Ethereum l2 series of investigations

Many users of the abstract chain reported the depletion of their money, while Devs claimed that the problem stems from a specific application on the network.

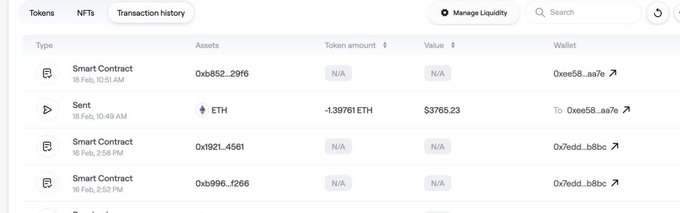

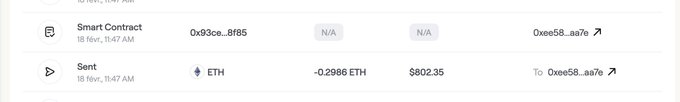

On February 18, a number of abstract global users reported unexpected withdrawals in the fund, which raised concerns about a possible security breach.

The exploited portfolios have witnessed that their balances are fully erased, letting users scramble for answers.

Urgent reports of ETH depletion from abstractchain. Move NFTS and assets as soon as possible! People say the cherry.

What happened?

It is initially believed that it is an external exploitation of the smart contracts of the network, and the fears quickly turned towards one specific application.

A few hours after the appearance of initial reports, the developer of the 0xbeans chain Users users This problem was not an abstract global security vulnerability, but instead linked to Cardex, a symbolic trading card game based on the abstract ecosystem.

“We are aware of some abstract users who are at risk,” posted on X, and urged users to avoid interacting with Cardex while investigating the team.

In a later post, 0xbeans explained that the root cause was Cardex worsened its own key, which may have left users exposed.

“If you have previously interacted with this application, the heart is your sessions,” warned against users to use the Web3 Resoke Cash tool, a tool that allows users to manage the distinctive code approvals and cancel them on their encryption wallets.

Although the total losses have not yet been determined, 0xbeans pledged to release the “largest death” of the accident in an upcoming update.

However, a member of the community cited data for sand dune analysis, estimates the losses of more than 180 ETH, which reaches a little more than $ 482,000 on the basis of current prices.

Security company on the series Quill Audits analysis The attack, explaining that the exploiter publishes a harmful contract that allowed them to raise funds from an hacker portfolio before starting money laundering.

The stolen assets passed for the first time through the title loading of the boot before converting them to the striker’s contract.

From there, the money was dispersed through multiple portfolios, a common tactic used to hide the corridor and make tracking boxes more complicated.

Among the specified governor, at the time of the Quill Audits report, it was at least three strikers of the striker about $ 30,000 in the stolen eth.

Meanwhile, DAPP users are supposed to be X with frustration and accusations, describing Cardex for a fraud and claim answers.

Hey, this is the entire X account.

As of the time of the press, the Cardex team has not yet issued a statement on allegations. The development comes a few days after the appearance of DAPP on February 12.

What is the abstract chain?

It was launched last month, which is the Ethereum Layer-2 network developed by Igloo Inc. , The company responsible for the famous NFT group called Pudgy Penguins.

It enhances ZKsync from Zkync to provide various costly and cost -effective solutions.

The case of depletion of the portfolio also comes after only one day after the summary achieved a major teacher by publishing more than a million AGW portfolios.

AGW allows users to create smart contract portfolios using familiar records records such as e -mail or social accounts, making it easier for original users without CRYPTO setting a portfolio on the chain.

Post ethereum L2 stripping series of a wallet depletion problem after users appeared lost money first on Invezz