Solana (Sol) drowns 38 % in one month

Solana has faced intense pressure for sale, recently decreased to less than $ 120 – its lowest level since February 2024. More than 38 % have decreased over the past thirty days, enhancing its declining momentum.

With the sellers ’control firmly, Sol is now facing an important test of support levels, while any possible recovery will need to penetrate the main resistance areas to indicate a transformation in the momentum.

The Solana Ichimoku cloud is offered to a strong dilemma

The Solana Ichimoku cloud shows that the price is currently trading less than both Tenkan-Sen (the transfer line) and Red Kijun-Sen, indicating that the short-term trend remains down.

The price has recently increased from a local decrease but has not yet recovered these main resistance levels. In addition, the upcoming Ichimoku Cloud (Kumo) is Red, which reflects the declining feeling in the market.

The cloud itself is much higher than the current price, indicating that even if Sol faces a short -term recovery, you are likely to face strong resistance near the 130 to 135 dollar area.

The Tenkan-Sen position at the bottom of the Kijun-Sen supports the declining expectations, as this intersection usually indicates the declining momentum.

For any signs of the reflection of the direction, you will need a break over these two lines and perfectly insert the cloud, indicating a possible transition to a neutral stage.

Until then, the dandruff cloud indicates the front and the current weak structure of the current prices that any gatherings may be temporary before resuming the broader downward trend.

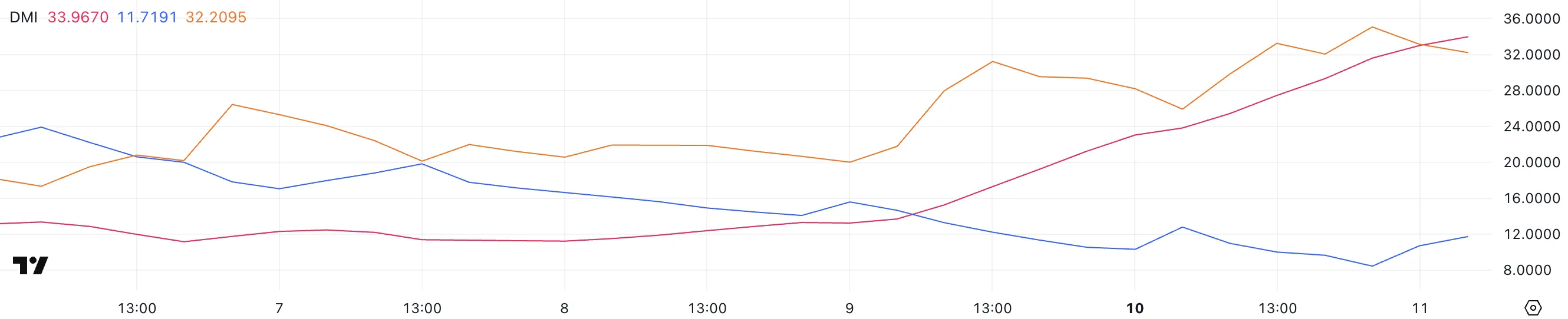

Sol DMI shows that sellers are still controlling

The Solana Directional (DMI) movement plan (DMI) reveals that the average trend index (ADX) is currently 33.96, a significant increase from 13.2 only two days ago.

ADX measures the strength of the direction, reading above 25 usually indicates a strong direction, while values are less than 20 to a weak or not present direction. Looking at this sharp height, it confirms that the constant direction of Sol is gaining strength.

+Di (the positive trend index) decreased to 11.71 from 15.5 two days ago, but it recovered slightly from 8.43 yesterday. On the other hand, the -di (the negative trend index) sits at 32.2, up from 25.9 days ago, although it slightly decreased from 35 hours a few hours ago.

The relative position of +Di and -Di lines indicates that sellers still control, because -Di is still much higher than Di +.

The last decline in -DI from 35 to 32.2 can indicate some short -term relief, but with ADX quickly, it enhances that the prevailing trend is still intact.

The slight bounce in +DI suggests the simple purchase pressure, but it is not enough to convert momentum in favor of the bulls. Until +Di above -Di or ADX rises in the decline, the SOL direction is likely to continue, while sellers dominate price procedures in the near term.

Will Solana decrease to less than $ 110?

Solana moving lines (EMA) continues to depict a declining direction, with EMAS mode in the short term under the long term.

This alignment indicates that the declining momentum is still dominant, although the price is currently trying to recover. If this recovery gains strength, the Solana price may face resistance at $ 130 and 135 dollars, which are main levels that must be wiped for any reflection in the possible direction.

A successful break over this resistance may pay a Sol about $ 152.9, an important level, if breached with a strong purchase pressure, the road may pave the way for a march of about $ 179.85 – where the price level was last seen on March 2, when Sol was added to the strategic coding reserve in the United States.

However, if the declining structure remains the same and the resumption of the sale pressure, Solana can re -test the support levels of $ 115 and 112 dollars, both of which served as major basic floors.

Failure to get these support can open the door to a deeper decline, and may push Sol to less than $ 110 for the first time since February 2024.

Given the location of the current EMAS, the declining trend in control remains unless Solana recovers the main resistance levels and establishes an upper intersection, indicating a shift in market morale.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.