The price of Chainlink (Link) disrupts 7.5 %, and another 15 % decrease forward?

The comprehensive cryptocurrency market looks down. Amid this, some investors saw accumulated opportunity and symbols, while others were panic and sold their property.

610,000 links were sent to the stock exchanges

Recently, a prominent encoding expert shared a post on X (previously Twitter), and revealed that encrypted whales have moved nearly 610,000 symbols (LINK) to exchanges within the past 24 hours, indicating an increase in the pressure pressure.

https://twitter.com/ali_charts/status/189444877764369086

Current price momentum

This major conversion of the link link led to a noticeable prices. At the time of the press, LINK is trading near $ 15, after it has decreased by more than 7.50 % over the past 24 hours. However, during the same period, the trading volume increased by 160 %, indicating an increase in participation from merchants and investors compared to the previous day.

The increase in trading volume is possible due to the collapse of a long unification zone and the price procedure.

Technical analysis of the series (LINK) and the upcoming levels

According to expert technical analysis, Link looks down and is preparing for more. In the daily time frame, Link was combined within a long tight range. However, with the transformation of market morale, the asset failed to retain this area, which reduces monotheism and experience a significant decrease.

Looking at the movement of prices and historical momentum, Link seems to have found some support near $ 15. If this feeling remains unchanged, Link closes a daily candle less than $ 15, then there is a strong possibility that can decrease by another 15 %, to reach the next support at $ 12.60.

This is the collapse of monotheism pushing Link to the declining direction. During the standardization stage, the original not only was traded within a narrow range, but also moves higher than the Si -moving average (EMA) on the daily time frame. This collapse below 200 EMA may explain the direction of the declining origin.

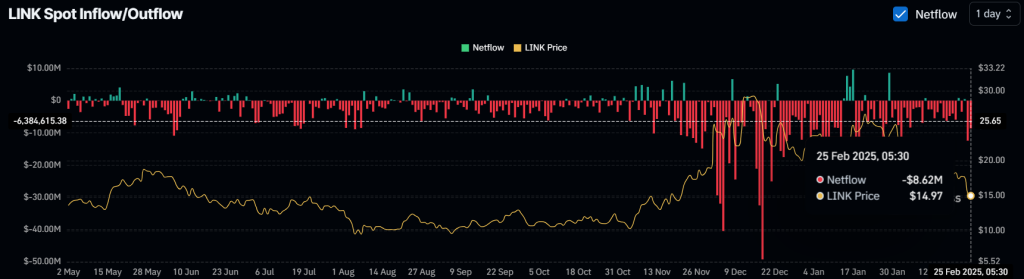

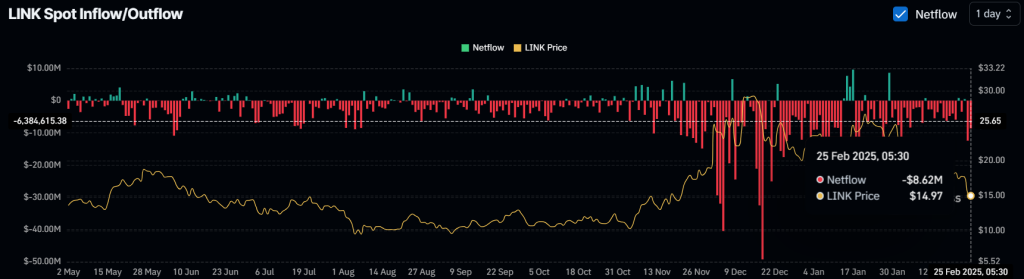

At a value of 8.65 million dollars in the external flow

This downward view may be the reason that the whales have transferred the links of the link to exchanges. However, some of the long -term investors and holders accumulate symbols, as stated by the Analysis Company on the series Coinglass.

The immediate flow/external flow data reveals that exchanges have witnessed an external flow of more than $ 8.65 million of correlation symbols in the past 24 hours, indicating a possible accumulation.

The dumping and the great accumulation of linking by investors, long -term holders and whales reflects individual feelings amid uncertainty in the market.