44 billion dollars to liquidate Bitcoin is possible?

Este artículo también está disponible en estñol.

Strategic shares (NASDAQ: MSTR) decreased by more than 55 % of November 24 increase at $ 543 to about $ 250. With the software intelligence company that now maintains about 499,096 bitcoin – about $ 44 billion at current prices – market participants wonder whether the company can face forced liquidation of the huge Bitcoin Treasury.

On Tuesday, analysts took the Kobeissi (Kobeissileter) speech to X to introduce a comprehensive string Analysis of this scenario. Here is what they said: “Microstrategy: Microstrategy, MSTR, falls more than 55 %, and many ask about” forced liquidation “. The company now owns Bitcoin with a value of $ 44 billion, can it be forced to sell it? Is the liquidation possible?”

Is the forced bitcoin possible possible?

According to the Kobeissi message, the total Microstrate’s Bitcoin Holdings amounted to 499,096 BTC, at a value of $ 43.7 billion. The average cost of the company sits about 66,350 dollars per bitcoin. This naturally raises concerns about what happens if the price of bitcoin decreases dramatically less than the average microstrategy.

“Let’s start by saying that this is not the first time that the liquidation has been mentioned. Time?, “Analysts write.

Related reading

It is important, the Microstrategy operations depend on the collection of capital – through convertible notes – to buy more bitcoin. Kobeissi’s speech indicates that Microstrategy currently holds about $ 8.2 billion of total debt for $ 43.4 billion bitcoin, which represents approximately 19 % lever. Many of this debt is held in mature conversion notes around 2028.

“About the only way in which” forced liquidation “occurs if there is a” basic change “in the company. This may require Mstr to liquidate Bitcoin if early redemption is called on notes,” experts argue with Kobeissi message.

The “basic change” can include companies ’bankruptcy, or a vote by shareholders to dissolve the company – both scenarios that Kobeissi’s speech stresses a distance under the current structure. Michael Silor, CEO of Microstrategy and a prominent Bitcoin lawyer, holds 46.8 % of the company’s voting power, which means that it can effectively prevent decisions to liquidation.

Related reading

Despite the decrease in acute arrow prices, Kobeissi’s speech indicates that explicit forced liquidation is “very unlikely”. Convertible notes and Microstrategy’s capacity to raise the capital gives the company great flexibility. However, if Bitcoin will face a long decrease in prices – less love, Microsrate may face challenges in serving her debts and raising fresh capital:

“However, what if these conversion bonds remain less than the transfer price at the eligibility, starting from 2027+? To happen, Bitcoin will need a decrease in more than 50 % of the current levels and stay there.”

Michael Sailor repeatedly brushed the filter scenario. According to Kobesi’s message: “Michael Seilor was asked about the liquidation recently. His answer was that even if Bitcoin fell to one dollar, it is still uncomfortable.” He will just buy both Bitcoin. ”Although this looks good in theory, only It cannot be forgotten by convertible notes.

Microstrategy’s business model – collecting money to buy bitcoin, may pay the price up, then release new shares at installment price – on investor confidence. If the shares continue to stumbling, or if Bitcoin dives much lower than the average Microstrategy’s entry price, the company’s ability to attract capital may be tested strongly: “We are now witnessing the first” bear market “in Microstrate since it gained popularity in 2024 The question is: Will the investors continue to decline here?

However, with the power of Silor vote and the long -term convertible observations, the forced liquidation appears to be very likely to be not in the short term.

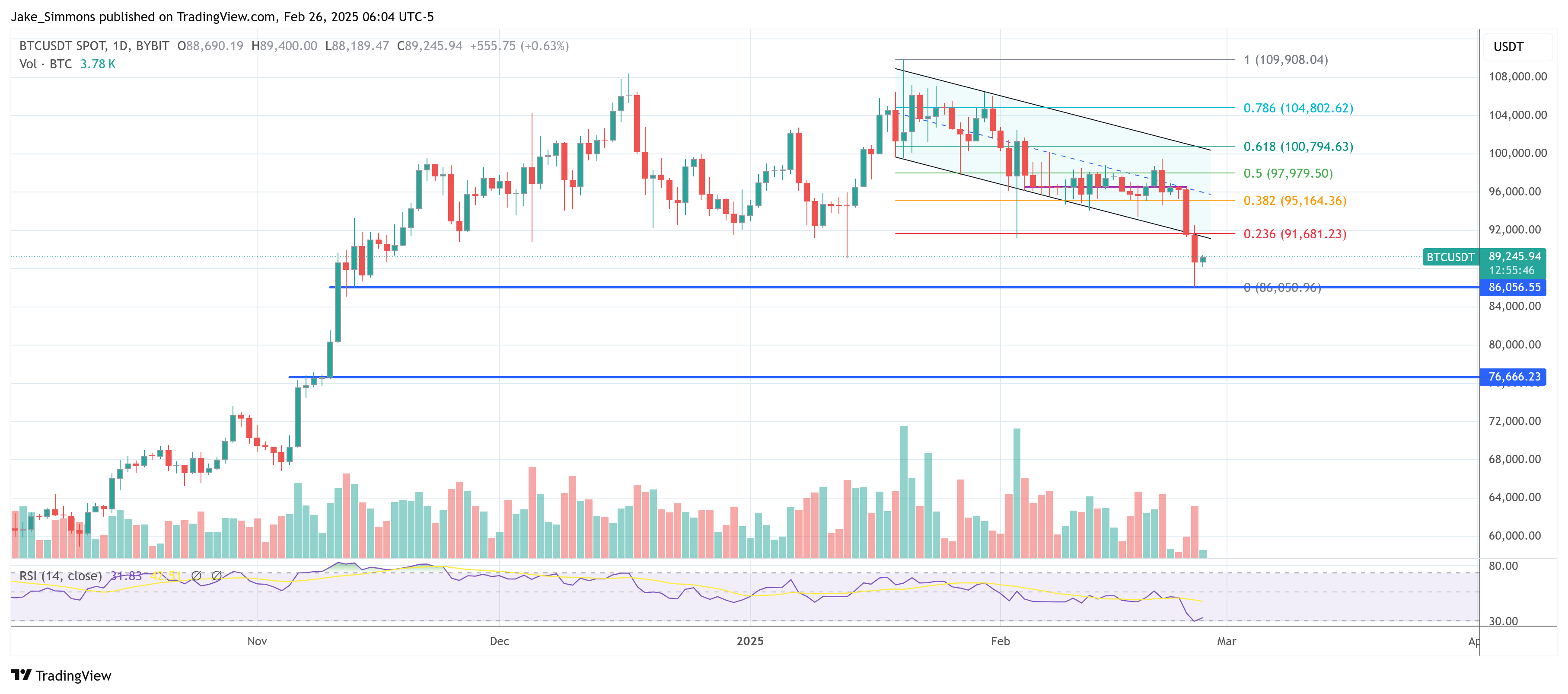

At the time of the press, BTC was traded at $ 89,245.

Distinctive image created with Dall.e, Chart from TradingView.com