The analyst reveals the Bitcoin Bear market less than this level

The analyst explained how the average moving (MA), which was historically as limits of the bear markets at this level.

Bitcoin is now 50 weeks currently 75,195 dollars

In new mail In X, analyst James van Stin shared an important diamond couple related to Bitcoin. “MA” is a technical analysis tool (TA) calculates the average value of any certain amount and as its name indicates, it moves in time with the quantity and update its value accordingly.

MAS can take any time window, whether it is only 10 minutes or 10 years. The main use of this indicator is to study long -term trends, as it helps to filter any short -term deviations in the scheme.

Here is the graph that the analyst shared, which shows the direction in the diamond of 50 weeks and 200 days from the price of Bitcoin during the past year:

As visible in the graph above, the price of bitcoin decreased to less than the Master of 200 days after the last market shrinkage, which means that the value of the original now is less than the average for 200 days.

In TA, MA is often seen for 200 days as a boundary line between hippos and filtering trends, with level breakdown is a bad sign. Thus, it seems that BTC has lost this important level with the latest diving.

However, another level may divide the macro trends is a 50 -week master’s degree, which is still the coded currency above. “Less than 50wma is the bear market,” Van Strat is noted. Nowadays, the level is about 75,195 dollars.

If the current landing path continues in BTC, this line is likely to be tested. The analyst pointed out, though, that the currency has decreased under the Master of 200 days several times before and was able to recover before the collapse under 50 weeks. It remains now to see if there is a similar pattern that will be turned on this time as well or not.

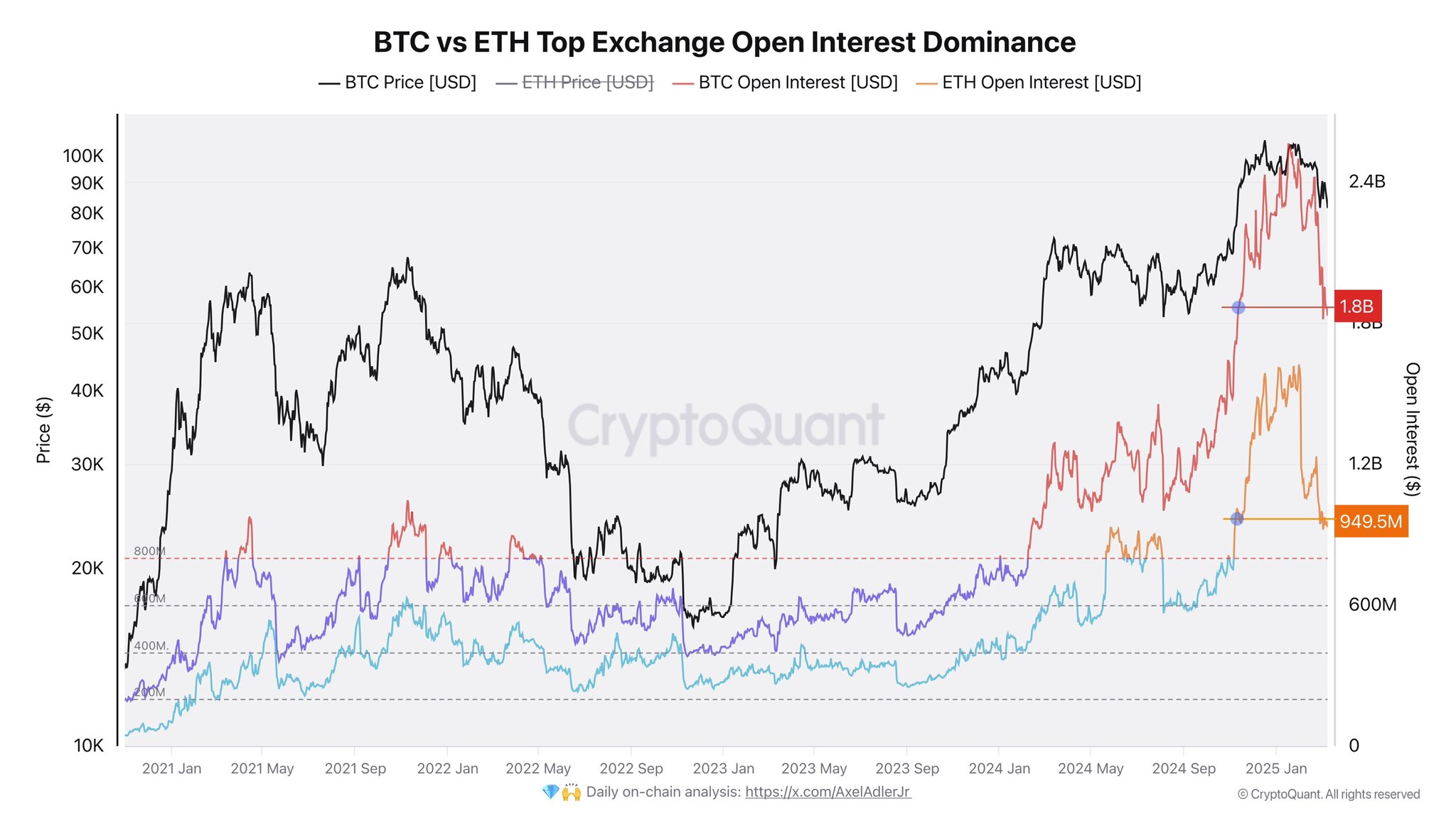

In some other news, the downward path of the market meant that the flow of financial leverages occurred on the side of the derivatives from the sector, where the author of the Cryptoquant Axel Adler JR participated in X mail.

In the graph, the analyst has connected the data for “open interest”, an indicator that measures the total amount of derivatives related to a specific original open origin on all central stock exchanges.

The scale seems to have decreased by $ 668 million for Bitcoin and $ 700 million for ETAREUM.

BTC price

Bitcoin has recovered over the past 24 hours, when its price jumped by 7 %, reaching a level of $ 83,000.