Bitcoin can gather over ATH to $ 128,000-an indication of the series refers to a possible recovery

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin (BTC) continues to face massive sale pressure, as prices have decreased to less than 85,000 dollars, which represents a 12 % decrease since last Friday. The last shrinkage increased the panic and increased fear, which prompted many investors to predict the potential start of the bear market. With uncertainty, the market controls, traders remain careful about the next main Bitcoin step.

Related reading

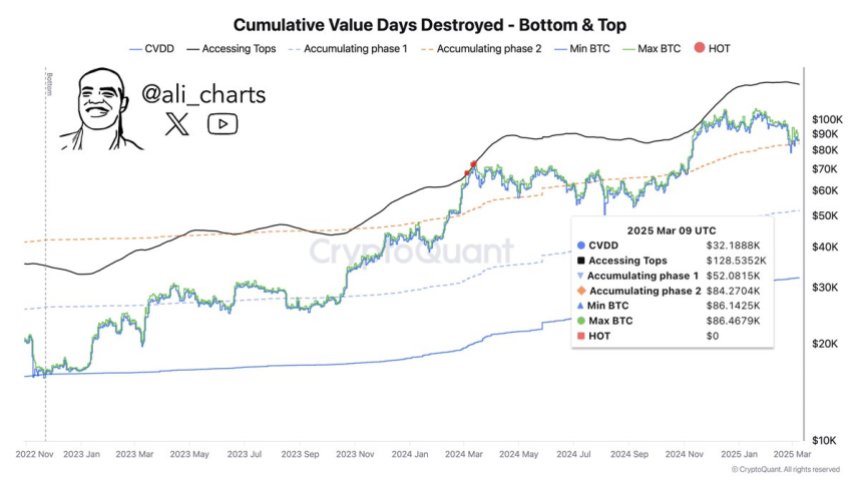

However, despite the ongoing sales, the main data indicates the chain of Cryptoquant that Bitcoin can be prepared for recovery. The destroyed cumulative value index (CVDD), a scale that tracks a long -term standing behavior and capital flows, indicates that BTC can soon enter a new upward direction. If Bitcoin stabilizes and recovered the main support levels, it may pave the way for a rise in the highest new level ever at $ 128,000.

With Bitcoin at a critical turning point, the following few trading sessions will be very important in determining whether BTC can regain momentum or if the additional downside is in the foreground. Investors are now closely monitoring whether the sale pressure is continuing or if the long -term holders are interfering with accumulation, indicating the recovery of the potential market.

Bitcoin visions give hope to the bulls

Bitcoin is at a critical turn, as it faces a dangerous danger to the continuation of the correction, as it controls the homosexuality on the market. Many analysts now believe that the Bitcoin Bull course may end, as BTC is struggling to less than $ 85,000 while barely maintained more than $ 80,000. With the condensation of the sale pressure, investors expect another leg down, and they may push BTC to low -order areas.

Despite negative expectations, some analysts argue that recovery is still possible if Bitcoin can restore key levels. Senior analysts Ali Martinez shared visions on xSaying that if BTC recovers $ 84,000 as support, it can open the path towards the gathering to the highest new level ever at $ 128,000. This indicates that although the market is still fragile, there is still a possibility for Bitcoin to restore strength if the bulls enter the critical price points.

The coming weeks will be decisive in determining the strength or weakness of this course. If BTC persists in the struggle without the main resistance levels, it may follow a deeper correction, which enhances the homosexuality. However, if Bulls can push BTC back above 84 thousand dollars, this will indicate a transformation in the momentum, and may hinder the bullish direction.

Related reading

With the uncertainty dominating the market, traders closely monitor the next step for BTC, because its ability to retain or restore support levels will determine whether this session has truly ended or if there is another gathering on the horizon.

BTC is fighting less than 85 thousand dollars

Bitcoin faced tremendous pressure for sale, as a significant decrease occurred on Sunday, when the price fell from $ 86,000 to $ 80,000, which represents a decrease of 7 % in just hours. This acute stagnation has led to the sale of panic as investors are still not sure of Bitcoin in the short term.

In order for bulls to regain control, BTC must restore $ 86,000 and pay more than $ 90,000 to confirm the potential recovery rally. A strong step that goes beyond these main resistance levels can restore confidence in the market, indicating that Bitcoin correction may approach its end.

However, the failure to break more than $ 86,000 can keep bitcoin under Habbudian control, which increases the risk of another leg decrease. If BTC decreases to less than 80,000 dollars, it can test a decrease of $ 78,000, which may lead, if breached, increases pressure on the negative side.

Related reading

With Bitcoin at a critical turning point, the following few trading sessions will determine whether the bulls can restore the main levels or whether the bears will continue to control the market, pushing BTC to a deeper correction area.

Distinctive image from Dall-E, the tradingView graph