Curding market recovery: analysts limit

Bitcoin (BTC) tests the feelings of investors again because they are hovering in an unstable position, which annoys the possibility of a long bear cycle.

Amid the uncertainty in the market, analysts and merchants weigh in the current case of the encryption market, discussing whether the last contraction is a sign of more losses or preparation for the main bounce.

Analysts weigh the encryption market

Julio Moreno, head of research at Cryptoquant, indicated that on Wednesday, Bitcoin holders made the largest loss for one day since August 2024, with a total of $ 1.7 billion. This important sale indicates a widespread panic among merchants, as many choose to reduce their losses as Bitcoin decreased without the main support levels.

“Bitcoin holders today realized the largest loss since August 2024: $ 1.7 billion,” male Moreno.

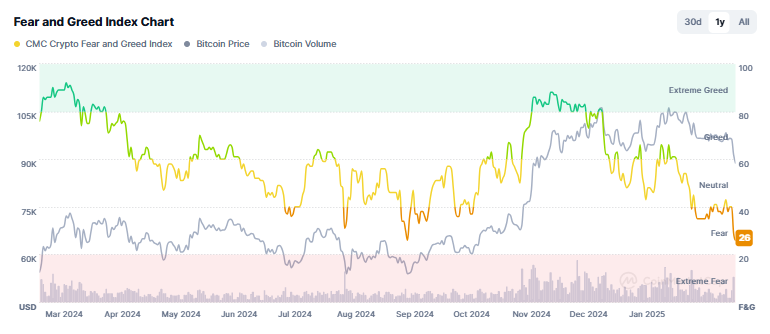

Meanwhile, market analyst Miles Deutschestra highlighted that the index of fear and greed, which is an indication of a widely followed feelings, has decreased to its lowest levels since October 2024. However, extreme fear in the market may be a prelude to the reflection of the price, which indicates that Bitcoin may approach a critical turning point.

“People finally die again. Believe it or not, this is exactly what we need to form a bottom in the end”, ” Make up.

In another noteDeutscher noted that BTC Exchange flows amounted to the highest level in the year amid recent market disturbances. This indicates that merchants rushed to liquidate their holdings, as Bitcoin fell to less than $ 90,000.

However, it has also been predicted that this sales moved it can pave the way for an unexpected apostasy, which is likely to hunt those who sold guarding.

Mark Coleen, an analyst at Alphabtc, has formed the situation, highlighting the role of market makers in installing the price. According to Cullen, the Binance Exchange company intervened to prevent deeper crash, with the awareness that the additional decrease can lead to a large -scale surrender event.

“They know that Bitcoin’s broken, that is, less will lead to a market collapse and customers who leave with burning fingers.” I mentioned.

Despite the intervention, Collen is still cautious, suggestion It may happen temporarily bounce before the next leg down. Although no immediate crash is expected, he has not ruled out another decrease to $ 87,000 to create the lowest level before a possible recovery.

M2 Money Supply Model is expected to increase Bitcoin in MarkH

Some analysts look forward to a 2025 march to obtain a potential upper turn. Colin Talks Crypto, a well -known encryption analyst, pointed to the strong relationship between Bitcoin price movements and M2 Global Mons.

https://www.youtube.com/watch?

Its model indicates that the price of bitcoin often interacts with changes in liquidity with the delay of about 46 days. According to the model, Bitcoin is expected to see a big escalating step on about 7 March 2025, although this schedule may turn early based on modern trends.

The time of the decreasing delay between the M2 movements and the Bitcoin response indicates that increasing global liquidity can boost BTC prices soon. While the link is incomplete, it was historically a strong directional signal for bitcoin prices.

“It is a strange relationship, and it is very close, in my opinion, to be a coincidence,” the analyst said.

If the M2 Money show continues, Bitcoin can be set for a recovery in early March. However, fluctuation is still the dominant topic in the short term, and merchants must prepare for potential apostasy as total economic factors affect institutional feelings.

“… the price needs to recover more than 96,000 to 100,000 dollars, which will confirm the market’s willingness for new growth. If the pressure continues, the market may enter a stage of deeper correction.” Maria Carola, CEO of Stealthex with Beincrypto.

In addition to the declining pressure, the investment funds traded in Bitcoin recorded large net flows. As Beincrypto said, institutional investors, who played a major role in Bitcoin, to the highest new levels, are withdrawing money from the market, which raised concerns about more negative risks.

“This process [institutional redemptions] “It puts great pressure on the BTC rate because the two sources are forced to sell the original to cover the withdrawal requests.”

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.