$ 23B Bitcoin Boom? Vank says that state reserve bills can provoke huge flows

Many US states, including Texas, Pennsylvania and Ouhayu, pay proposals for investing public funds in cryptocurrencies or the creation of bitcoin reserves at the state level.

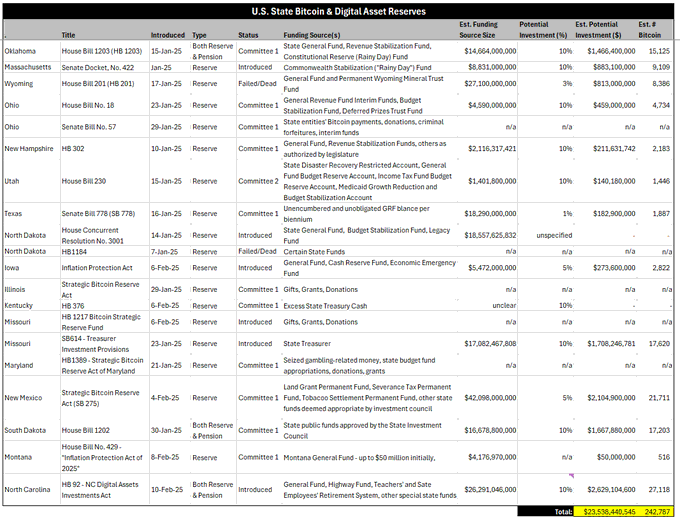

The VANECK Asset Manager analyzed 20 of this bill and estimated that, if it is implemented, it may lead to $ 23 billion in bitcoin purchases, equivalent to about 242,700 BTC.

We analyzed 20 Bitcoin reserves at the state level. If a year, they can lead 23 billion dollars in purchase, or 247 thousand BTC. This amount is independent of any allocations for pension funds, it is likely that it will rise if legislators move forward.

This estimate excludes potential contributions from pension funds, and is expected to rise with the progress of legislative efforts.

Florida recently proposed a draft law to allow state investments in Bitcoin and other encrypted currencies, while North Carolina has submitted legislation that enables the treasurer to invest in “qualified digital assets”.

Meanwhile, the Senate Finance Committee in Arizona has approved a similar bill, which is now transferred to the Senate Rules Committee for further study.

States such as Colorado, Utta and Louisiana have already accepted the cryptocurrencies of government payments, and Detroit announced the plans of last year to become the largest American city to accept encryption.

Trump’s pro -sulfur government

At the federal level, President Donald Trump has made efforts to create an organizational framework for digital assets, including Stablecoins, and to evaluate potential national digital assets.

Crypto Crypto Czar David Sacks recently praises Bitcoin as “an excellent value of value”.

Bitcoin Act for 2024, presented by Senator Centum Lomes, proposes that the US Treasury Ministry will increase for a million BTC for five years to create a national bitcoin reserve.

VANECK designed the effect of such a reserve, indicating that it can compensate 42 trillion dollars of US national debt by 2049, provided that Bitcoin grows 25 % annually to reach $ 42.3 million per BTC.

However, this optimistic scenario requires a 43,000 % increase over 24 years and US debt compounds assume 5 % annually from the base of $ 37 trillion in 2025.

Between Q4 2022 and Q4 2024, governments all over the world added 377,000 BTC to their reserves, mainly through criminal seizures, according to Vanck.

Bitcoin reserves at the state level and a largely possible federal stock can affect the adoption of digital assets and the influence of global cryptocurrency markets.

Since government and federal initiatives to integrate bitcoin into financial strategies combine momentum, these developments highlight the increasing recognition of digital assets in economic planning and their potential role in addressing national debt and leading financial innovation.

Bitcoin cases

Earlier this week, Maryland and Kentucky joined an increasing number of US states taking into account bitcoin and digital assets as part of its financial strategies to support reserves.

In the state of Maryland, Democratic delegate, Kayyin Yong, presented a “strategic bitcoin reserve law in Maryland” this week.

The proposed legislation of the state will allow the creation of the Bitcoin reserves, with the explicit designation of the coded currency in the draft law.

It also gives Maryland’s state treasurer investment authority in Bitcoin using the funds derived from the enforcement of gambling violations.

Meanwhile, the Parliament’s Bill in Kentucky, which was presented by the Republican Republican representative, aims to authorize state investments in digital assets and precious metals.

Although the draft law does not mention Bitcoin by name, it limits the qualified digital assets for those who have a market value of no less than 750 billion dollars, which is appointed by bitcoin as a basic option.

Maryland and Kentucky joins 16 other states that have proposed similar legislation, while Northern Dakota remains the only country to reject this direct procedure, according to Bitcoin Reserve.

The 23B Bitcoin Boom post? Vanc says that state reserve bills can provoke huge flows first appeared on Invezz