Bitcoin Hatheen marches to ATH amid price rates

The data on the series shows that the Bitcoin mining segmentation has seen a sharp rise towards a new rise in all the chaos in the market.

Bitcoin mining was increased recently

“Hashrate” refers to a scale that tracks the total computing amount of bitcoin mines as a whole. The indicator is measured by retail units per second (H/S) or the largest and most practical TERHASHHES (th/s).

When the value of this scale rises, this means that new miners join the network and/or expand their current scope. Such a trend means that these chain auditors find an attractive opportunity.

On the other hand, the fiery index indicates that some miners decided to separate their devices from the series, and perhaps because they no longer make a profit on BTC mining.

Now, here is a plan from Blockchain.com This indicates the trend in the average bitcoin mining segmentation for 7 days over the past year:

The 7-day average value of the metric appears to have spiked in recent days | Source: Blockchain.com

As shown in the graph above, average Bitcoin mining increased for 7 days to the highest level (ATH) around 817,700 th/s during the beginning days of the year, but the scale was unable to maintain these levels such as its value quickly I didn’t dive.

The index showed unification around its lowest level for the rest of January, but it seems that February has finally brought fresh winds because its value witnessed a sharp sharp trend and shattered its previous peak to record a new record of about 832,600 th/s.

This renewed expansion of miners comes in an interesting way, while the cryptocurrency is in an unconfirmed period with the exhibition of its high price in both directions.

Mining is a look at the feelings between miners, and therefore this recent increase means that these auditors in the series believe that the original will eventually come out of this period flying in the upward direction.

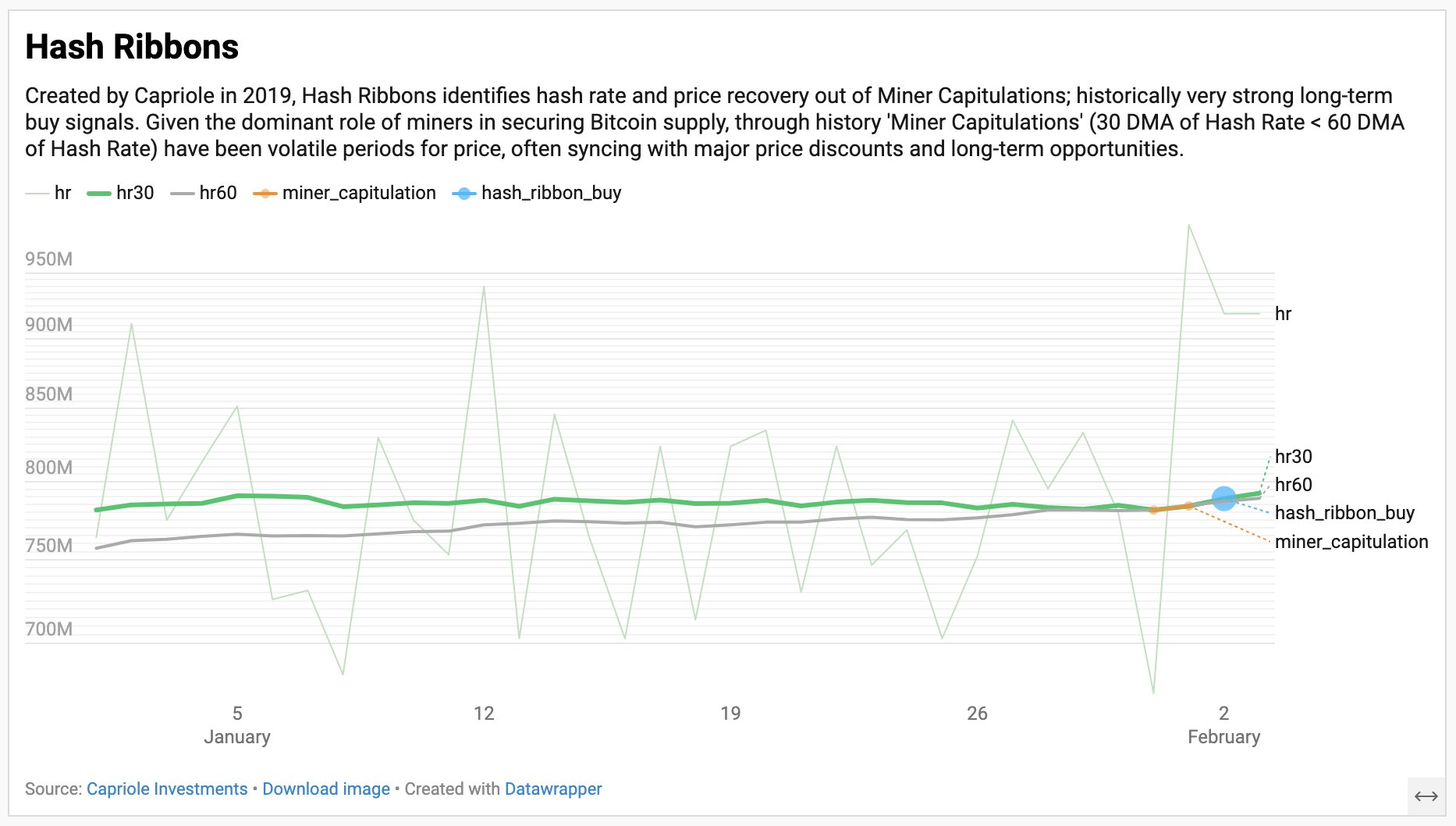

The indicator that makes it easy to use retail to track the condition of miners is retail strips. This scale consists of two moving averages (MAS) retail: 30 days and 60 days.

The founder of Capriole Investments Charles Edwards explained at X mailRetaires flabby a very brief surrender signal at the beginning of the month.

The trend in the BTC Hash Ribbons over the past month | Source: @caprioleio on X

A mine surrender occurs when MA is located for 30 days under 60 days. This intersection could not last for a long time this time as the retail noticed a sharp increase, which leads to the reverse intersection. Historically, this was a bitcoin purchase signal.

BTC price

At the time of this report, Bitcoin is trading about $ 100,000, a decrease of 3 % last week.

Looks like the price of the coin has been going through a rollercoaster recently | Source: BTCUSDT on TradingView

Distinctive image from Dall -e, Blockchain.com, Capriole.com, Chart from TradingView.com