Bitcoin price is struggling near 100 thousand dollars, as investors are waiting for the main consumer price index numbers

Bitcoin (BTC) is still trapped in a narrow range between $ 90,000 and $ 110,000, and is fighting to violate the main resistance levels as investors wait for fresh inflation data.

The version of the upcoming consumer price index (CPI) can determine whether Bitcoin finds a renewed momentum or is still stuck in the current monotheism.

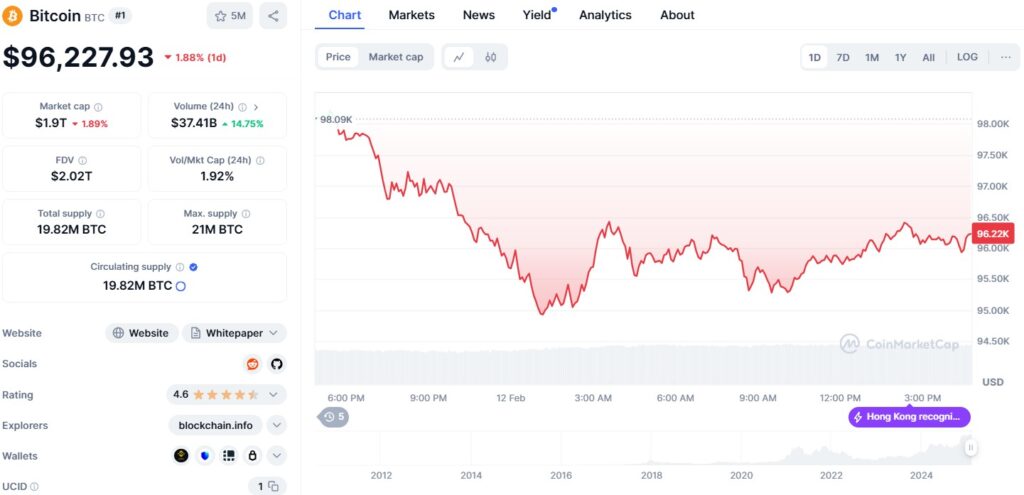

With the market value of about $ 1.9 trillion, bitcoin price movements are largely affected by macroeconomic factors.

source: Coinmarketcap

The federal reserve position on interest rates and inflation expectations remains the dominant forces that make up the morale of investors.

While Bitcoin recovered after the opening of Trump and Bitcoin’s reserve plan, her long -term gathering depends on stable organizational clarity.

The next few days may be it is very important in determining the Bitcoin path in the short term as traders evaluate CPI data and FBI policy expectations.

The interest rate position in the Federal Reserve keeps bitcoin under pressure

Bitcoin price struggles greatly stem from the Federal Reserve frequency in reducing interest rates despite the slowdown of inflation.

The markets were initially hoped for an axis, but the President of the Federal Reserve, Jerome Powell, has repeatedly indicated that the price cuts are not likely in the short term.

The CME Fedwatch tool shows a possibility of 54 % of only one rate reduction in 2025, with a chance of 48 % of any reduction by June.

The probability of price discounts in 2025 decreased to 42 %, and some traders now believe that there is a 20 % chance in the Federal Reserve that will not reduce rates at all.

This restricted monetary policy has the limited biotcoin aspect, as higher interest rates make traditional financial assets such as bonds and savings accounts more attractive compared to the most dangerous assets such as cryptocurrencies.

The inflation expectations remain a major risk

In addition to the immediate consumer price index, long -term inflation forecast adds more uncertainty.

According to Mott Capital Management, inflation forecast increased for two years to 2.8 %, the highest level since early 2023.

Fears related to increased prices can push the Federal Reserve to maintain its narrow political position, which will affect Bitcoin.

Commercial tensions and potential new tariffs also add inflationary pressure, which makes the Fed Bank to reduce its grip on interest rates anytime.

If the inflation is printed higher than expected, Bitcoin may see a decrease in the lower end of its trading range.

Reading the consumer price index may provide the most soft -term rest, although the continuous assembly remains unlikely without more clear signals than the Federal Reserve.

Market feelings depend on organizational clarity

While the macroeconomic factors dominate the work of bitcoin, the uncertainty still affects the investor’s confidence.

Many merchants are still cautious, pending clearer bases to impose taxes on encrypted currency and oversee exchange in major markets such as the United States and the United Kingdom.

The stable regulatory policies are seen as a pre -conditioning condition for a full encryption guard.

In particular, the founders are hesitant to allocate a large capital in Bitcoin without a clear legal framework.

The market reaction can play any organizational ads in the coming months a major role in determining the long -term Bitcoin path.

Bitcoin faces obstacles despite flexibility

The price of Bitcoin remains flexible near $ 100,000, but many opposite winds continue to reduce the potential of the upward trend.

Narrow monetary policy contributes to the federal reserve, high inflation expectations, and organizational uncertainty, in the current monotheism.

With traders now watching the consumer price index data for the direction, the next step for Bitcoin depends on whether inflation surprises the upward trend or confirms the direction of the cooling.

Until then, Bitcoin is likely to remain linked in the range, waiting for a great incentive for the exit of current price levels.

Bitcoin prices are fighting near $ 100,000, as investors wait for the main consumer price index numbers first on Invezz