The FTT price rises with FTX payment date in February

The FTX TOKEN (FTT) price is rising from news that the stock exchange will start payments for the creditors of the Bahamas on February 18. Despite this positive development, FTT is still fighting to maintain higher levels than two dollars as technical indicators show mixed signals.

While the relative strength index recovered from the conditions of excessive sale and upward momentum, ADX is still weak, indicating that the strength of the trend has not been fully established yet. If FTT can break the key resistance levels, it may pay about $ 3. However, failure to obtain current support may lead to a deeper decrease.

The fetal direction fett is lost, but the upward trend is still unified

The FTT DMI chart shows that ADX has decreased to 23.4, a decrease from 41 just four days ago. This decline indicates that the strength of the previous landing trend is weakened.

ADX measures the intensity of the direction but does not indicate the direction. This means that although FTT is trying to form the upward trend, the lower ADX indicates that the momentum behind this step was not yet strong.

If ADX decreases less than 20, this may indicate monotheism, while the bounce above 25 would indicate the trend of reinforcement.

ADX is a major part of the directional movement index (DMI) that tracks the strength of the trend. Values of more than 25 indicate a strong direction, and readings that are less than 20 weak or decisive price procedures suggest.

Meanwhile, the FTX TOKEN +DI rose to 27.7 out of 14.1 in just one day, indicating an increase in bullish pressure, while -Di decreased from 26.5 to 15.3, indicating that the declining momentum fades.

This intersection, where it moves +Di above -Di, supports the upper direction. If ADX starts to rise again, FTT may see a stronger bullish continuation, but if ADX remains weak, the price may be struggled to earn momentum.

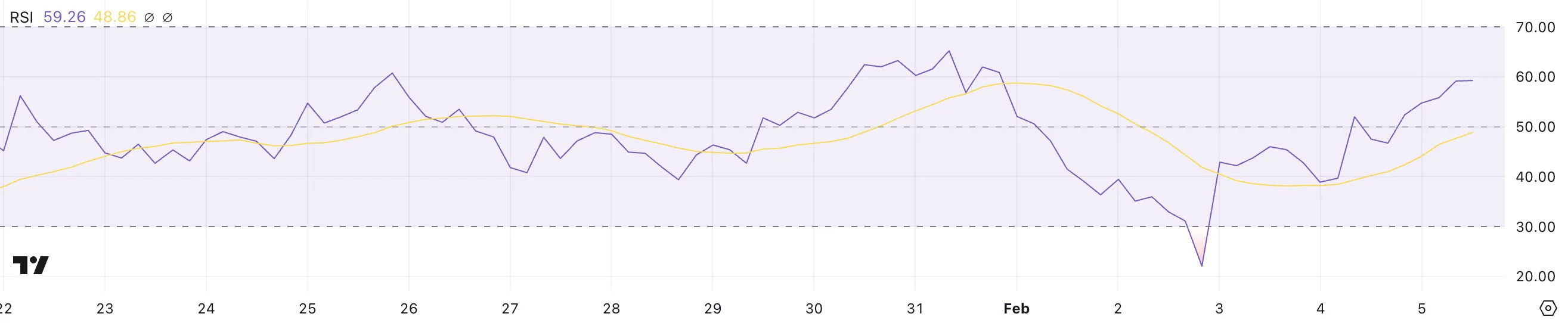

FTT RSI It rises quickly

The FTT (RSI) is currently 59.2, a significant increase from 22 days ago, after announcing that FTX will start pushing the Bahamas Islands creditors from February 18.

This sharp increase indicates that the purchase pressure has returned after FTT was in the sale conditions. The relative strength index usually indicates that the original has an exaggerated stadium and resort to a recovery, which is in line with the last price recovery from FTT.

Now approaches the level of 60, the momentum turns more up, although the FTX code still needs a higher payment to confirm a strong upward continuation.

RSI is an index of momentum that measures the strength and speed of price movements on a scale from 0 to 100. Readings above 70 indicates.

With RSI from FTT now at 59.2, it approaches the peak area but still has a room for climbing. If the RSI cross over 60, it may indicate more bullish momentum. However, if you start to decrease, FTT may unite it before making its next step.

FTT price prediction: Can FTT rise to $ 3 in February?

FTX Taken EMA lines show that short -term averages are still less than that long -term but gradually move to the top. If they cross over Emas in the long run, it will form a golden cross. This is a upscale signal that can push FTT towards the following resistance levels at $ 2.32 to $ 2.44.

A successful collapse can open over these levels the door for further transition to $ 2.77. In addition, speculation about Donald Trump can pardon the co -founder of FTX, Sam Bangan Farid, to an increase in the FTT price, which is paid by about 3 dollars or even 4 dollars.

On the other hand, if the FTT price fails to create a bullish trend, it may struggle to keep its current levels. The decline towards $ 1.89 support can indicate twice the momentum. If this level is lost, the distinctive symbol may decrease to $ 1.50.

As EMA lines continue to have a declining preparation, the market remains in a critical stage as it can be revealed either a certain interruption or deeper decline.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.