330,000 ethereum was withdrawn from the stock exchanges in 72 hours – pressure on admission?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

ETHEREUM faced great pressure for sale and fluctuations during the past month, as the entire encryption market is heading down, pushing ETH towards decisive demand levels. With the uncertainty in the market, merchants remain cautious because Ethereum is struggling to restore the lost land.

Related reading

Analysts expect more fluctuations in the wake of the executive order of US President Trump on Thursday, which established a strategic bitcoin reserve. While this advertisement was expected to enhance feelings on the market, he has entered more uncertainty, making investors not sure of its long -term impact on the encryption space.

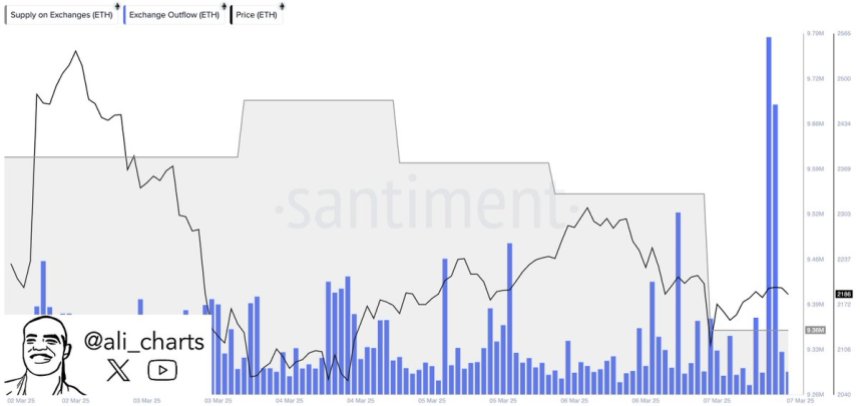

Despite the continuous decrease, the data on the Santiment series reveals a bullish sign-330,000 ETAREUM has been withdrawn from the stock exchanges over the past 72 hours. These large external flows often refer to investors who transport ETH to private portfolios, indicating lower sales pressure and a possible long -term accumulation.

With ETHEREUM hovering at the main support levels, the coming days will be it is extremely important in determining whether ETH settles or faces a negative aspect. If the market morale improves and the external drainage flows continue, Ethereum may see a strong recovery. However, if the pressure in the sale continues, another leg will remain a possibility, while maintaining traders at maximum alert.

Ethereum faces a decisive test

ETHEREUM has lost more than 50 % of its value since late December, which has led to massive fear and panic across the market. Once a pioneering force in encryption gatherings, ETH is now struggling to restore momentum, letting investors wonder whether the long -awaited Altseass will be achieved this year. Many analysts expect that ethereum and most of Altcoins will not last in the struggle, unable to restore the upscale settings or create a clear recovery trend.

Despite the declining feeling, there is still hope for a reflux, as the data on the chain indicates potential upscale stimuli. Share on Martinez Santime The data, and revealed that 330,000 ETHEREUM has been withdrawn from exchanges over the past 72 hours. This important external flow can indicate that investors move ETH to private portfolios, which reduces immediate sale pressure and may pave the way for the pressure pressure.

The width pressure occurs when the display available for the original is decreased, which makes it difficult for sellers to push prices to a decrease. If ETHEREUM continues to obtain the main demand areas and increase purchase pressure, the low exchange supplies may lead to a strong recovery towards high price levels.

Related reading

Currently, merchants monitor whether ETH can stabilize and restore critical resistance levels. If the bulls regain momentum, the ethereum may start towards the recovery in the coming weeks. However, if the pressure continues, another wave of descending movement remains a possibility, while maintaining the market on the edge of the abyss. The next few days will be decisive in determining the direction of Ethereum in the short term and whether the last exchanges of exchanges indicate a turning point for ETH.