Why is BTC still stuck less than $ 100,000

The Bitcoin Prices Movement remained side by side, which shows a little reaction because the Crypto community celebrates the day when the market value of BTC for the first time crossed a trillion dollars in 2021.

It has been traded to less than $ 100,000 for more than two weeks, and a hint of technical data and the chain on the possibility of extended residence without this price point.

Bitcoin is the anniversary of the Bitcoin visa, but they are less than $ 100,000

On this day in 2021, the market value of Bitcoin Over 1 trillion dollars For the first time. Since then, it has almost doubled, as the market value of the leading currency is now $ 1.9 trillion.

Interestingly, with the market anniversary of this landmark today, Bitcoin prices are still weak, still trapped less than $ 100,000. Maintaining the relative balance between the pressure and the clouds has kept the trading currency in a narrow range since the beginning of February.

However, the BTC/USD chart assessment for one day reveals that the declining bias against the king’s currency appears to be gaining momentum. Technical indicators such as the RSI Relative Power Index (RSI) reflects the downward pressure. At the time of the press, the RSI is located under the font 50 neutral at 44.29.

The RSI index measures the conditions of the asset market and its excessive rotation. It ranges between 0 and 100, with values higher than 70, indicating that the original is his arm at a peak and stipulates a decrease. On the other hand, values of less than 30 indicate that the original has been worn and may witness a recovery.

At 44.29, the BTC’s relative index suggests that the sale pressure is stronger than the purchase of momentum but not yet at the sales levels. This means that there is room for more negative or possible monotheism before the trend turns.

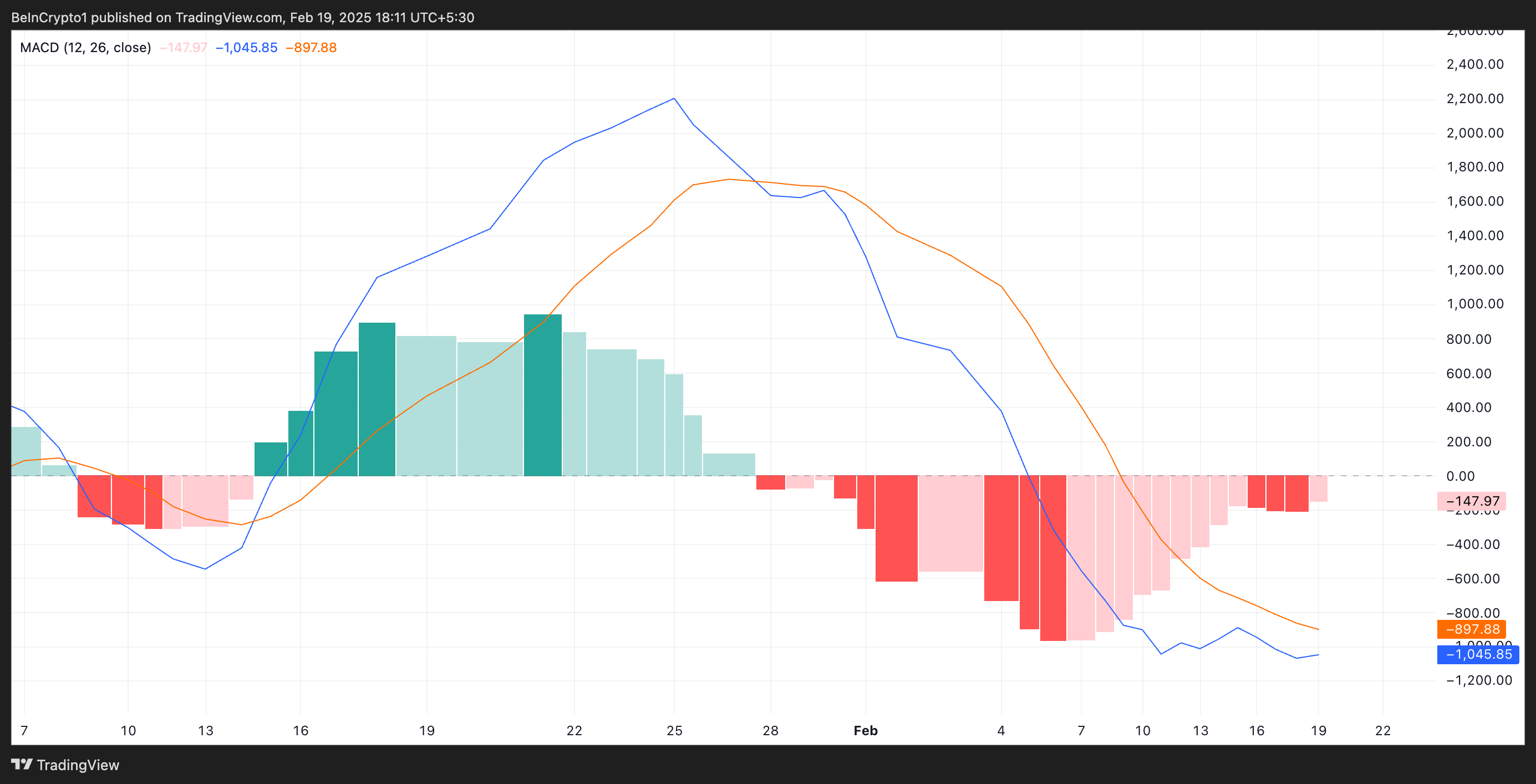

In addition, the preparation of the moving average rapprochement of the currency (MACD) supports this hybrid view. As of the writing of these lines, the BTC (blue) MACD line settles below the sign (orange).

The assets index determines the trends and momentum in price movement. Traders help to discover signs or sell potential signals through the transmission processes between MacDs.

As in the case of BTC, when the MACD line is lower than the signal line, it indicates a declining momentum, indicating that the low price of the original may continue. Traders believe this is a possible sale signal, which adds to the declining pressure in the market.

BTC at a crossroads: a collapse of 90 thousand dollars or a penetration of 100 thousand dollars?

At the time of the press, BTC is trading $ 96,248, just less than the strong resistance that was formed at 99,805 dollars. With the strengthening of sales, BTC risks out of its narrow range in a declining direction. In this scenario, the currency price may decrease to less than $ 90,000 to exchange hands at $ 89,434.

On the other hand, the recovery in the upward pressure of the market can nullify this landfill. In this case, the currency price for resistance can collapse at 99,805 dollars, cross the $ 100,000 threshold, and tries to reconsider its highest level at $ 109,350.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.