No Bitcoin 200 thousand dollars? Brandt explains why this contract is unlikely

Este artículo también está disponible en estñol.

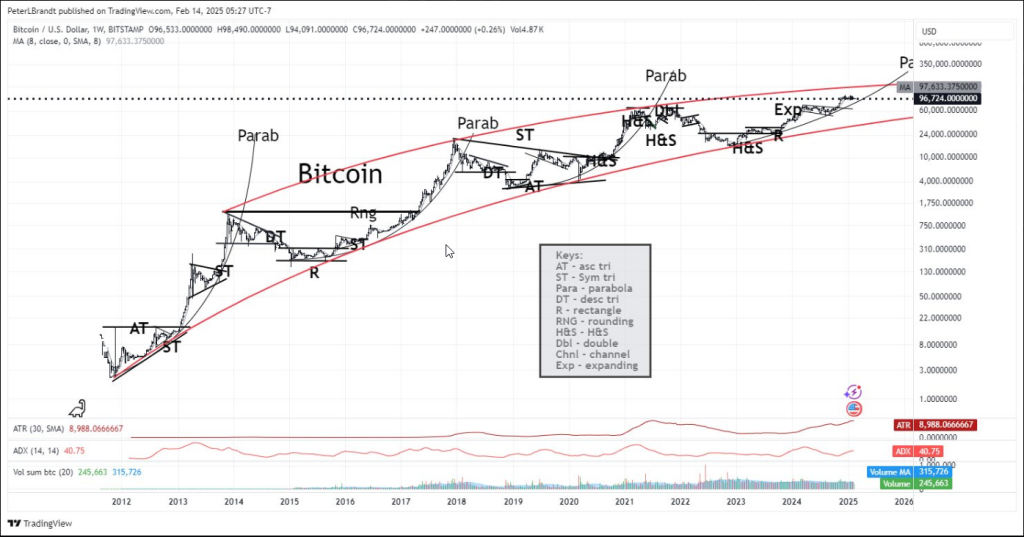

Peter Brandt, an experienced trader, rejected optimistic predictions in the wake of Bitcoin’s recent increase to $ 97,000+.

His recent technical analysis indicates that the most prominent encrypted currency may face difficulty in exceeding the threshold of $ 200,000 before 2030.

Bitcoin showed a mixed performance, with a daily gain of 0.17 % and a decrease of 2.85 % throughout the week, which paid expectations.

Related reading

The prolonged path to six numbers

Bitcoin will face major challenges in the psychological barrier breach of $ 100,000. The moving average of 8 weeks offers 97,633 dollars, which constantly rejected the upscale movements, the cryptocurrency with large resistance.

From the world of crazy ideas, this thought – thought, not trade comes

Unless Bitcoin has the speed of escaping through the upper equivalent resistance line, it is unlikely that BTC is trading above 200 thousand dollars at the end of this contract. Just reply. There is no interest in otherwise ☑ pic.twitter.com/7a5n7gliw8Peter Brandt (Peterlbrandt) February 14, 2025

The average real range (ATR) of 8,988 and the average trend index (ADI) of 40.75, which support a strong trend, appears increasingly fluctuating in current market conditions.

Historical patterns draw a warning story

Since 2012, Bitcoin has developed a distinctive pattern that captured the interest of technical experts. Within the Red RISing channel, the cryptocurrency was bounced between decisive two -way lines that operated as price barriers.

It is particularly interesting bitcoin towards both sharp corrections and equivalent movements. The veterans of the market raised the antennas due to the amazing similarities between the current gathering and the previous sessions.

Trading volume raises red flags

Numbers tell an interesting story on how people share the market. There is an opportunity to stabilize the current assembly because the total bitcoin size of 20,600 degrees is low compared to other penetration stages.

Maintaining a long -term upward trend may be difficult in the absence of a noticeable increase in the volume of trade. For analysts who watch the main step for Bitcoin, this weak size was an increased concern.

Related reading

Support and Resistance: Drawing battle lines

Bitcoin’s future depends on critical price levels that can determine its fate. There is strong support in the range of 60,000 to $ 70,000, while the strong resistance area waves between $ 100,000 and 120,000 dollars.

If the situation increases, Bitcoin may reconsider the lower boundaries of its long -term duct, which ranges between 40,000 dollars to $ 50,000.

Brandt’s analysis indicates that Bitcoin’s path to $ 200,000 by 2030 is doubtful in the absence of a large break over the upper limits of its equivalent track.

The veteran trader emphasizes the need for constant momentum and the ability to overcome critical resistance levels in order to achieve such high reviews.

Distinctive photo of Pixabay, tradingvief chart