Sui aims to collapse up with the capabilities of the Golden Cross

Sui has gained some momentum in the past 24 hours, with the maximum market now at $ 10.5 billion. However, he is still trying to recover from a 26 % decrease over the past thirty days. Technical indicators currently show mixed signals. CMF at -0.06, which reflects the relief of sale pressure but still indicates cautious market morale.

Meanwhile, Ichimoku cloud suggests monotheism with the possibility of an upward outbreak. EMA lines offer early signs of a possible golden cross. If the momentum continues, this may lead to a resistance test at $ 3.73 and maybe an increase of more than $ 4.25.

Sui CMF is still negative, but it shows a potential recovery

SUI’s CMF is currently at -0.06, indicating a remarkable recovery from -0.35 two days ago, although it has been in negative lands during the past four days.

CMF height indicates that the sale of the sale is abandoned, indicating that buying interest may gradually return. Despite this improvement, the negative value reflects that external flows still exceed the flows, indicating the presence of cautious market morale.

This ongoing negativity indicates that the sellers still maintain some control over sui Blockchain, but the bullish movement hints to a possible transformation in the momentum if the purchase pressure continues.

The flow of Chaikin (CMF) is an indicator based on size that measures pressure and selling pressure by analyzing price data and its size.

It ranges from -1 to +1, with positive values indicating the purchase of pressure and negative values indicating the pressure pressure. CMF is usually higher than the accumulation of zero signals and bullish feeling, while CMF refers less than zero to distribution and a declining feeling.

Thanks to the CMF at -0.06, the market still tends to drop, but the recovery from -0.35 indicates that the SUI pressure pressure weakens. If CMF can cross over zero, it may indicate a bullish reflection. However, if he remains negative or hiking again, it may indicate the continuation of the declining direction.

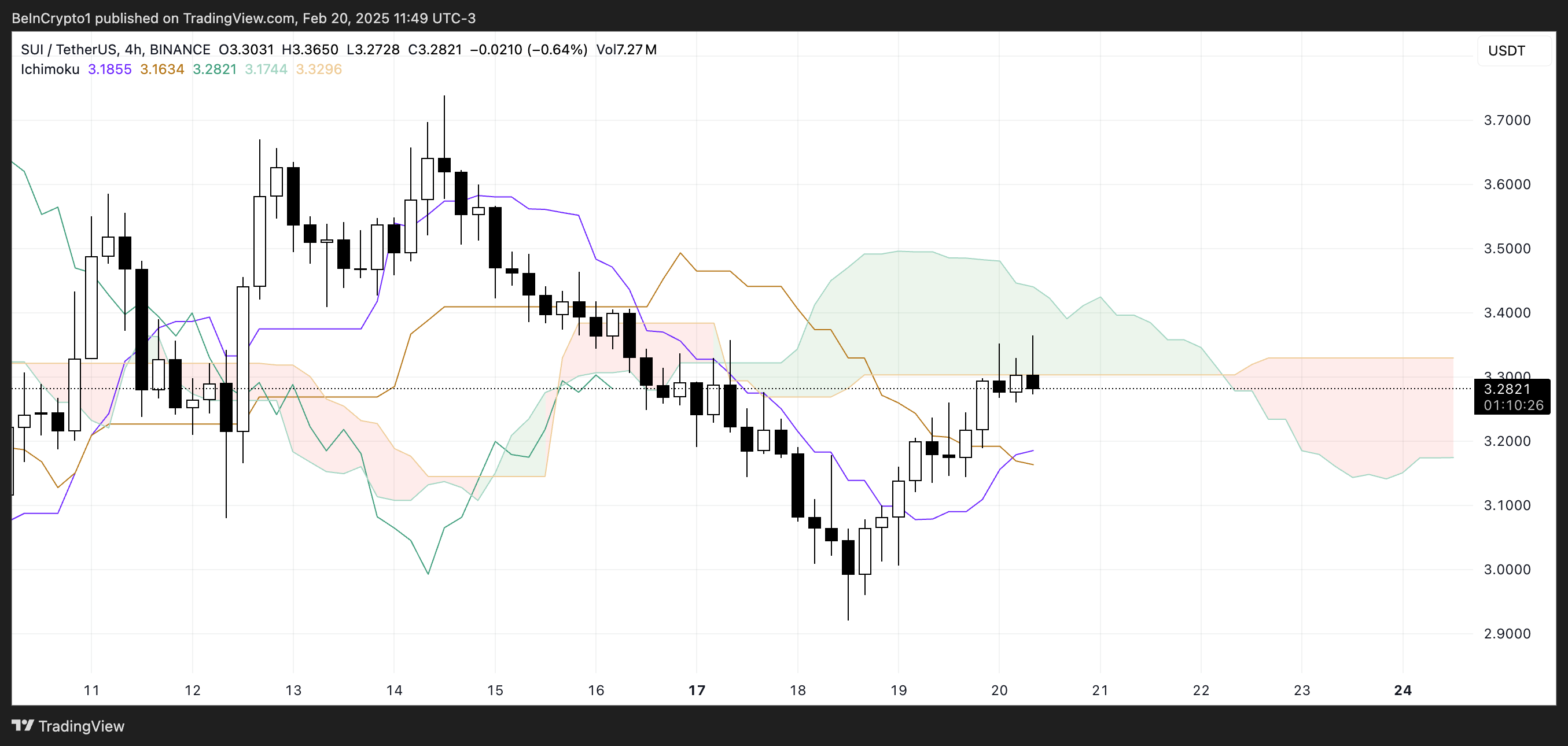

Sui Ichimoku cloud shows cautious optimism

The Ichimoku cloud of sui displays a mixed look with signs of possible unification. The leading period in the current cloud (Green Line) exceeds the leading category B (orange line), indicating the presence of upward feelings for the near future.

However, the price is currently trading inside the cloud, indicating the frequency and lack of a clear direction of the direction. When the prices are inside the cloud, they often indicate monotheism or a period of uncertainty, as buyers or sellers have full control.

The green cloud reflects before the slight upward momentum, but its bee indicates a weak trend that can be easily reversed.

The Tenkan-Sen purple line is located below the Kijun-Sen Orange line, which usually indicates a declining momentum. However, the gap between them is narrowing, indicating a potential upward intersection if the SUI price continues.

This intersection can indicate a shift in momentum towards bulls. Chikou SPAN (green line) is placed over the price movement, which enhances the current upward feelings, but its proximity to candles indicates that the momentum is not strong.

In general, the Ichimoku setting shows cautious optimism, with the possibility of an upward outbreak if the price can move over the cloud. However, if you fail to do this and break under the cloud, the downward pressure can resume.

Sui can restore $ 4 levels soon

Although Sui Price has risen over the past 24 hours, its EMA lines are currently in a declining state, with Emas in the short term in EMAS in the long term. This alignment reflects a prevailing landmark, indicating that sellers still maintain control.

However, short -term Emas shows an ascending path, indicating a potential transformation in the momentum. If this short -term Emas crosses over it in the long run, form a golden cross, the Sui can test the resistance at $ 3.73.

If this level penetrates, SUI may continue to rise to $ 4.25, which represents a large outbreak over $ 4 for the first time since the end of January. This bullish intersection is likely to attract more attention to purchase, which confirms the reflection of the declining direction.

On the other hand, if the bullish momentum fades and Emas fails in the short term in crossing over that long -term, the declining direction may continue. In this scenario, SUI can re -test the support areas around $ 3.08 and $ 2.86.

If these levels are violated, Sui may decrease more, which may decrease to $ 2.39.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.