Gold adds gains on Friday before the American job report in February

- Gold faces some doubts after the Trump administration relieves the induction pressure of Mexico and Canada.

- The United States has recovered a touch while Waller sees Fed’s opportunities for two or even three price cuts this year.

- Merchants are preparing to issue non -agricultural salaries for February this Friday.

The gold price (Xau/USD) is ranked slightly and is merged for the third day in a row this week. He gathered in bills after US President Donald Trump protects all goods from Mexico and Canada, which is under the USMCA trade agreement from the fresh tariffs that were implemented earlier this week. Meanwhile, American stock markets are trading below as it was on the day of the inauguration of President Trump.

On the side of the rates, traders received some support from the Federal Reserve official Christopher Waller, who said on Thursday that he would not support the reduction in interest rates in March, but sees a space to reduce two, or maybe three times this year. This coincides with what the markets expect, with June being the first pivotal moment to reduce interest rates this year.

Digest Market Mark: Back to the homeland

- Tensions rise between the largest economists in the world, the United States and China. Chinese Foreign Minister Wang Yi defended his nation’s actions to organize the flow of fentanel to the United States on Friday of highlighting and accused US President Donald Trump of using the case as an excuse to pressure his government.

- The expectations were high for the encryption industry after President Donald Trump signed a long -awaited thing to create a bitcoin strategic reserve and an additional stock of other digital assets. However, Bitcoin decreased to less than $ 90,000 after it turned out that the symbols already owned will be central and no new currency will be purchased with taxpayer money, according to Bloomberg reports.

- “If the labor market, everything, appears to be detained, you can just monitor inflation,” said Waller Vood on Thursday at the Wall Street Journal summit. “If you think it is returning to the target, you can start lowering prices. I will not say at the next meeting, but it can certainly see moving forward.”

- Australia has shipped a record amount of gold to the United States in January, where fears of possible customs tariffs witnessed that traders are pushing to deliver minerals to New York warehouses in order to benefit from extreme prices between the main markets. The Australian Bureau of Statistics said in its monthly commercial report that exports to the United States amounted to $ 4.6 billion ($ 2.9 billion) per month – the highest amount in records dating back to 1995.

Technical analysis: a small opportunity

Bets on discounts in interest rates by the Federal Reserve began to obtain support from policy makers at the central bank. This must support the price of gold throughout the year, although it may not be sufficient to push gold to the highest level ever. Therefore, a new catalyst must occur, such as new definitions or another page in the Book of Trade War.

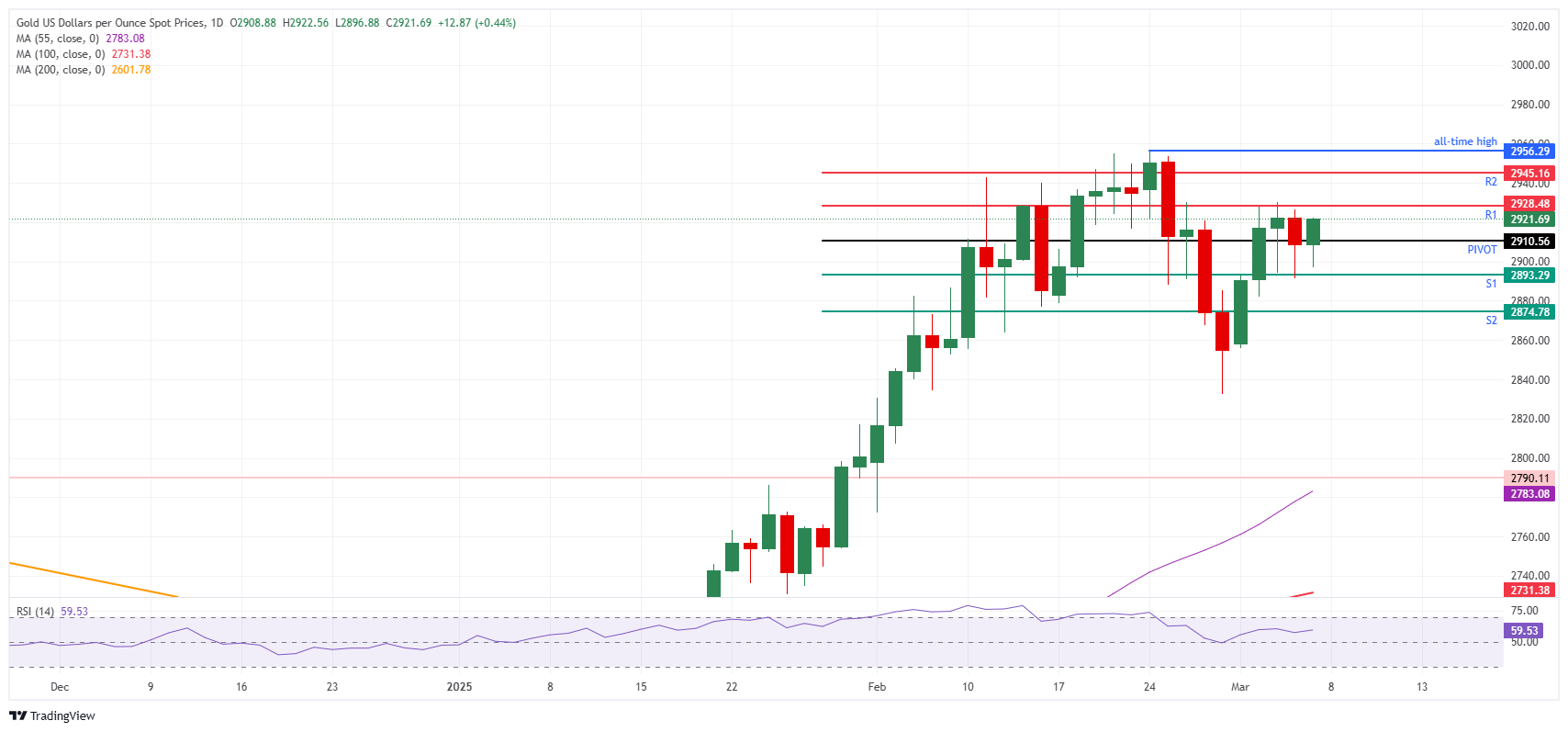

While the gold trading is close to $ 2,917 at the time of writing this report, the axial daily point is at $ 2910 and the daily R1 resistance at $ 2928 are the main levels that must be monitored on Friday. If you see more flow gold, the daily R2 resistance at $ 2945, is likely to be the final maximum at all at the highest level at $ 2956 reached on February 24.

On the negative side, the largest psychological number of $ 2900 and S1 support for $ 2,893 works as a double support barrier. If bulls want alloys to avoid other less leg, then this area should keep. Moreover, daily S2 support at $ 2,874 should be able to pick up any additional negative pressure.

Xau/USD: Daily chart

Customs fees are common questions

Customs duties are useful customs duties on some imports of goods or a category of products. Customs duties are designed to help local producers and manufacturers to be more competitive in the market by providing the price feature on similar goods that can be imported. Definitions are widely used as fever tools, along with commercial barriers and import shares.

Although customs tariffs and taxes generate government revenues to finance public goods and services, they have many differences. Customs duties are pre -paid in the entry port, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and companies, while customs duties are paid by importers.

There is a school of thought between economists regarding the use of definitions. While some argue that definitions are necessary to protect local industries and address commercial imbalances, others see them as a harmful tool that can push prices up in the long term and lead to a harmful commercial war by encouraging customs tariffs.

During the period before the presidential elections in November 2024, Donald Trump explained that he intends to use the customs tariff to support the American economy and American producers. In 2024, Mexico, China and Canada accounted for 42 % of the total imports of the United States. During this period, Mexico emerged as the best source with $ 466.6 billion, according to the American Statistical Office. Thus, Trump wants to focus on these three countries when imposing definitions. It is also planned to use the revenues created by definitions to reduce personal income taxes.