The price of ETH turns into climbing as the Drama of Solana Mimi is revealed

ETHEREUM (ETH) price turns up after weeks of trading to less than $ 3,000, a level that has not been broken since February 2. This shift comes at a time when capital appears to flow from Solana to Ethereum, with stablecoin flows and TVL height supports its momentum.

Meanwhile, the ETHEREUM EMAS price scheme appears in the short term, indicating a possible golden cross that can pay about $ 3,020. If this trend continues, ETH may see a 22 % rally, while the failed interruption may lead to another re -test of the main support levels.

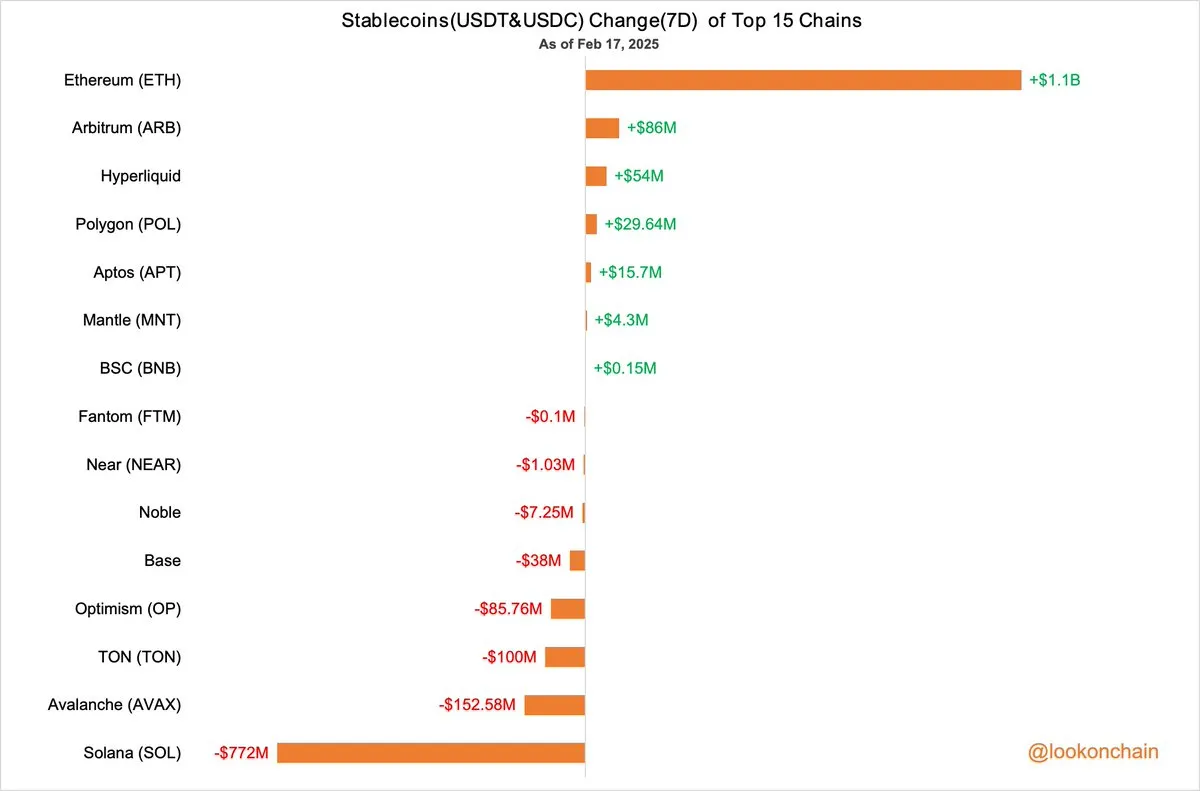

Stablecoin assets flow from Solana to Ethereum

Amid controversy about the Solana Meme currencies, data from Lookonchain indicates that the capital turns towards Ethereum. In the past seven days, Stablecoin Holdings has increased on Ethereum (USDC and USDT) by $ 1.1 billion, while $ 772 million of Stablecoins Solana came out.

This comes after the launch of the budget MG currency, which raised many users and raised concerns about the sustainability of the Solana ecosystem. With questions arising from the main players such as JuPiter, Pumpfun and Meteora, investors appear to be recycling money in Ethereum.

Data indicates that traders may reduce Solana’s exposure due to uncertainty about the M and major protocol scene.

Meanwhile, ETHEREUM seems to benefit, as it attracts new liquidity that can support Defi, trading or launching a new distinctive symbol. If this trend continues, Ethereum may see more flows, while Solana may need to restore confidence to reflect the ongoing external flows.

Network Ethereum TVL I rise

This trend is also reflected in the total value of closed chains (TVL). TVL of Solana reached its climax by $ 14.2 billion on January 18, but it has decreased steadily since then.

In the past four days alone, it decreased from 10.95 billion dollars to 10.5 billion dollars, indicating capital flows from Solana projects.

TVL measures the total closed assets in the Defi protocols in Blockchain, which represents liquidity and general activity. The rising TVL suggests increasing confidence and participation, while the decrease indicates the capital leaves the ecosystems.

Meanwhile, Ethereum TVL rose, increasing from $ 59.66 billion on February 2 to $ 63.7 billion by February 16.

This shift indicates that investors prefer Ethereum over Solana, which enhances Stablecoin data that shows capital rotation.

If this trend continues, Ethereum may enhance his position, while Solana may struggle to restore lost liquidity.

ETH Prediction: 22 % potential increase

ETHEREUM price chart shows its EMA lines, with short -term EMAS less than long -term lines. However, short -term lines move up, and the golden cross can be formed soon.

If this happens, ETH can test the resistance of $ 3,020, which exceeds 3000 dollars for the first time since February 2. Continuous momentum ETH can push up to 3442 dollars, which is a potential increase of 22 % of the current levels.

Additional external factors can support short -term, such as upcoming Pectra upgrade, this upward trend.

On the downside, in case of strengthening the downtown trend, ETHEREUM can re -test support at $ 2551.

Loss of this level may lead to a deeper decrease to $ 2,160. Bears need to break the main support areas, while the bulls must keep the momentum for a higher resistance team.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.