The scales on the series reveal the most important resistance to Bitcoin-can BTC break 97.5 thousand dollars?

Este artículo también está disponible en estñol.

Bitcoin continues to trade in a narrow range, holding a level of $ 94,000 while struggling to violate the brand of $ 100,000. Long -term expectations remain optimistic as BTC maintains the main demand levels, but the short -term price procedure remains uncertain. Investors and analysts closely monitor the collapse, with the high speculation that this period of monotheism is calm before the storm.

Related reading

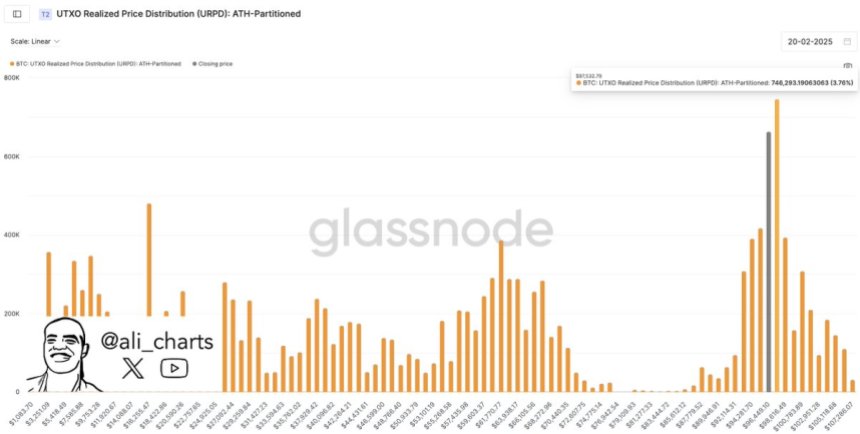

While the bulls defended the decisive support levels, they could not push BTC over the main resistance, which led to an increased frustration in the market. Analysts suggest that an aggressive step in either direction is imminent. The main scales of Glassnode reveal that the level of the most important resistance for Bitcoin is currently 97,533 dollars. This level has been a major rejection zone in recent weeks, preventing BTC from restoring momentum.

If Bitcoin is able to break this resistance and maintain it over this resistance, it may indicate the beginning of a new upward trend, and may lead the prices towards and outside ATH. However, the failure to do so may lead to the continued side trading or even a re -test of the low demand areas. While the market participants are waiting for confirmation, Bitcoin remains at a pivotal moment that can determine its next main step.

Bitcoin prepares an aggressive movement

Bitcoin has been in a quiet unification of less than a sign of $ 100,000, creating an environment full of uncertainty and frustration among merchants. The price procedure remains linked in the range, fluctuates between 94 thousand dollars and 100 thousand dollars without any clear direction. Analysts continue to speculate about the next step, with most of them agreeing that aggressive collapse is inevitable. However, the main question remains – will it be a bullish boom in discovering prices or selling at low demand levels?

Senior analysts Ali Martinez Glassnode joint data on xAnd revealed that the level of the most important resistance to Bitcoin is currently 97,533 dollars. This level has worked over and over again as a barrier, preventing bulls from regaining control. Martinez suggests that the continuous collapse above this level can indicate more bullish trend, which may pave the way for the move towards the psychological barrier worth $ 100,000.

The feelings of investors are mixed, as some expect the bitcoin to recover momentum and push to the past, while others remain cautious due to the long monotheism and weak volatility. Historically, the extended periods of low fluctuations are often preceded by the main price movements, but the market remains divided into the direction that BTC will take.

Currently, Bitcoin continues to trade within a narrow range, and investors are eagerly awaiting confirmation of the next main direction.

Related reading

BTC price procedure details

Bitcoin is trading at $ 97,300, in an attempt to restore the main moving averages that can determine its short -term direction. The SIA moving average for 4 hours (EMA) operates at $ 98,000 and 200 mobiles (MA) at $ 100,000 as critical resistance levels that the bulls must overcome to confirm the bullish direction. If Bitcoin separates from these levels and keeps them as support, this may ignite a huge gathering towards new levels.

However, uncertainty continues to dominate the market as BTC is struggling to maintain the bullish momentum. Investors closely monitor whether the price can penetrate these resistance areas or if another rejection occurs. A failed attempt to pay above 98 thousand dollars to 100 thousand dollars can increase the pressure pressure, which leads to a decrease in the demand areas of about 91 thousand dollars.

Related reading

Despite cautious feelings, the long -term Bitcoin structure is still optimistic as it continues to maintain the main support levels. The coming days will be very important, as traders are looking to confirm either collapse or potential decline. If BTC is able to restore these main moving averages, confidence may return to the market, which leads to more bullish momentum. Until then, Bitcoin remains in a critical monotheism stage, waiting for its next decisive movement.

Distinctive image from Dall-E, the tradingView graph