ONYXCOIN (XCN) insists

Onyxcoin (XCN) has decreased by 16 % over the past seven days, although it increased by 52 % in the last 30 days. The Xcn (RSI) is currently 40.1, indicating a slight but not strong momentum enough to indicate the signal.

Meanwhile, the average trend index (ADX) decreased to 15.1, indicating that the declining trend loses strength and may lead to a period of low momentum. Despite the continuous declining trend, the EMA (EMA) lines show the possibility of Xcn to challenge the main resistance levels and may rise by up to 30 % before March if the upscale momentum rises.

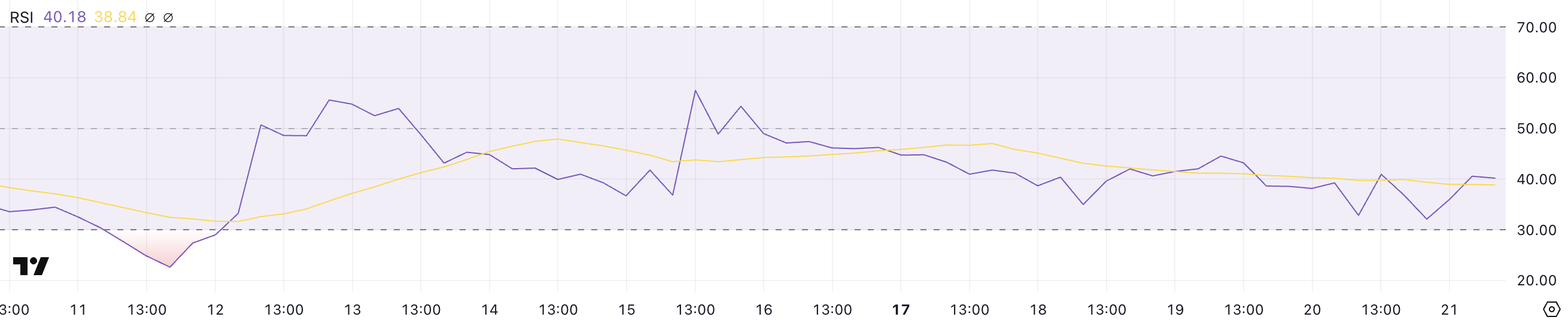

Xcn RSI has been neutral since February 12

Xcn (RSI) is currently 40.1 and is less than 50 years old during the past five days without decreasing to the sale level 30.

This indicates that Xcn suffers from a slight declining momentum as it remains under the score of 50 neutral.

However, the fact that it has not touched the thirty levels indicates that the pressure pressure is not overwhelming, which may indicate the stage of unification or weakening the declining direction.

RSI is a momentum that measures the speed and change of price movements, ranging from 0 to 100. The relative strength index is usually considered above 70 peaks, indicating that the original may be due to correction or decline.

At the same time, RSI is less than 30 years old as excessive, indicating a potential purchase opportunity where the original can be less than its value.

With XCN RSI in 40.1, it is in a cautious area where there are firm feelings but not particularly strong. This may mean that the price is in a standardization stage, waiting for a catalyst to determine the next direction.

If purchase of interest picks up, Xcn can move towards the score 50, indicating a possible reflection of the upscale momentum. On the contrary, if it continues to be weak, the decrease of less than 30 will indicate the increase in the pressure pressure and a possible continuation of the homosexuals.

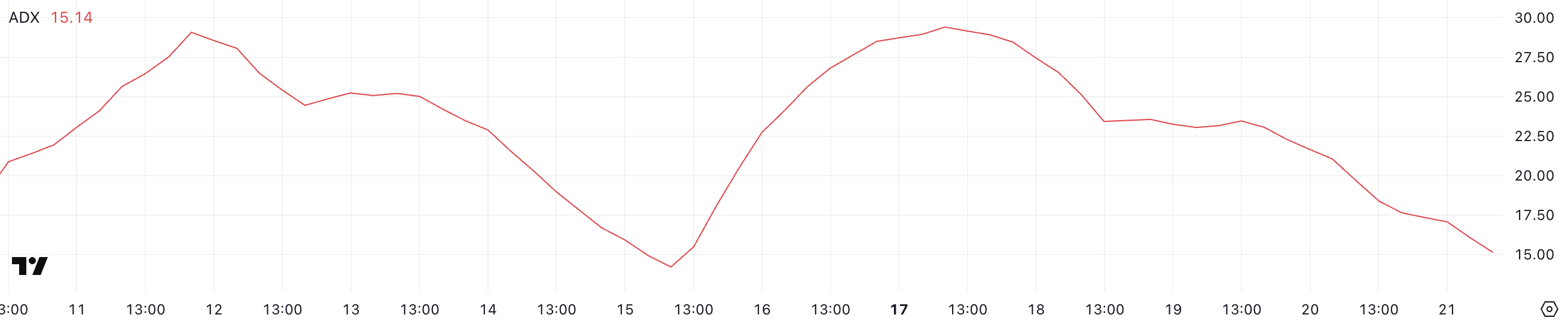

Onyxcoin AdX shows that the downward trend reduces

Onyxcoin, which was built on an induction, currently contains an average directional index (ADX) of 15.1 after reaching the peak of 29.4 just four days ago. Since then, ADX has been decreasing steadily, indicating a direction of weakening.

The 20 decrease indicates that the declining trend, which has been present during the past few days, loses momentum.

While the price of the Onyxcoin is still in the declining direction, the retreating ADX indicates that the strength of this landfill decreases, which may lead to a period of monotheism or slowing down the sale of pressure.

ADX is an indicator used to measure directional strength, regardless of its direction. It ranges from 0 to 100, with values less than 20 indicates a weak or not above or not above 25 direction and values, which indicates a strong direction, either climbing or decline.

When ADX rises, it indicates the strengthening of momentum, while ADX is low indicates poor direction. ADX Onyxcoin notes in 15.1 that the current lower direction loses strength and that the market enters a stage of low momentum.

This may lead to a period of uniformity of prices or even a possible reflection in case of purchasing interest revenues. However, as long as ADX remains less than 20, any price movements are likely to be weak and lack a great directional strength.

Can onyxcoin increase 30 % before March?

Between January 15 and January 26, the Xcn price increased by more than 1,300 %, making it one of the best performance in January. However, its price began to decline after that.

The onyxcoin moving average lines indicate that the declining direction is still present, but the declining momentum is not as strong as it was a few days ago.

This indicates that the pressure pressure has ended slightly, although the bears are still controlling. If the pressure pressure persists, XCN can test the support level at $ 0.017.

The rest at the bottom of this support can open the path to a deeper correction towards the next main support at $ 0.014.

On the contrary, if the landmark fades and the reflection of the direction occurs, Xcn may challenge the document at $ 0.021. A break above this level would indicate a possible transformation in the market morale, which leads to a gathering towards the following resistance at $ 0.025.

In the event of a bullish momentum, Xcn can target $ 0.0339, which is approximately 30 % up to current levels.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.