How will the Crypto market reaction be to the next step for the FED?

The United States market is eagerly awaiting the second inflation report for 2025. The report is scheduled to be released today. Analysts predict a slight decrease in both the main enlargement and basic inflation. If this is confirmed, this will be the first time since July 2024 that inflation indicators have decreased.

American inflation forecast for February

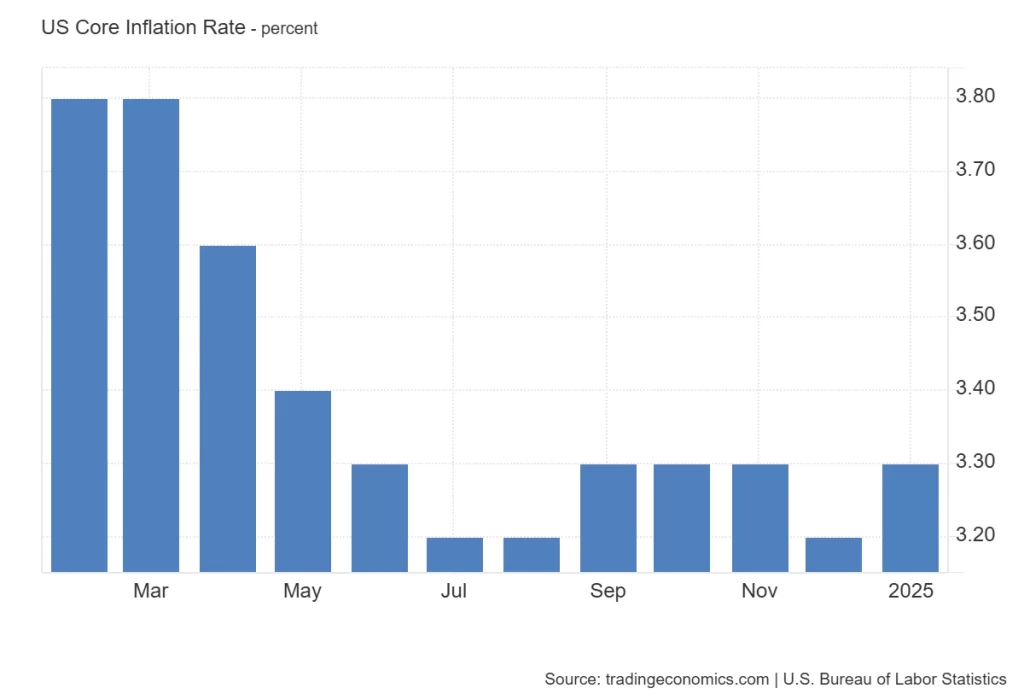

In January 2025, the basic inflation rate increased from 3.2 % to 3.3 %. The consensus is that the rate will decrease from 3.3 % to 3.2 % in February. According to Teforecast, the rate is expected to decrease sharply from 3.3 % to 3.1 %.

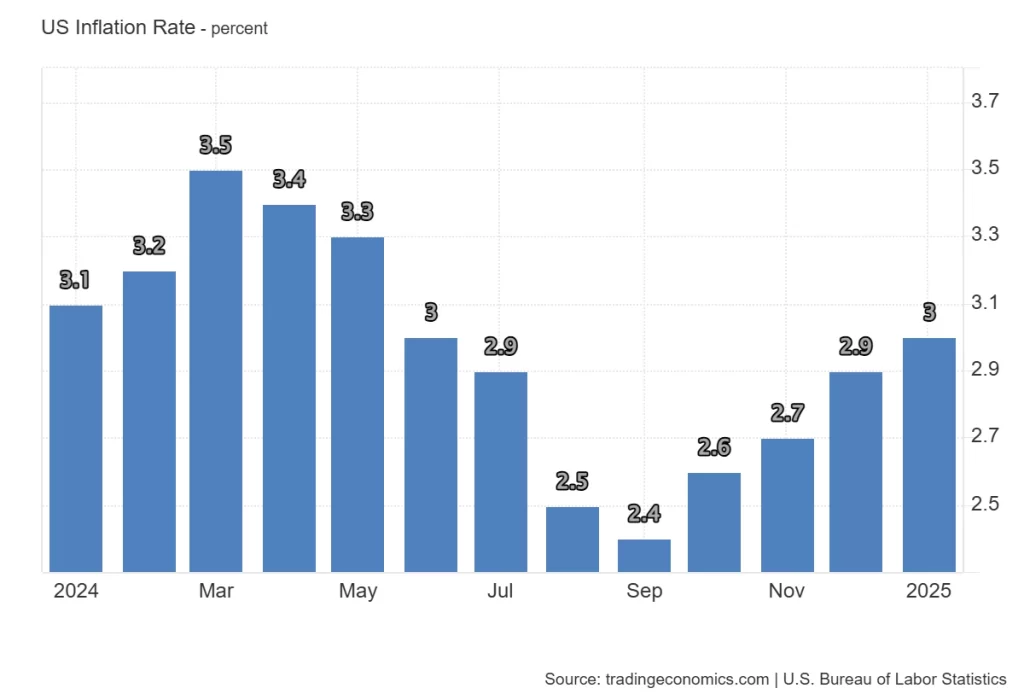

In January 2025, the American inflation rate increased from 2.9 % to 3 %. The consensus is that the rate will decrease from 3 % to 2.9 % in February.

If this is confirmed, this will be the first time since July 2024 that inflation indicators have decreased.

In July 2024, the basic inflation rate decreased from 3.3 % to 3.2 %, and the inflation rate in the United States decreased from 3 % to 2.9 %.

Since September 2024, the American inflation rate has increased continuously. Meanwhile, the basic inflation rate increased from 3.2 % to 3.3 % in September. He remained at the same level for the next two months. In December, it decreased to 3.2 % of 3.3 %.

Market confidence in cooling inflation

The markets are very optimistic that inflation will decrease. Kalshi merchants expect the main consumer price index to decrease to 2.9 %. It is worth noting, Like Traders predicted at least 6 of the last 8 numbers of the consumer price index.

- Also read:

- Crypto News Today, 12 March: XRP News, Pi Network PRICE, XLM Crypto, Economic Calendar

- and

The effect of Trump’s commercial policies on inflation

US President Donald Trump

Donald Trump Donald Trump is a former American president, a businessman, and a media figure, who held the position of forty -fifth President of the United States between 2017 to 2021. Trump won the Bachelor of Science in Economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential elections as a candidate for the Republican Party against the Democratic Party candidate Hillary Clinton. In his capacity, Trump ordered a travel ban on citizens from many Muslim majority countries, transforming military financing towards building a wall on the border between the United States and Mexico, and implemented the family separation policy. Trump remained a prominent figure in the Republican Party and is considered a potential candidate for the 2024 presidential elections president Recently imposed an import tariff on China, Canada and Mexico. His aggressive trade policies sparked a retaliatory tariff and prompted the global economy to the brink of a catastrophic trade war.

Donald Trump Donald Trump is a former American president, a businessman, and a media figure, who held the position of forty -fifth President of the United States between 2017 to 2021. Trump won the Bachelor of Science in Economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential elections as a candidate for the Republican Party against the Democratic Party candidate Hillary Clinton. In his capacity, Trump ordered a travel ban on citizens from many Muslim majority countries, transforming military financing towards building a wall on the border between the United States and Mexico, and implemented the family separation policy. Trump remained a prominent figure in the Republican Party and is considered a potential candidate for the 2024 presidential elections president Recently imposed an import tariff on China, Canada and Mexico. His aggressive trade policies sparked a retaliatory tariff and prompted the global economy to the brink of a catastrophic trade war.

The inflation report will be the first to reflect inflation under Trump’s difficult commercial policies.

Impact on the cryptical currency market

If inflation decreases as expected, it may affect the cryptocurrency market in multiple ways. The rate of hypertrophy increases the possibility of a federal reserve reduction from the money policy, which leads to low interest rates. This can create a more suitable environment for risk assets such as encryption, which causes the investor confidence. However, the uncertainty surrounding Trump’s commercial policies may lead to fluctuations, because global economic instability often pushes investors towards safe armed assets such as gold. If inflation remains stubbornly in exchange for expectation, the Federal Reserve may maintain narrow cash policies, which leads to pressure on the financial markets and wider encryption.

Do not miss any rhythm in the world of encryption!

Stay in the foreground with urgent news, expert analysis, actual time updates about the latest trends in Bitcoin, Altcoins, Defi, NFTS and more.