Why bitcoin decreased today? 696 million dollars in liquidation and economic concerns hit the encryption

Bitcoin has reconsidered its lowest multiple levels today, as the concerns of the US -Chinese trade war kept investors on their fingers.

A wave of filters pushed the total value of the cryptocurrency market under the brand of $ 3 trillion to another level seen before November 10, before the start of the US elections 2024.

When writing, the market ceiling reached $ 2.717 trillion, a decrease of more than 5 % in the past 24 hours alone.

Within the past 24 hours, 241,118 traders have been filtered, with a total of 696.38 million dollars.

The biggest individual liquidation request has occurred on the Binance’s BTCUSDT pair, worth $ 32.09 million.

The fear and greed index has decreased to 10, which is its lowest level since July 2022, indicating “extreme fear”.

Traders kept the assets of risk in the Gulf, as the Altcoin market is struggling to find momentum with a large extent continued to make prices amid the increasing sale pressure.

Why is Bitcoin’s disruption today?

Bitcoin decreased more than 5 % to $ 79367, as the market dealt with a number of dumpted stimuli.

First, Bitcoin interacts with US President Donald Trump’s recent comments, admitting that markets may face short -term pain due to his economic policies, including commercial tariffs in China, Canada and Mexico.

In an interview with Fox News, Trump admitted, “There can be a little disorder,” which enhances fears that his broader economic agenda may create fluctuations in the short term.

His observations were inflated for concerns about a long trade war with China, which led investors towards risk assets and caused a sharp shrinkage in the encryption markets.

While Trump frame his policies as the basis for stability in the long run, the immediate effect was an increase in uncertainty, providing references and a decrease in market morale.

Moreover, the latest reprisal definitions in China on American agricultural goods entered into force today, which doubled the market concerns while the encryption industry was already suffering from disappointment due to Trump’s decision to exclude the purchases of direct bitcoin from his strategic reserve plans.

Moreover, Bitcoin futures at Chicago Mercantile Exchange began on March 10 at $ 82,110, as $ 4,320 slipped from the end of the previous day of $ 86,430.

This represents the second largest decrease for one day this month, as it only fails the record worth $ 10,350 on March 3, adding uncertainty.

Bitcoin price expectations: More pain in the future?

At the time of writing this report, Bitcoin was trading at $ 80,526, as the bulls struggled to restore $ 82,000, which served as major support during the past month.

According to prominent analyst Arthur Hayes, Bitcoin can decrease further, which may re -test $ 78,000.

If this level is not steadfast, he sees that $ 75,000 is the next main goal.

He pointed out that many bitcoin options are stacked between $ 70,000 and $ 75,000, which may lead to an increase in volatility if bitcoin slipped to that region.

Another point of view was shared by the Rekt Capital, which referred to the Bitcoin Relative Power Index (RSI) as a major sign of its viewing.

He pointed out that if Bitcoin expands the low prices while RSI prints its lowest levels higher, this may indicate a bullish contrast – a classic reflection signal.

Rekt Capital also highlighted that in the current bull cycle, Bitcoin usually wore whenever the daily relative strength index decreases to less than 28.

When writing, RSI reached 33.2, indicating that although Bitcoin is not in levels of historical bounce until now, it may be approaching.

Bitcoin has made the highest level in the diary, there is no denial, but throughout this entire session, whenever Bitcoin reaches 28 or less on RSI … the price of Bitcoin will either below or range from -2 % to -8 % of the bottom.

Traders are also awaiting major economic reports this week, including the US consumer price index on March 12 and the producers’ price index on March 13.

If inflation is higher than expected, it may indicate that the federal reserve may stop price discounts, while maintaining tight financial conditions and pressure of risk assets such as bitcoin.

On the contrary, reading the cooler inflation of expected can provoke optimism for cash relief, which may provide some comfort for the encryption market.

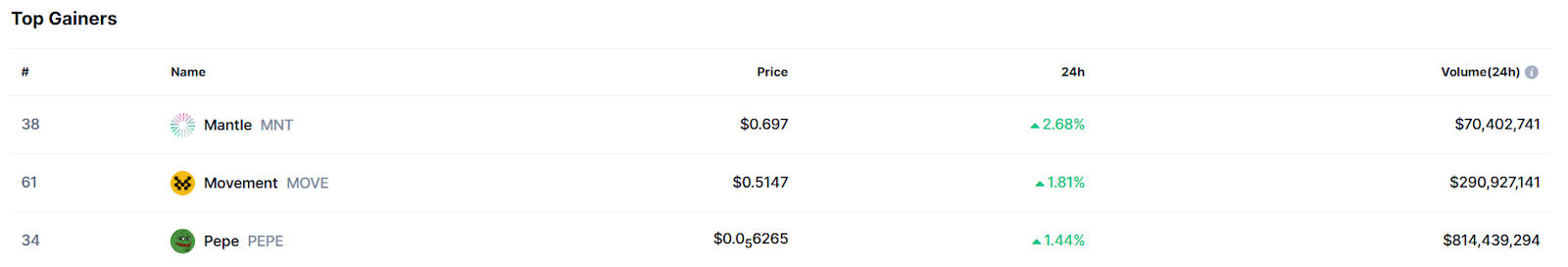

The highest altcoins conflict

Despite the broader shrinkage, the Altcoin market increased slightly over the day from 1.09 billion dollars to about 1.15 trillion dollars until the time of the press.

A handful of Altcoins only managed to maintain its gains, with a few low -mineral currencies that achieve two numbers, such as Superrare (Rare), iost (iost) and B3 (B3).

Meanwhile, most of the 99 cryptocurrencies remained in red, and their weekly losses extend.

source: Coinmarketcap

The weak momentum coincided with the broader Altcoin market with no interest among altcoin merchants, where the Altcoin season index was 24 when writing, which means that the majority of Altcoins was low -performance compared to bitcoin.

The post why Bitcoin below today? 696 million dollars in the qualifiers and economic concerns struck the encryption for the first time on Invezz