Crypto Weekly: Bitcoin is back late in the week, leads IP with 150 % gains

Bitcoin remained confined to its monthly scope this week, trading between $ 93,902-99,244 dollars, as it prevented many bulls from bulls from pushing them towards six numbers.

Although the total ceiling of the encryption market decreased to the lowest weekly level of $ 3.2 trillion, it managed to recover from the sign of more than $ 3.3 trillion by late Friday, as traders found some relief amid signs of a more absorbing organizational environment In the United States.

Ride that wave of optimism, market morale also showed signs of life, climbing green at 55 years through the late Asian trading watch on February 21 – the highest level since early February.

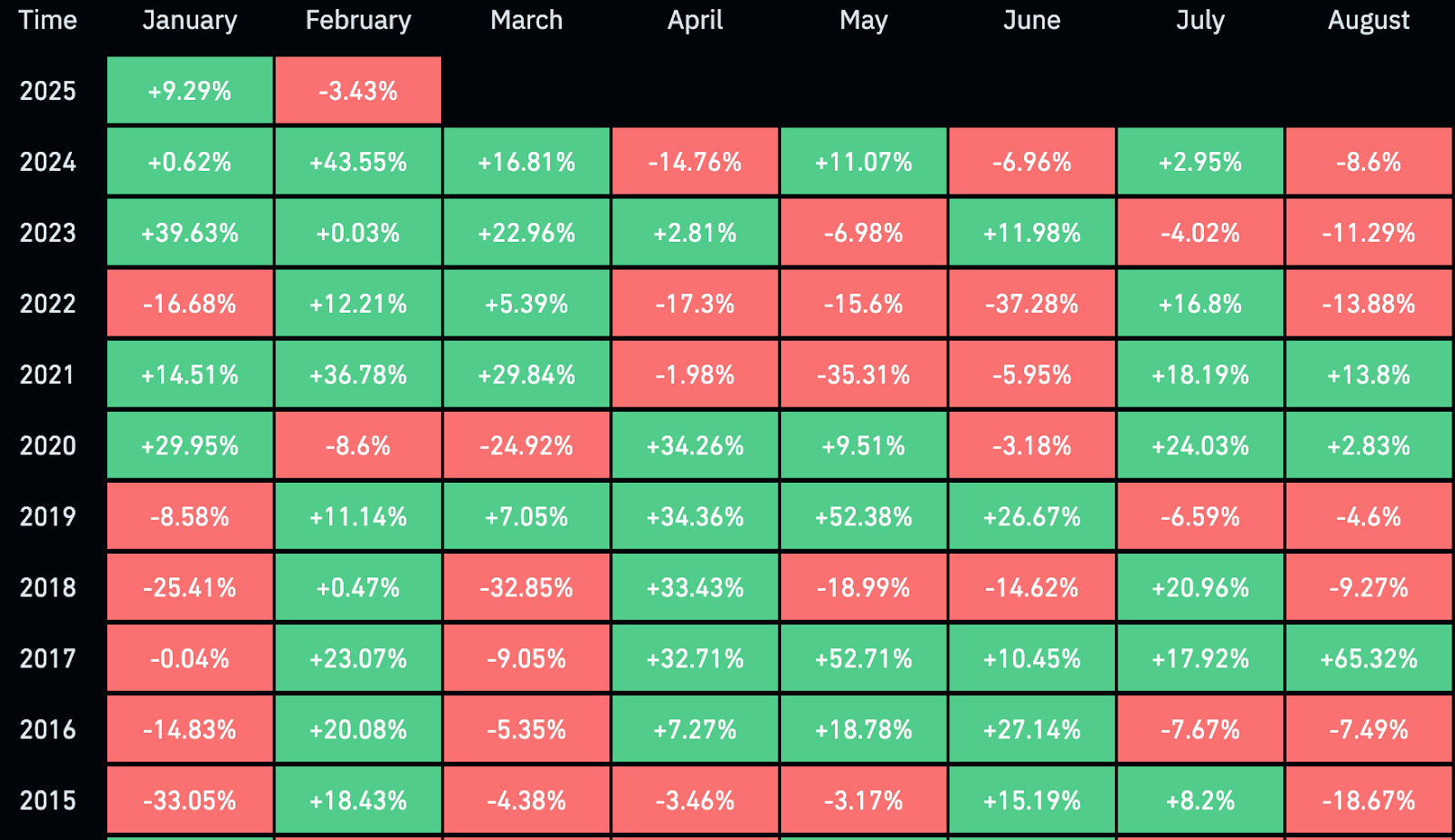

The market appears to be in line with the historical trend in the second half of February, the rise of both Bitcoin and the broader encryption market.

According to Coinglass data, on average, February has delivered solid returns, as Bitcoin usually publishes gains of about 12 % over the years.

Source: Coinglass

The altcoin market followed a similar path, as many upcoming upper weekends recorded.

Why did Bitcoin decrease this week?

A number of landfill stimuli maintained the wrong bitcoin prices during the past week.

First, the Federal Reserve Lecturer has strengthened a position of hawks, prompting merchants to curb between concerns that price cuts can be delayed further.

Continuous inflation transforms market morale, with a decrease in the probability of the rate of March to only 2.5 %, according to the Fedwatch CME tool early in the week.

However, tensions were slightly eased after the federal reserve meeting records were launched in January.

Political makers have hinted to stop or slow down the budget reduction program due to debt concerns.

However, the Federal Reserve maintained the average measurement policy between 4.25 % and 4.5 %, as many officials indicated that rates can remain at restful levels if the economy remains strong and inflation remains high.

Second, US President Donald Trump has alluded to a new tariff about car imports, semiconductor and medicines.

Historically, developments related to the tariff sparked bitcoin corrections, and this week was no exception.

The additional pressure came from concerns about the Crenter FTX payment, with more than $ 1.2 billion to the affected users.

Since these payments are based on the price of Bitcoin in November 2022 of about $ 20,000, traders were concerned that the beneficiaries may cancel the loading of property in their profits.

Will Bitcoin rise?

By the end of the week, Bulls found a renewed power after SEC dropped the long -term enforcement issue against Crypto Giant Coinbase.

The decision is in line with President Donald Trump’s position in support and his pledge to alleviate organizational pressures.

Fresh American macro data gave the market another reason for the gathering. Initial unemployment claims rose to 219,000 – 4000 expected – preparing that the labor market may eventually lose some steam.

For merchants, this is a possible sign that the federal reserve can reduce its restricted policies closer than the plan, and open the door for more liquidity to flow into dangerous assets such as encryption.

According to Roman pseudonym, Bitcoin can look at a return above six numbers in the coming weeks if it regains the main support level.

In a newly post, Roman described 98,400 dollars as a “pivotal point” and suggested that its breaking over it could lead to a crowd of about $ 108,000.

Rekt Capital’s colleague was on the same page, as he called for $ 97,000 to a decisive level to see.

He told his followers that bitcoin needs a daily closure over that mark “to continue to keep the highest level as support” and stay in the upward lands.

Meanwhile, the merchant Warren Mop Bitcoin allocated $ 98,000 to the daily chart for the first time since February 4.

He added that if BTC can close this level-and penetrate the weekly direction-the way will be paved to run at new levels at all.

At the time of this report, Bitcoin was hovering near $ 97,677, after it gained less than 1 % during the past week.

Altcoin markets show signs of life

Many Altcoins separated from Bitcoin this week, preparing recovery operations on the back of individual developments.

The total ceiling of the Altcoin market jumped from the lowest weekly level of $ 1.36 trillion to more than $ 1.45 trillion by Friday.

However, the Altcoin season index still shows the Bitcoin season in 29, which means that the broader market is still hesitant.

Senior artists for this week all the gains of two numbers:

story

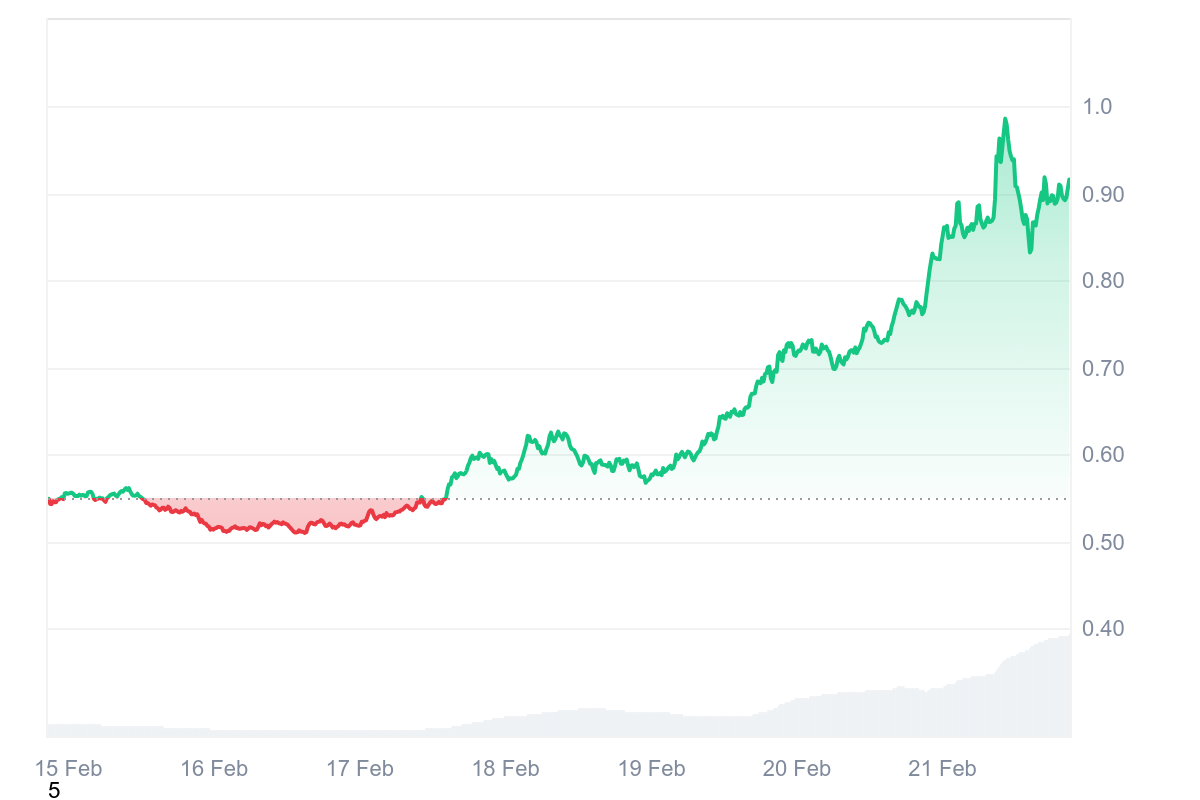

The story has increased by approximately 150 % over the past seven days, and the exchange of hands at $ 4.56 from the time of the press while the maximum market was sitting at $ 1.44 billion.

The price rally accompanied a leap in the trading volume of about $ 175 million on February 15 to approximately $ 1.44 billion, which showed a great demand among its merchants.

source: Coinmarketcap

The distinctive code has increased by more than 370 % of its lowest level ever at $ 1.00 since its launch last week alongside Mainnet Mainnet Layer-1’s Layer-1’s Story.

On February 21 this afternoon, it reached the highest new level of about 7.00 dollars.

Although it is not quite clear what drives prices, the story protocol released more details about the artistic road map on February 20.

The road map shows plans to launch a general experimental version of the IP Gate and the URACLE decentralization in Q2.

Meanwhile, Coinglass data shows 33 % in an open interest from $ 162 million to 216.9 million dollars early on Friday, indicating that more merchants are betting on the future future procedure of IP.

Sonic

Over the past 7 days, Sonic (S) erupted from the standardization stage, increasing by approximately 61 % to $ 0.87 at the time of publication.

source: Coinmarketcap

The growing Sonic effect on the DEFI space leads to increasing the recent increase.

Data from Defi Llama shows that approximately 80 developers have joined the ecosystem in the past two months, which enhances the network activity.

Sonic’s DAPPS closed value reached $ 70.4 million, making it the largest quarter of a blockchain through this scale.

Several DAPS in the ecosystem has seen significant growth. For example, Silo Finance, a lending protocol, now owns $ 233.57 million of assets, an increase of 74 % in just one week.

Avalon Labs also grew to $ 133.72 million.

Another factor leads the Sonic Rally, its high return of 5.76 %, which exceeds 2.8 % of ETHEREUM and 2.55 %.

The Sonic user base and the volume of transactions are also climbing.

According to Dune, the network treated more than 2.29 million transactions last week, and the number of active headlines grew to 46,300.

This momentum indicates that attention is continuing from both developers and users.

maker

The MKR manufacturer increased by 41.2 % during the past week, trading at $ 1,427 for the coin, while the maximum market was sitting at $ 1.21 billion.

The daily trading volume also doubled almost three times over the past day to about $ 308 million until the time of the press.

source: Coinmarketcap

The weekly gains followed a large amount of $ 156.77 million from MKR, which greatly reduces the distinctive symbol supply.

The decrease in the width increases the scarcity, which creates a pressure pressure that usually pays the demand among users.

Another main factory that collects its maker is its strong presence in the DEFI space.

Data from Defillalama shows that the total closed value of the protocol amounted to $ 5.55 billion, which enhances its position as one of the best Defi projects in Ethereum.

The price increase appears to be driven by increasing the accumulation of whales and strategic movements from Dex Smart merchants.

The post Crypto Weekly Recap: Bitcoin’s rebound late in the week, and IP appeared with 150 % gains first appeared on Invezz