Cardano breaks the main support, as whales are more than holdings

Cryptocurrencies are witnessing significant declines today as the bears tighten their grip.

A prominent momentum deterioration in the Cardiano structure.

Ada was in a free fall despite the recent purchase activities of the players.

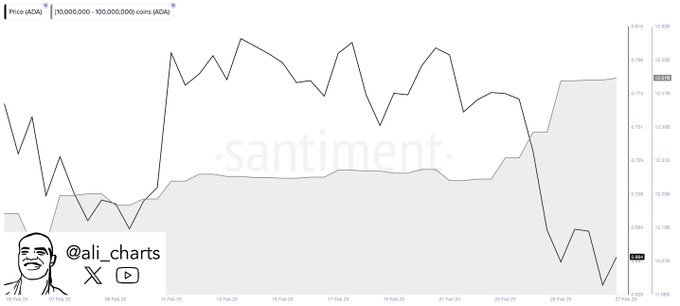

Ali Charts has highlighted that whales were swept away of more than 130 million Cardano icons in the past 72 hours.

The Santiment scheme shows whales between 10 million to 100 million shares from 12.39 billion to 12.51 billion Cardiano symbols.

While whale purchases often lead to counterattacks, ADA has extended their declines and lost major support today.

Altcoin trades at $ 0.5993 after losing more than 10 % during the past day.

The current price Cardano puts less than a decisive foothold of $ 0.60.

Buyers must intervene to defend this support to avoid uncompromising price declines in Ada.

Cardano price enters the landing area

The Daily Chart explains ADA’s terrible mode, with prices lower in the formation of a descending wedge.

Today’s decline in more than 10 % Cardano is a third decrease in a row.

ADA rests the local support for the Trendline line after losing 50 % of FIB ($ 0.6272).

The SuperTrend index completes this structure, indicating the effect of the overwhelming seller.

Bears are likely to target psychological support at $ 0.50.

FIB levels indicate that the countdown setup breach can pay the Ada price to 23.68 FIB at $ 0.4396.

This means a decrease of 26.65 % of the current price of Cardano.

Kardano’s negative feelings

ADA has a declining structure and is likely to decline more before decisive.

The daily active headline index indicates the dull demand.

The index fell from early February levels from 49,585 to 24,407 today.

This reflects the network activity that is exposed with the exit of users.

Moreover, the MVRV ratio of Cardano decreased to -6.05 %.

This indicates that most of the investors who bought Altcoin at the last high levels keep their assets at a confusion.

It is unlikely to keep the reduced profitability or attract new buyers, which increases the deterioration of the price.

Also, the negative MVRV sheds light on the homosexual feelings, as fewer players are looking for the current price levels of ADA.

What is the following for Cardano

The current ADA performance reflects the dominant sale pressure in the encryption market.

Donald Trump’s tariff was exposed to risky assets on past sessions.

In the midst of uncertainty, experts believe that the prevailing market has a chance to join low prices.

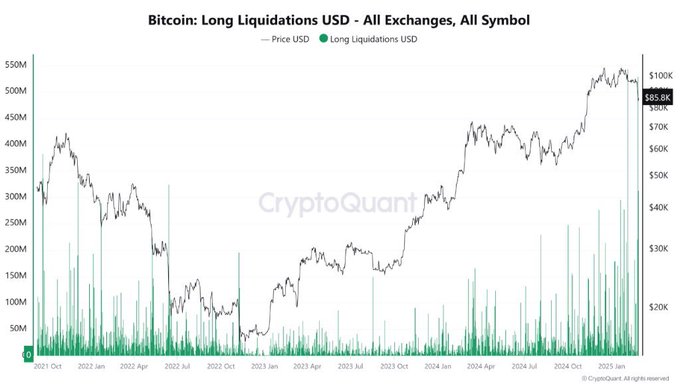

While Bitcoin is witnessing long licenses, Michael Van de Bob stated:

We are not at the end of the bull cycle. This is just an extreme opportunity to buy in the market.

This has been the highest long liquidation since October 2001 to #Bitcoin. This shows the weight of the effect, and the exchange of hands between weak and smart people. We are not at the end of the bull cycle, this is just an extreme opportunity to buy in the market.

Consequently, the interest in ADA may indicate an upcoming counterattack for Altcoin.

The gatherings will widely transform the Cardano path and pay prices over the $ 1 psychological brand.

However, the ADA path in the short term depends on its performance at $ 0.60. The bulls should restore this level to prevent the decreases to $ 0.4396 (in the near term).

Postcardo prices break the main support as whales of property first appeared on Invezz