The analyst breaks the real reason behind this

The price of Bitcoin (BTC) was the lowest level in three months, which reflected the post -election gains after Donald Trump’s victory.

While the preliminary market feelings blamed the tariff worn by US President Donald Trump and the last BYBIT, analysts now point to a more structural reason.

Why Bitcoin’s disruption, the analyst presents a new perspective

CRypto Kyle Chasse is attributable to the collapse of the continuous coding market to relax on money and carry a trade that was suppressing the BTC price for several months. He explains that the hedge funds have taken advantage of the low -risk trading that includes the investment funds circulating in Bitcoin (the exchange funds on the stock exchange) and CME FUTERES.

“Bitcoin crashes. I wonder why? I mentioned.

The strategy included the purchase of investment funds circulating in Bitcoin, such as those in Blackrock (IBITC). It also included BTC’s shortcomings on CME and a spread of an annual return of about 5.68 %.

According to the analyst, some leverage funds were used to enhance two numbers. However, this trade is now collapsing, causing the pulling liquidity from the market and sending the price of bitcoin to a free decrease.

The collapse of cash and carrying trade led to more than $ 1.9 billion in Bitcoin that was sold last week. This represents a significant decrease in CME, where hedge boxes relax. It also caused a decrease in a percentage of two numbers in the price of bitcoin within days.

According to Chasse, hedge funds are never betting on the long -term Bitcoin price estimation. Instead, they were planting a risk -free return using pleading. Now that the trade has died, it quickly withdraws liquidity, and the sale of bitcoin intensifies.

“Why does this happen? Because hedge funds do not care Bitcoin. He did not bet on BTC Moong. Add.

Before identifying criticism and relaxation, many traders blamed the Trump tariff. Recently, the customs duties against the European Union have raised market concerns. The latter breeder also contributed to the strained investor’s feelings.

While Bitcoin remains under pressure, Kyle Chase sees a front. More cash, criticism and pregnancy are expected to continue, which means that forced sale will continue until all the hedge boxes are wiped. The fluctuation is likely to increase with the liquidation of subsidized positions, which leads to severe fluctuations in the price of bitcoin.

If the analyst’s perspective is correct, then Bitcoin will need a long -term real pregnant to intervene and absorb the pressure pressure. According to technical analysis, the next goal for Bitcoin may be about $ 70,000, a major support level that may settle in the market.

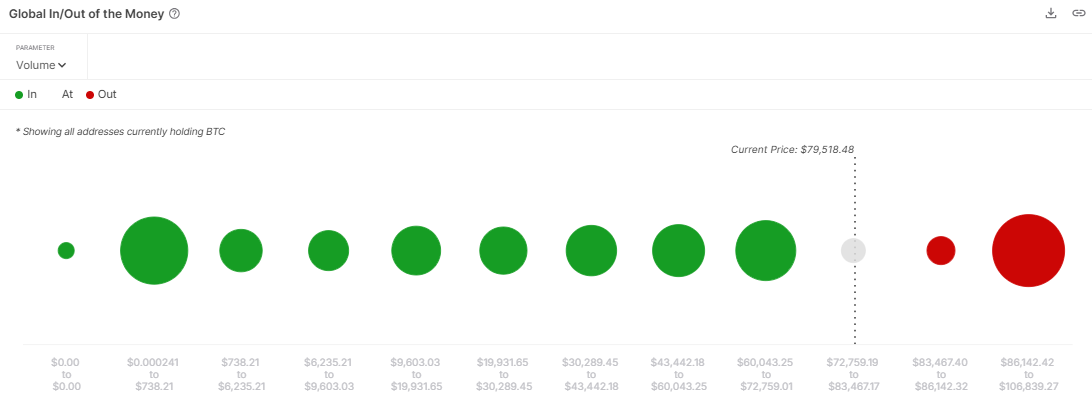

On this level, 6.76 million addresses have approximately 2.64 million BTC codes obtained at a rate of $ 65.296. Therefore, this region may provide great support for the price of bitcoin, as it prevents holders of more losses.

The analyst acknowledges that ETF’s demand was partially real, but he is strongly affected by players in the argument looking for quick profits. Currently, the market is subject to painful but necessary reset. However, merchants and investors must prepare for volatility as it can lay the foundation to bias the next direction of Bitcoin.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.