Solana Etf Delay Fuels ASFECTS, 6 million dollars withdrawn from Sol

On Tuesday, the US Securities and Stock Exchange Committee (SEC) has postponed its decision on multiple money circulating in the altcoin (ETFS) exchange, including Solana’s.

This development has increased investor morale towards Seoul, which continued to watch significant flows on the market.

Investors come out of Solana, amid a second delay – 16 million dollars withdrawn less than 24 hours

In a series of filings It was made on March 11, SEC announced its plans to postpone its decision regarding the multiple circulating investment funds associated with the main assets, one of which is Sol. According to the regulation, a “longer period” has been set to review the proposed base changes that would enable the circulating investment funds to become operating.

This has exacerbated the firm feelings towards Seoul, which is reflected in capital flows from its topical markets over the past 24 hours. As of the writing of these lines, $ 16.43 million was removed from the market, which represents the seventh day of external flows in a row, which now exceeded $ 250 million.

When assets test external flows like this, their investors sell their property. This trend reflects the lack of confidence in the short -term prices for Sol, as traders choose to benefit from their gains due to prevent further losses in investments.

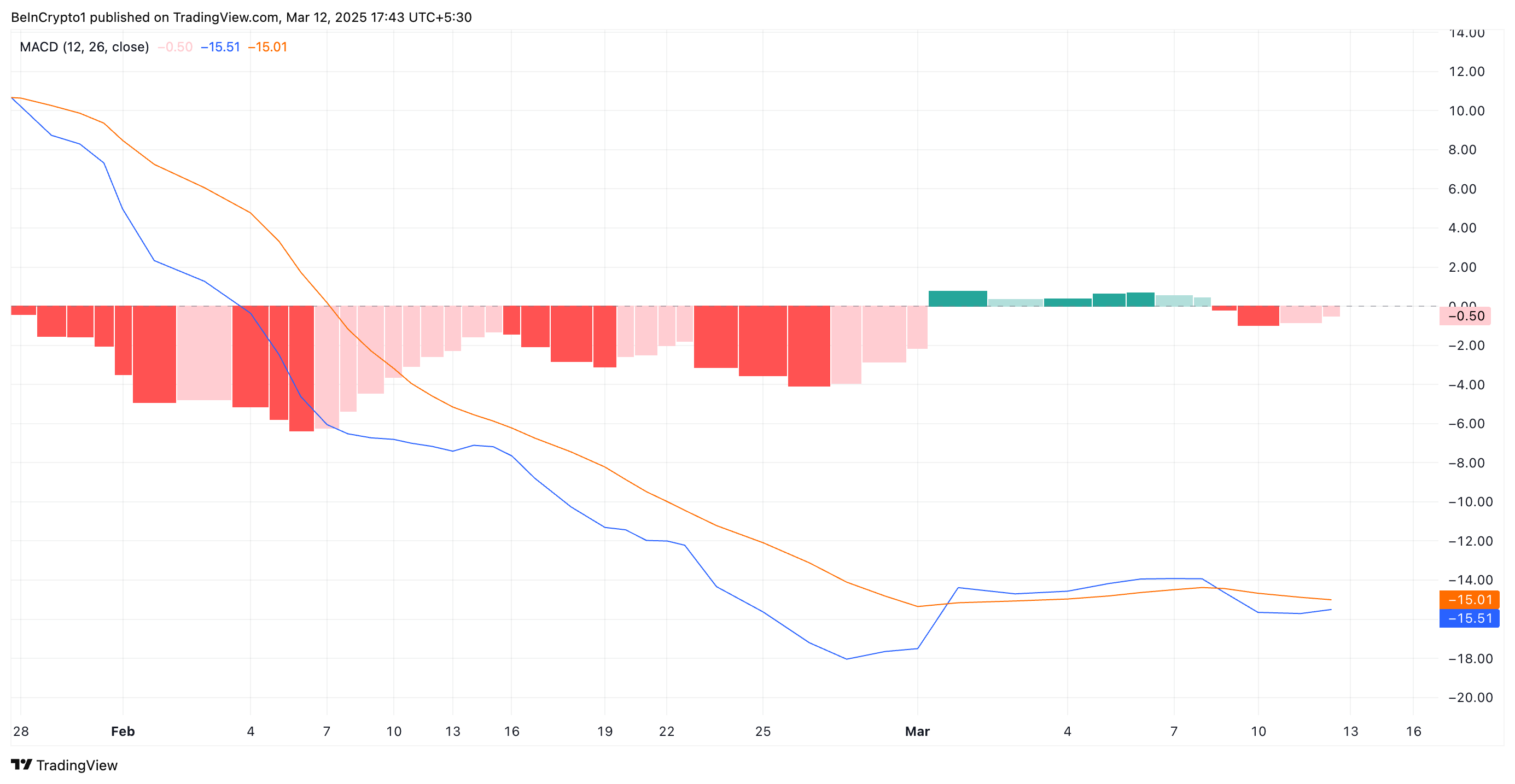

Moreover, the SOL medium rapprochement index, which was observed on the daily chart, supports this landmark. As of the writing of these lines, the currency (blue) MACD line is less than the (orange) signal line.

MacD measures price trends and momentum transformations and determines potential purchase signals or sale based on the crossing of the MACD line, signal line and changes in the graph.

When the MACD line settles below the signal line, the market is in a declining direction. This indicates that Sol sales exceed the purchase activity among the market participants, which hints to a decrease in another value.

Solana in Crossroads: Will Sol hold $ 126 or decrease to $ 110?

Sol is trading at $ 126.82 at the time of the press. With the purchase pressure decreased, it risk a decrease to $ 110, the lowest level in August 2024.

However, the strong recovery in the purchase activity would prevent this. In order for this to happen, Sol must create a strong support flow at $ 135.22. If it succeeds, its price may pay for trading at $ 138.84 and above.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.