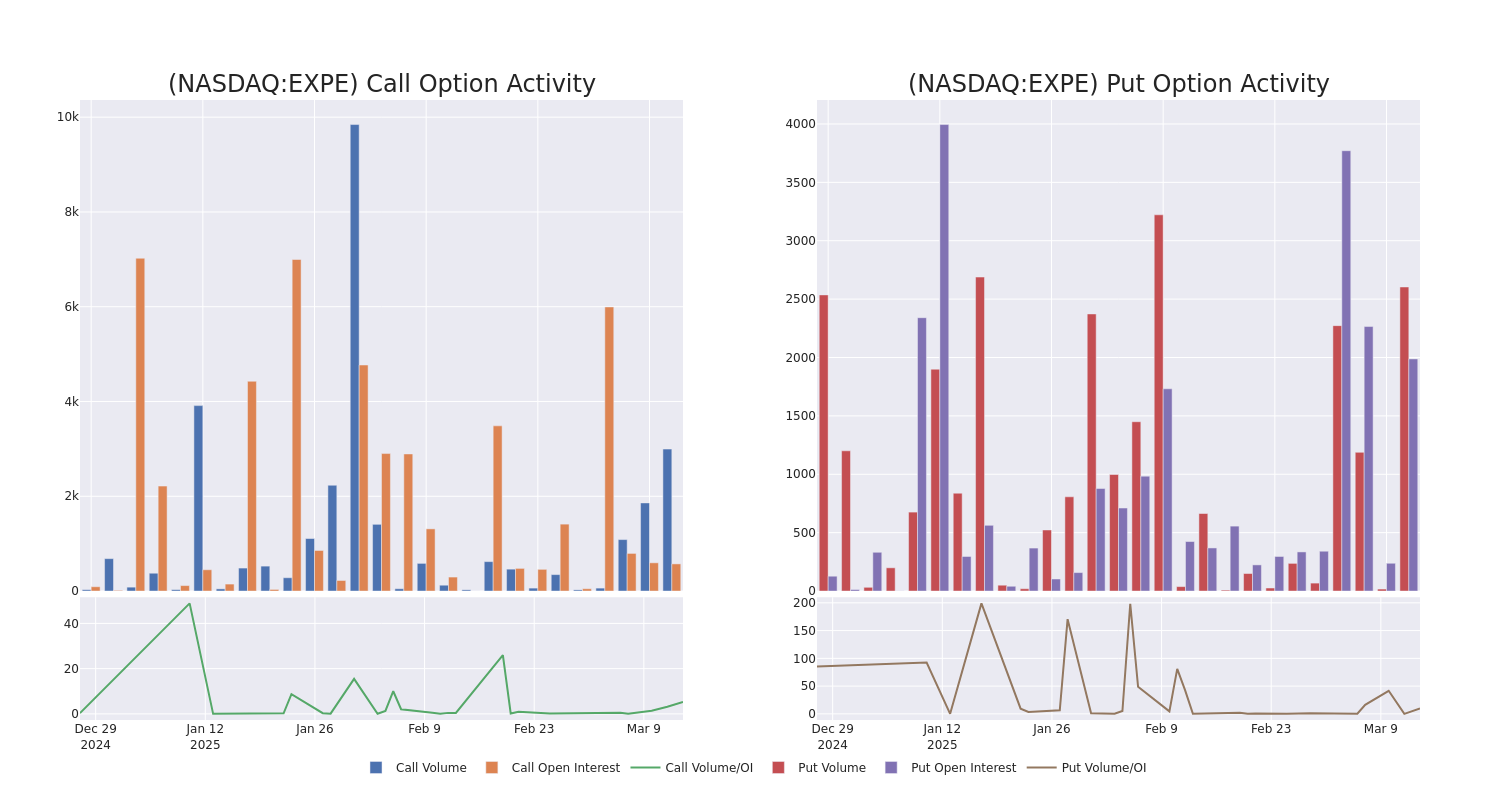

Visions in size and open attention

Open size assessment and attention is a strategic step in trading options. These scales shed light on liquidity and the investor’s interest in the Expedia collection options at the specified strike prices. The upcoming data is visible in size and open interest of both calls and making, associated with the transactions of the Expedia Group group, within the target spectrum of $ 75.0 to $ 200.0 over the past thirty days.

Experience of the Expedia Option Activity: Last 30 days

The largest monitoring options:

| code | Set/call | Trade type | Feelings | Earn. date | Asking | tender | price | Strike price | Total trade price | Open attention | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Expe | Call | commerce | bearish | 04/04/25 | 7.6 dollars | 7.45 dollars | 7.45 dollars | 160.00 dollars | $ 122.9k | 1 | 165 |

| Expe | Put | commerce | bearish | 03/21/25 | $ 19.5 | 18.2 dollars | $ 19.5 | 180.00 dollars | 97.5 thousand dollars | 218 | 51 |

| Expe | Put | Sweep | bearish | 06/20/25 | $ 39.5 | $ 38.95 | $ 39.11 | 200.00 dollars | 94.0 thousand dollars | 467 | 160 |

| Expe | Put | Sweep | bearish | 03/21/25 | $ 2.84 | $ 2.7 | $ 2.77 | 160.00 dollars | 86.5 thousand dollars | 267 | 597 |

| Expe | Put | Sweep | bearish | 03/21/25 | $ 2.84 | $ 2.55 | $ 2.78 | 160.00 dollars | 77.8 thousand dollars | 267 | 876 |

About Expedia

Expedia is the second largest online travel agency in the world through reservations, providing housing services (80 % of total sales of 2024), air tickets (3 %), rented cars, cruises, serving, and others (10 %), and advertising revenues (7 %). Expedia runs a number of brand travel booking sites, but the three brands of the online travel agency are Expedia, Hotels.com and VRBO. It also has a Metasearch brand, Trivago. Putting transaction fees via the Internet calculate the largest part of sales and profits.

After analyzing the activities of the options associated with the Expedia Group group, we take a closer look at the company’s performance.

Where does Expedia stand now?

- With a trading volume of 1863,997, the Expe price increased by 3.18 %, to reach 162.11 dollars.

- Current RSI values indicate that the arrow may be exaggerated.

- The next 48 -day profit is decided from now.

Professional analyst assessments of Expedia Group

Over the course of last month, industry analysts shared 1 visions around this stock, suggesting the average target price of $ 175.0.

Unusual options activity: Smart money in this step has been discovered

The unusual Benzinga Edge’s provides that the potential engines of the market are raging before they happen. Learn about the situations taken by the big money on your favorite shares. Click here to arrive. * Maintaining their position, a Truist Securities analyst continues to obtain a classification with Expedia Group, targeting the price of $ 175.

Trading options offer higher risks and possible rewards. Smart traders manage these risks by constantly educating themselves, adapting their strategies, monitoring multiple indicators, and closely monitoring market movements. Keep aware of the latest options of the Expedia Group collection with actual time alerts from Benzinga Pro.

batch84.70

growth35.50

quality–

value32.50

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.