The price of Pinlink (PIN) jumps by 15 %, reaches 90 million dollars in the market ceiling

The price of Pinlink (PIN) is gaining momentum, as it has increased by 15 % in the past 24 hours as it approaches the roof of a market worth $ 90 million. Technical indicators show mixed signals, as the relative strength indicators of the levels of the two weeks subside, while ADX indicates that the upward trend is still strong but may settle.

The last golden cross in EMA lines indicates that if the upscale momentum continues, PIN can be tested resistance at $ 1.17, and it may pay about $ 1.41 or even $ 2 if you recover AI, DePin and RWA traction. However, if the bullish trend loses its strength, PIN may re -test the support at $ 0.70, with a deeper correction to $ 0.51 on the table.

Pinlink Rsi is still neutral after almost touching the peak area

Pinlink defines itself as the first DePin RWA market. It aims to reduce the costs of artificial intelligence developers while enabling new revenue flows for DePin assets.

By integrating assets into the real world (RWA) with decentralized physical infrastructure networks (DePin), Pinlink aims to provide an effective market for developers to reach the prosecutor’s resources at lower costs.

At the same time, the owners of assets can indicate their infrastructure, creating a more central and central environmental system.

Currently, RSI PIN’s 58.6 is 69.98 for a short period a few hours ago, as it rose from 24.4 just four days ago. RSI is an indicator of momentum that measures whether the original has been clarified or increased elephants, ranging from 0 to 100.

The above 70 readings indicate excessive conditions in the peak and a possible decline, while values that are less than 30 indicate excessive sale conditions and the possibility of recovery.

With the PIN relative index high sharply in a short period, but now it cools from the peak purchase area, it indicates that the purchase pressure was strong but now.

If RSI continues to stick to more than 50, PIN may maintain the bullish momentum, but if it decreases more, this may indicate poor demand, which increases the risk of short -term correction.

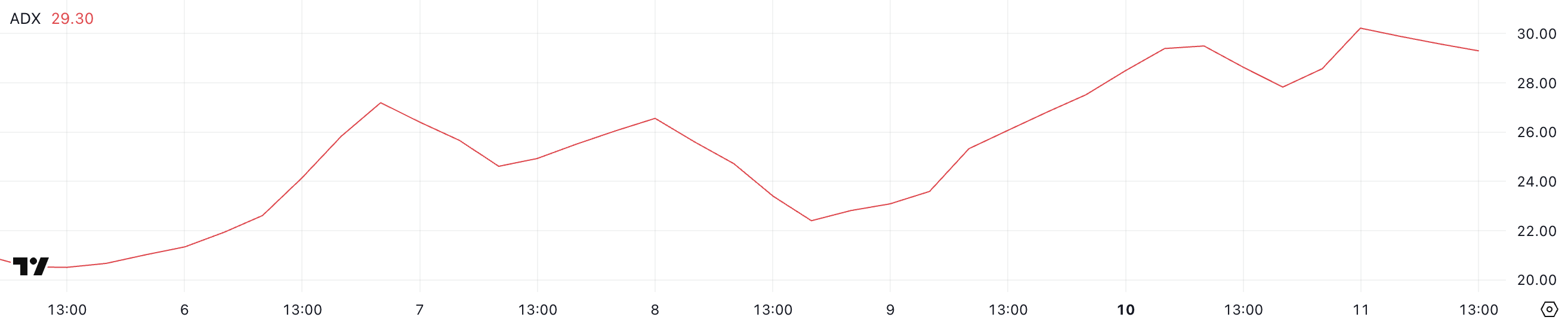

Pin ADX explains that the upward trend is still strong, but it can relieve

Pinlink ADX is currently at 29.3, and is slightly low of 30.2 a few hours ago, after height from 22.4 just three days ago. The average trend index (ADX) is a major indicator used to measure the strength of the direction instead of its direction.

The above -above readings usually indicate a strong direction, while values that are less than 20 indicate the momentum of the weak or the non -existent. ADX rising notes that the trend – whether bullish or down – is gaining strength, while ADX hanging can indicate a momentum fading or uniform.

With ADX from PIN currently at 29.3, the indicator indicates that the upward trend still maintains strength but may slow down a little. The last increase of 22.4 confirms that PIN has built a stronger direction during the past few days, which enhances the upscale momentum.

However, the small decline of 30.2 can indicate that the strength of the direction settles instead of acceleration.

If ADX remains higher than 25 years and continues to rise, it will confirm that the upper trend of Altcoins is gaining strength, but if it begins to decrease in 20, it may indicate that the momentum ascends weakens, leaving room for possible unification or transformation in the market.

Predging Pin Price: Can Pinlink reach $ 2 in February?

Pinlink EMA lines indicate a bullish sign, as the average moving in the short term has just exceeded another short -term line, and it forms a golden cross. If this upward trend remains strong, the pin, which depends on ETHEREUM, can test its next resistance at $ 1.17, and the collapse above this level can pay about $ 1.41.

In addition, if the accounts about artificial intelligence, DePin and RWA are momentum, Pinlink may benefit from the interest of the renewable market, which may push its price towards a sign of $ 2.

On the negative side, if PIN fails to maintain its current upward momentum and reflect the direction, it may face a $ 0.70 test.

The break may lead to no this level to accelerate the pressure pressure, which leads to a deeper decrease of about $ 0.51 – a 50 % possible correction of the current levels.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.