Cardano (ADA) Getting cooling, market morale or what?

ADA, the original, distinguished symbol of Cardano Blockchain, has gained great attention from encryption lovers after the asset manager moved to a file to the Cardano Exchandic Traded (ETF) file in the United States. This development has sparked remarkable attention between merchants and investors, which led to impressive momentum.

Cardano (Ada) loses its gains

Since the market increase pays ADA near the decisive resistance level, the assets began to experience huge sales operations, causing its low price-other disappointment for merchants and investors today.

Despite the last decrease in the price of ADA, the original has regained its trend as it moves above the 200 SIA moving average (EMA) on the daily time frame. In addition, the remarkable sale pressure today had no significant impact on investor morale, as it seems that long -term holders accumulate the distinctive symbol.

Current price momentum

ADA is currently trading near $ 0.77 and has witnessed an increase in prices of more than 11 % during the past 24 hours. However, the original reached the highest level during the day at $ 0.815 with 16 % profit, but the market has lost a large part of these gains, probably due to the ongoing profit reservation and the feeling of the current market.

However, the participation of traders and investors increased to the next level, increasing by more than 120 % during the same period.

Ada Price Action

According to expert technical analysis, ADA is at a decisive resistance level of $ 0.85, as she faced resistance today.

Based on the last procedure of the price, if the Ada continues to gather and violate the level of $ 0.85, with a daily candle closing over it, there is a strong possibility that can rise by 32 % to reach a level of $ 1.13 in the future.

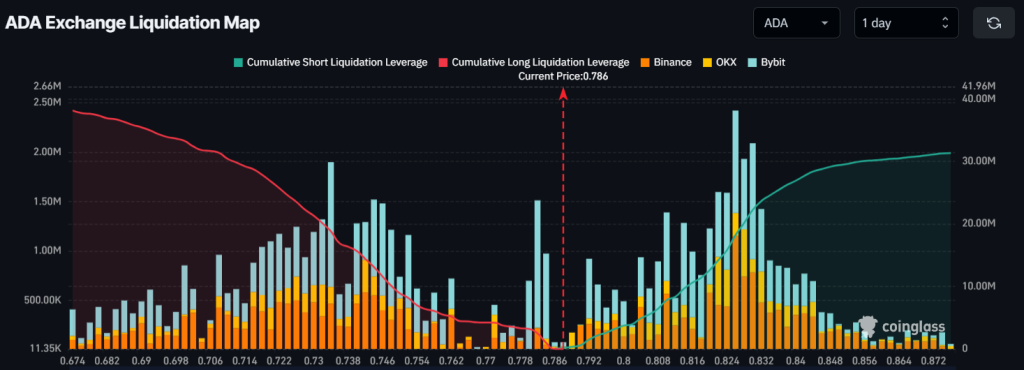

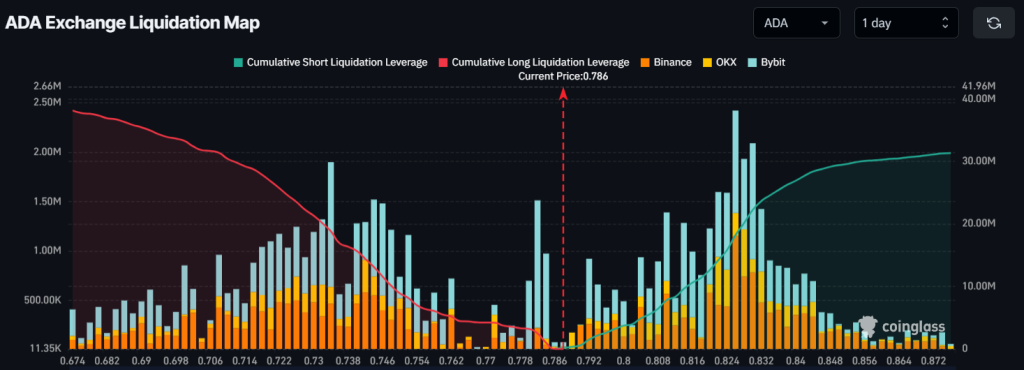

ADA main liquidation areas

Currently, merchants take a mixed approach. Nowadays, the pioneer Filter areas It is close to $ 0.734, as the number of traders who occupy long positions is excessive, with a value of $ 18.80 million in long positions. On the contrary, $ 0.826 is another liquidation level, as the number of traders who hold short positions is excessive, with $ 18.20 million of short positions.

When combining these scales on the chain and technical analysis, it seems that long -term holders accumulate symbols, while traders during the day benefit from the current market morale.