Bitcoin rhodl momentum slows down – the analyst warns “not ideal”

The series analyst indicated that the HODL (RHODL) ratio is on its way down, a sign that may not be positive for Bitcoin.

Bitcoin Rhodl has recently lost momentum

In new mail In X, the CheckMate analyst discussed the latest direction in the RHODL ratio of Bitcoin. The achieved “Rhodl) ratio is a scale on the chain that calculates the ratio between any two Rhodl wave ranges.

Hodl wave ranges follow the percentage of the total BTC supply that was last transferred within a specific age range. Rhodl Wave ranges are a modified form of this, adding an additional weighting factor: the achieved value.

Simply put, the achieved value is the immediate price in which a specific code of coded currency was treated on Blockchain. That is, it is the basis for the current cost of the currency.

Since the Rhodl wave range doubles this scale with the amount of width within a specific domain, it tells us about the total cost rules of metal currencies in that band. When the index value rises to any specific range, this means that the amount of capital invested in the coins in the age group rises.

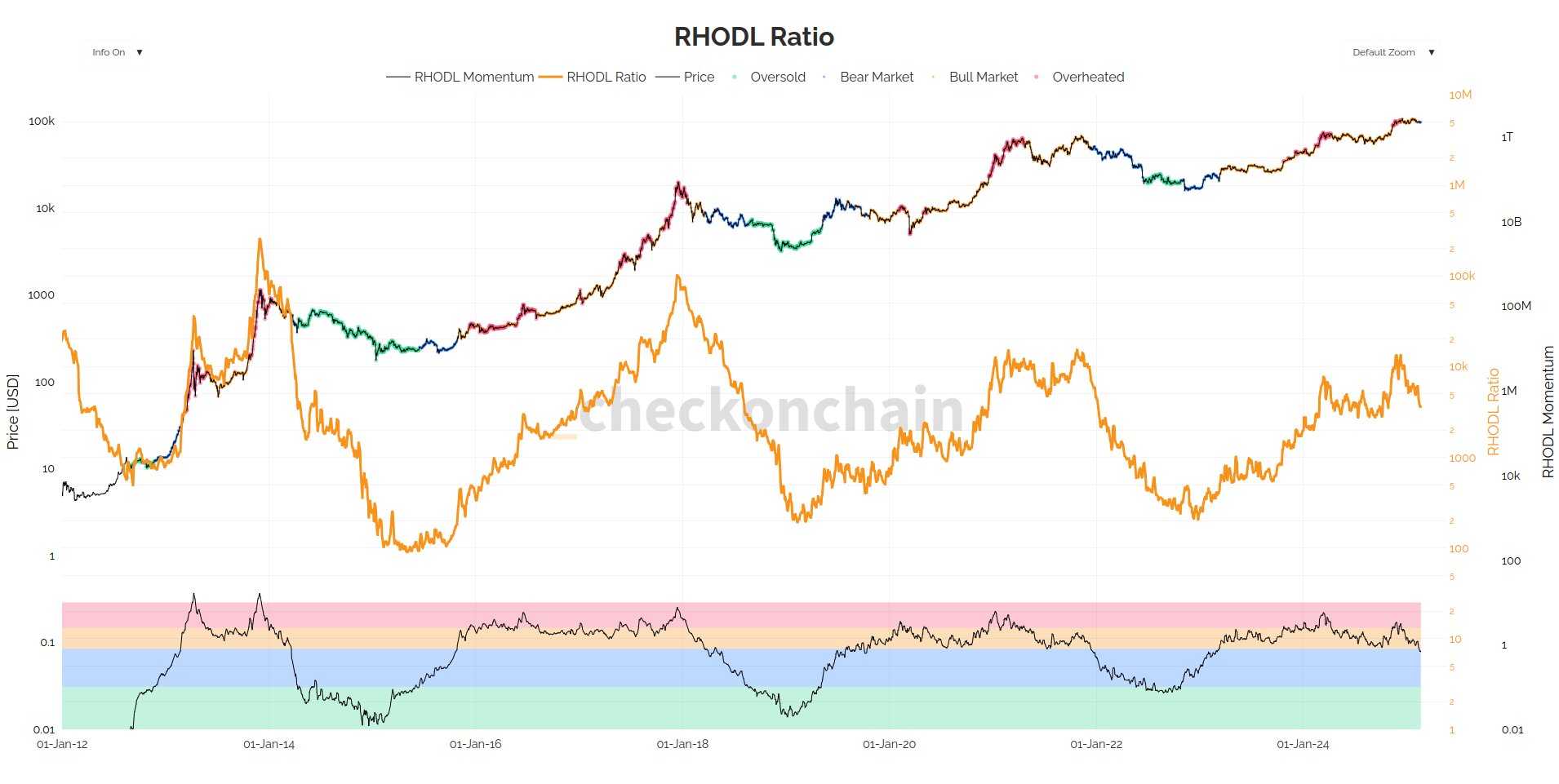

In the context of the current topic, the Rhodl ratio is from one to two years of relevant domains. Below is the graph shared by the analyst, which shows the trend in this Rhodl ratio on Bitcoin’s history.

As shown in the graph above, the Bitcoin Rhodl ratio of these wave ranges increased to a high level during the gathering that exceeds $ 100,000 held last year. This trend indicates that the wave range for one week, which corresponds to the new capital that comes to the sector, has grown large for the veteran band for a year to two years.

From the graph, it is clear that the intense capital spinning in the range of the wave for one week coincided historically with the bulls of the bull price of the encrypted currency.

Since the peak last year, the scale was on its way down, indicating that the new demand for the original is now slowing. This is also visible in the momentum of the index attached to the bottom analyst, which has just decreased in an area that played the role of the transitional region between upward and dominion trends in the past.

Given the historical style, this development in the Rhodl ratio is certainly the best for Bitcoin. It remains now to see whether the scale will continue to decrease in the coming days, which may indicate a move away from the emerging market, or if it will return again.

BTC price

Bitcoin re -tested the $ 98,000 brand earlier today, but it seems that the currency has ended in rejection because its price has now decreased to $ 97,000.