Bitcoin division, but XRP, Ethereum Enjoy

Data on the series show that retail investors have recently liquidated their Bitcoin portfolios, but the purchase in XRP and Ethereum.

Total amount of XRP and Ethereum holders, but down to Bitcoin

In new mail In X, the Santimate Santimon series discussed the last trend in the total amount of the first three assets in the encrypted currency sector. The “total amount of holders” here refers to a measure of a measure, as its name already suggests, the total number of addresses that carry some non -zero balance on a specific network.

When the value of this indicator rises, this means that new investors join Blockchain and/or the old who were originally sold, originally investing.

The trend can also arise when current users distribute their property through new addresses for the purpose such as privacy. In general, it can be assumed that the three of them are all under working as the increased scale records.

As such, the jump can be considered in the total amount of its owners as an indication that some of the pure adoption of the encrypted currency occurs.

On the other hand, the scale that is witnessing a decrease means that some investors have decided to remove their portfolios, and perhaps because they want to get out of the currency.

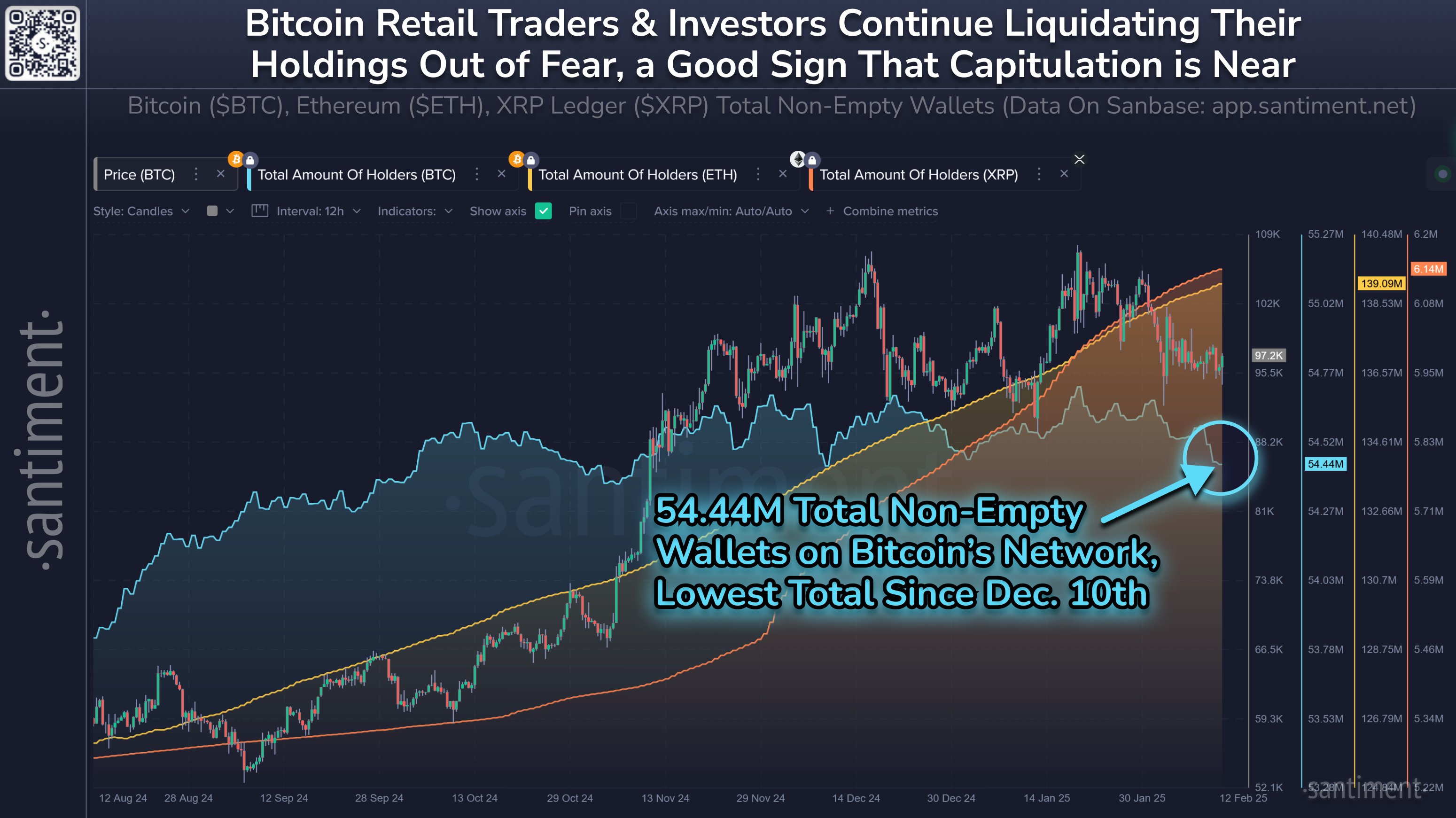

Now, here is the graph that the analysis company shares, which shows the trend in the total amount of bitcoin owners, ethereum, and XRP in the past few months:

The value of the metric appears to have diverged for BTC in recent weeks | Source: Santiment on X

As visible in the graph above, the total amount of XRP holders follows an upwards for XRP and ETHEREUM for a period of time now, which means that new investors have constantly joined these networks. Among the two, the first is the one who is currently noticing the adoption at a faster rate.

While these coins have the owners’ flow, Bitcoin was different. The first cryptocurrency was to see the total amount of owners moving earlier, but recently, the scale began to see an explicit decline, which means that investors are actively getting out of the network.

Compared to three weeks, the number of non -empty titles on BTC Blockchain decreased by 277240, which is a noticeable amount. Whales are usually few in the number, so any significant decrease in the total amount of owners issued by retail entities usually reflects.

The exit of the retailers may not be very bad for Bitcoin, Santemi explained,

Historically, these declines in the belief in retail are a positive sign of prices from mid to long -term. When the coins are thrown by small traders, whales and sharks accumulate and use their capital to raise the markets when the crowd is at its highest level.

BTC price

Bitcoin has not been able to collect any permanent bullish momentum in recent times, as it has taken a side movement. Nowadays, BTC is trading about $ 95,800.

Looks like the price of the coin has been heading down over the last couple of weeks | Source: BTCUSDT on TradingView

Distinctive image from Dall-E, Santiment.net, Chart from TradingView.com