Unusual Options Activity visa – Visa (NYSE: V)

The financial giants have taken a clear step in the visa. Our analysis of the history of the visa options Fifth 97 unusual deals revealed.

After going into the details, we found that 31 % of the merchants were optimistic, while 45 % showed declining tendencies. Among all the professions that we have dedicated, 46, at a value of 2,356,363 dollars, and 51 calls, were set by 3,049,433 dollars.

Expected price movements

Based on trading activity, it appears that important investors are aiming at the price of $ 140.0 to 430.0 dollars for the visa in the past three months.

Visions in size and open attention

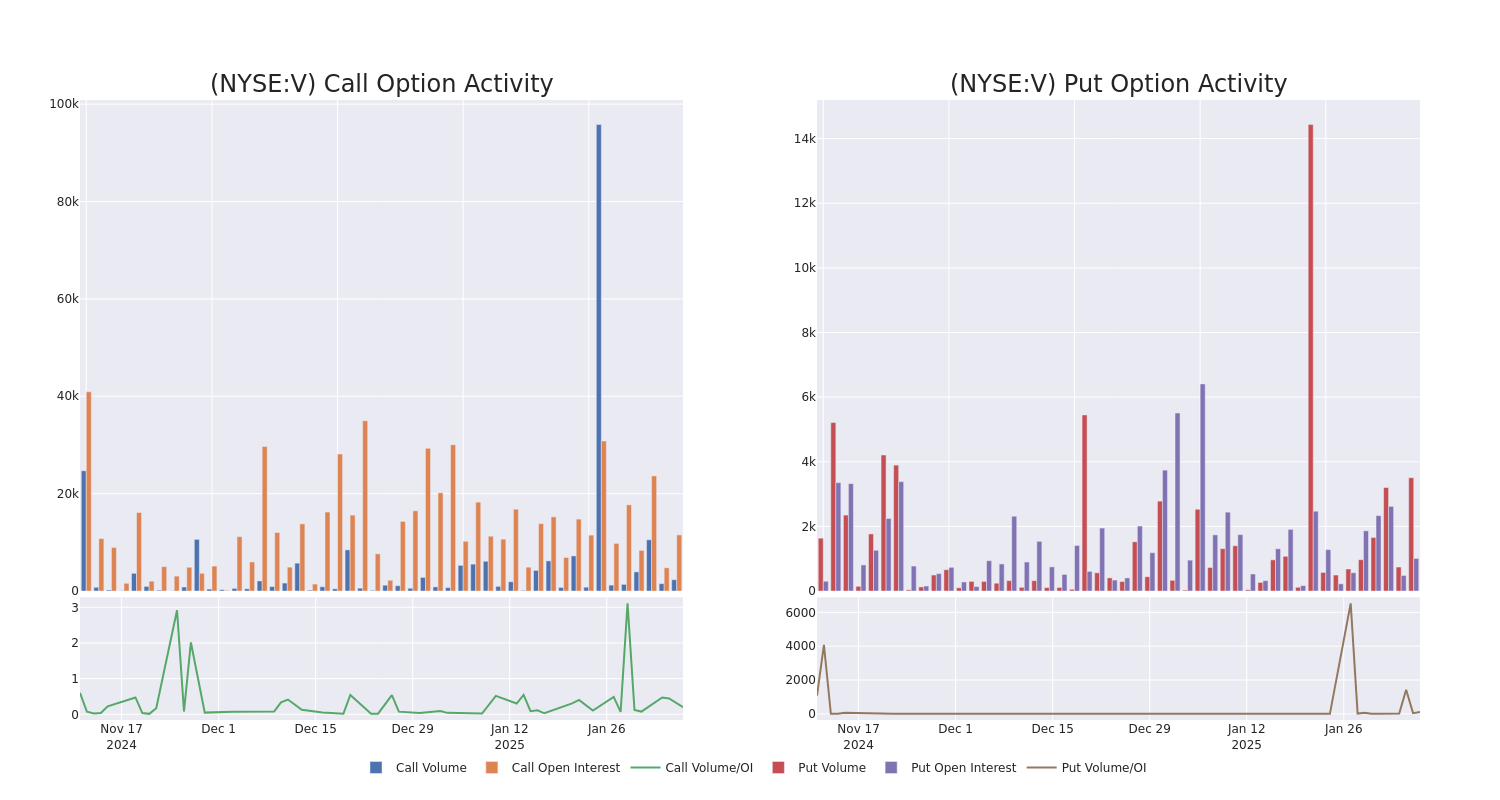

In the context of trading today, the average open interest for visa options is 696.33, with a total size of up to 5,215.00. The accompanying graph determines the development of both the size of the call, the option and the open interest of high -value trades in Visa, located in the hunger strike corridor from $ 140.0 to $ 430.0, over the past thirty days.

Visa option activity analysis: Last 30 days

The biggest options:

| code | Set/call | Trade type | Feelings | Earn. date | Asking | tender | price | Strike price | Total trade price | Open attention | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Fifth | Put | commerce | Climb | 06/18/26 | $ 25.9 | $ 25.3 | $ 25.4 | $ 345.00 | 508.0 thousand dollars | 3 | 200 |

| Fifth | Call | Sweep | Climb | 06/17/27 | 44.4 dollars | 42.5 dollars | 44.4 dollars | $ 380.00 | 88.5 thousand dollars | 231 | 56 |

| Fifth | Call | commerce | Climb | 01/15/27 | 215.55 dollars | 214.45 dollars | 215.55 dollars | 140.00 dollars | 86.2 thousand dollars | 72 | 22 |

| Fifth | Call | commerce | bearish | 01/15/27 | 217.8 dollars | 215.5 dollars | 215.5 dollars | 140.00 dollars | 86.2 thousand dollars | 72 | 18 |

| Fifth | Call | commerce | bearish | 01/15/27 | 217.65 dollars | 215.45 dollars | 215.45 dollars | 140.00 dollars | 86.1 thousand dollars | 72 | 26 |

About the visa

The visa is the largest payment processor in the world. In 2023, he treated nearly $ 15 trillion in total size. Visa operates in more than 200 countries and operating transactions in more than 160 currencies. Its systems are able to process more than 65,000 transactions per second.

The current visa situation

- Currently traded 2229,241, V -0.63 % has decreased, and now at $ 347.24.

- RSI readings indicate that the stock may be at a time now.

- The expected profit version is in 75 days.

Unusual options activity: Smart money in this step has been discovered

The unusual Benzinga Edge’s provides that the potential engines of the market are raging before they happen. Learn about the situations taken by the big money on your favorite shares. Click here to arrive.

Options are more dangerous assets compared to stock trading only, but they have higher profit potential. Dangerous options are managed by this risk by educating themselves daily, expanding the scope of trading and outside, following more than one indicator, and following the markets closely.

If you want to stay always on the latest visa trading options, Benzinga Pro It gives you options in the actual time alerts.

Overview Classification:

Speculation

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.