Ethereum (ETH) may test $ 1,700

ETHEREUM (ETH) faces sharp correction, as it decreased by 11 % during the past week with continued control of the declining momentum. The RSI (RSI) index remains weak, which indicates a lack of strong purchase pressure, while the DMI movement indicates that sellers are still controlling.

In addition, the EMA intermediate averages in a declining structure firmly, indicating that ETH can soon test critical support levels at $ 1756, and may decrease to less than $ 1700 for the first time since October 2023.

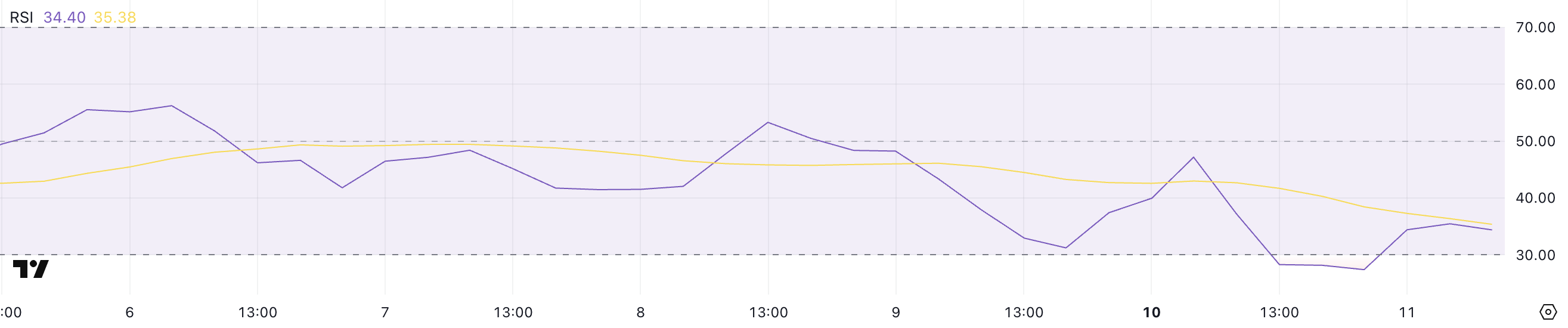

Eth RSI explains the lack of purchase pressure

The ETHEREUM (RSI) is currently 34.4, and it recovers a little after dipping it shortly to 27.4 yesterday. The relative strength index remained less than 50 marks for three consecutive days, indicating that the dumping momentum is still dominant.

RSI measures the speed and volume of changes in modern prices to assess whether the original has been purchased or excessive in the sale.

The relative power indicator usually indicates an excessive conditions in the peak, which indicates the possibility of withdrawal, while RSI is less than 30 of the sale conditions, which means that the pressure pressure may be excessive and may be imminent.

With RSI from ETH now at 34.4, it indicates that while the origin is still in the Habboudia area, the severe sale pressure that was seen yesterday was slightly reduced.

The brief decrease is less than 30 to a state of sale, which often leads to short -term relief pools. However, in order to restore ETH the bullish momentum, the relative strength index will need to climb up to 50, indicating a shift in market morale.

Until then, you may face any resistance escalating movement, and the broader direction remains weak unless the continuous purchase pressure pushes ETH from this descending area.

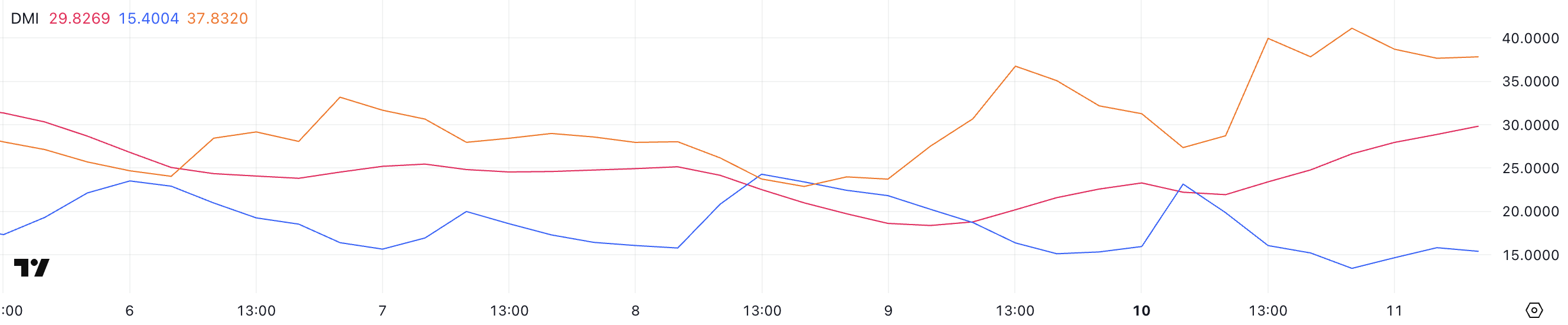

Ethereum DMI shows that the current downward trend is strong

The ETHEREUM (DMI) mode plan explains that the average trend index (ADX) is currently 29.82, as it rose from 21.9 yesterday.

ADX measures the strength of the trend, with values higher than 25 indicating a strong direction and readings less than 20 which indicates a weak or not present direction. Looking at the sharp increase of ADX, it confirms that the continuous trend of ETH is enhancing.

+DI (the positive trend index) decreased to 15.4 out of 23.1 last day, while -Di (the negative trend index) rose to 37.8 out of 27.3, which enhances the dominance of sellers in the market.

With -Di is much higher than +DI, it indicates that the dumping momentum is condensed, and the sellers continue to control ETH prices.

The decrease in +DI indicates that the purchase pressure weakens, which makes it difficult for ETH recovery. Unless +DI +begins to height and crosses above -DI, the ETH price is likely to remain under pressure.

Given that ADX is close to 30 and still climbs, the downward trend seems firm, and any short -term relief marches may face strong resistance before the meaning of the meaning of the meaning.

Ethereum is still struggling with less than $ 2000

ETHEREUM ASIs shows a strong declining preparation, with Emas in the short term lower long -term lines.

This alignment confirms the continuation of the declining momentum, as ETH has decreased more than 11 % in the past 24 hours. If the current trend persists, the ETH can test decisive support at $ 1756, a level that can determine whether there are other imminent declines.

The collapse without this support would offer the price of ETHEREUM to a possible decrease to less than $ 1700, a level that has not been seen since October 2023, which enhances the feelings of alphabetic in the market.

However, if ETH is in contrast to its declining direction, the first main resistance to recovery will be in the amount of $ 1996. A successful collapse above this level may lead to a stronger recovery, which pushes the eth towards the following resistance at $ 2,320.

If the upscale momentum accelerates, Ethereum can extend about $ 2546, a level that would be a full shift in the structure of the direction.

In order for this to happen, ETH will need a constant purchase pressure and the upcoming EMA hearts, indicating a transition from the current landing stage.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.