The commission of Ethereum was committed after Beetb

ETHEREUM (ETH) showed the recovery marks after a sharp decrease caused by a breast penetration, which affected its price. Despite this apostasy, ETH has still decreased by 18 % over the past thirty days, reflecting continuous volatility.

It is worth noting that ETH RSI has recovered to 58.6 of 39.2 decreased during the sale, indicating the renewal of purchase pressure. This recovery in RSI indicates that the market morale is gradually improving, which is likely to put the stage to achieve more gains if the momentum continues.

RSI ETH recovered from the last decline

RSI is currently 58.6, and it is a noticeable increase from the 39.2 level that it reached after the BYBIT penetrated significantly on its price.

Rsi recovery reflects the purchase momentum that ETH has acquired since a sharp drop.

This rising movement in RSI indicates that the pressure on the purchase has returned, which helps to stabilize the ETHEREUM price and may pave the way for other prices if the momentum continues.

RSI, or the relative strength index, is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with sills in 30 and 70.

The relative strength index is less than 30 years in general, which indicates possible purchase opportunities, while the relative power index exceeds 70 excessive timing, indicating a possible correction of prices.

RSI is currently 58.6, and it is placed in a neutral area, but it tends towards the bullish momentum. This level indicates that Ethereum still has a room for growth before reaching the peak purchase area, which may lead to a continued estimation of prices with the continued purchase interest.

Ethereum whale accumulates after penetration by Bybit

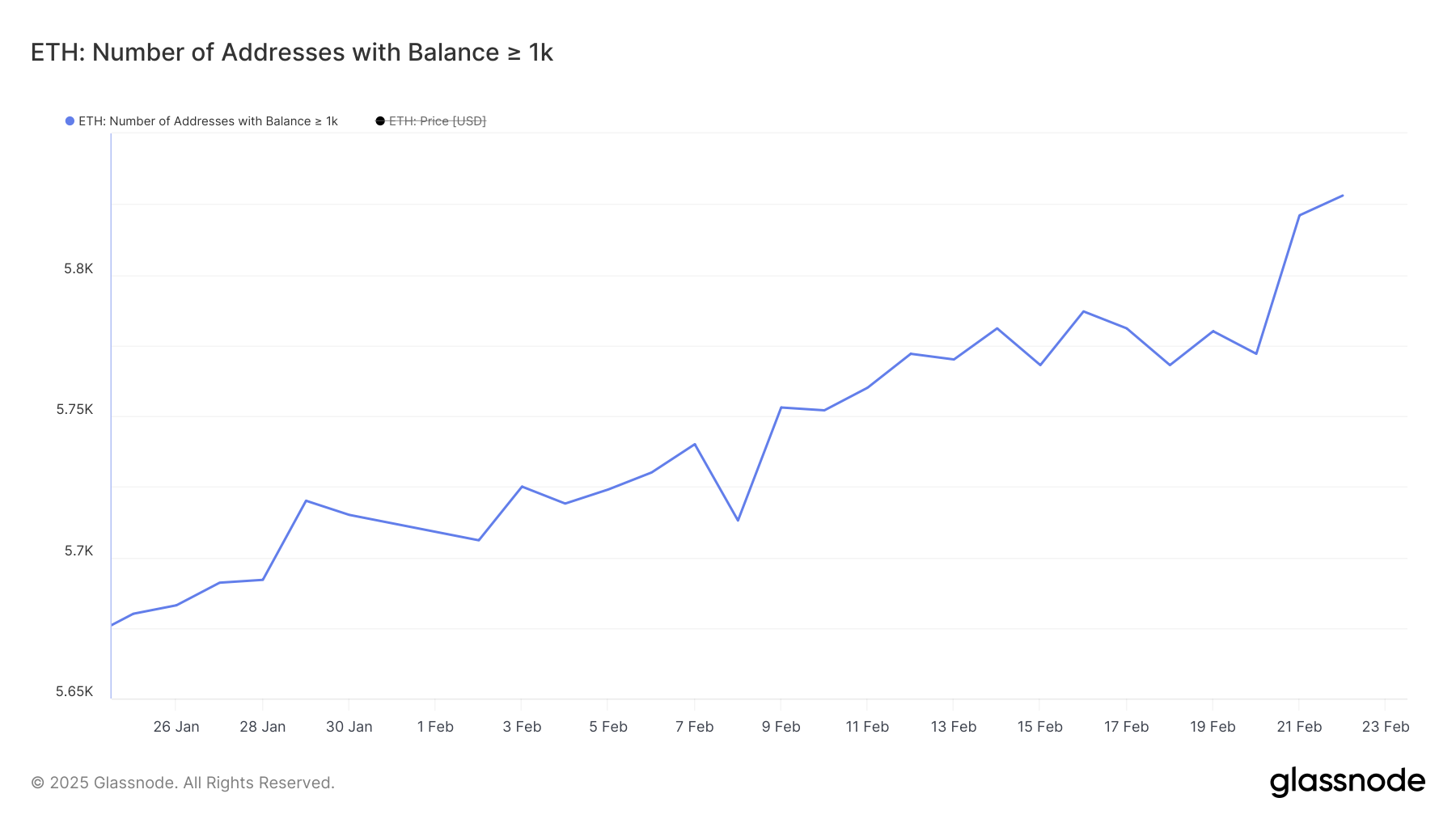

The number of Ethereum whales – headlines with at least 1000 ETH – rose steadily over the past month, increasing 5680 on January 25 to 5,828 on February 22.

This represents the highest level since December 2023, indicating renewed interest and accumulation among adult holders. The increase in whale headlines indicates that institutional investors or high -value individuals in the networks expect price gains in the future, especially between February 21 and February 22, when the ETH prices decreased after BYBIT.

This can provide increasing accumulation of a solid basis for the high price of ETH.

Ethereum whale tracking is very important because purchasing and selling behavior can significantly affect the market.

When the whales accumulate, it reduces the circulating supply, which is likely to lead to high prices with a decrease in demand for availability. On the contrary, when selling it, it can create a great pressure on prices.

Currently, the high whale headlines indicate the increasing confidence and the bullish feeling among the big investors.

Although this is the highest level since December 2023, it is still relatively low compared to historical data. This indicates that there is room for more accumulation. If this trend continues, this may lead to a sustainable escalating movement at the price of ETH with a high demand for supply.

Will Ethereum finally rise from $ 2900?

EMA lines from Ethereum indicate that the golden cross can be formed soon. The golden cross usually indicates a bullish direction and a potential ascending penis.

If this occurs, ETHEREUM can first test the price level near its long -term line (blue line in the scheme) about $ 2,876. Breaking this resistance can open the door to move to $ 3,020.

If the upward trend continues with a strong momentum, the ETH may reach a height of up to $ 3442.

However, ETH has struggled to restore levels of more than $ 2900 in recent attempts, indicating potential resistance and frequency in the market.

If you fail to penetrate again and start the downward trend, the ETH price can test the support level of $ 2551. Loss of this support may lead to a more clear decrease, which may decrease to $ 2,159.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.