The XRP bulls face a problem, will it decrease to $ 1.95?

After impressive price reflection, the encryption market appears again to face diving across various cryptocurrencies. Amid this, XRP, the original symbol of Ripple laboratories, is gaining great attention from encryption enthusiasts despite the continuous decrease in prices, as the analysis company reported.

Betting Binance Traders increasing on long positions

Binance XRPUSDT is long/short in the chain 2.80, indicating a strong bullish feeling among merchants. However, this scale also reveals that for every 2.80 long sites, there is one short position.

In addition, the data also shows that at the time of the press, 73.6 % of the best XRP traders in Binance are long situations, while 26.4 % occupy short sites.

Current price momentum

However, all this interest from Binance merchants comes while XRP is struggling to earn momentum. The original is currently trading near $ 2.50 and has witnessed a decrease in prices to more than 6.50 % during the past 24 hours.

Because of the uncertainty in this market, the participation of traders and investors decreased, which led to a 65 % decrease in trading volume.

XRP work rates and key levels

With this noticeable price, it appears that XRP fails to get the level of decisive support of $ 2.60, which it achieved during the large price reflection.

Based on the latest procedure for prices and historical momentum, if XRP does not refresh and close a daily candle lower than 2.50 dollars, there is a strong possibility of its 25 % decrease to reach the next support at the level of $ 1.95.

Meanwhile, the XRP (RSI) is 38, indicating that it may face a decrease in the price due to its weak strength. In addition, the SIA moving average of assets (EMA) is still less than the price, indicating the upward trend.

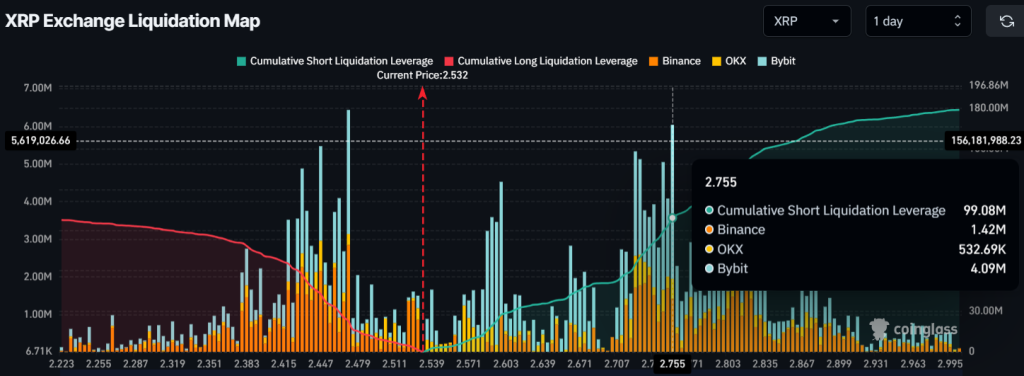

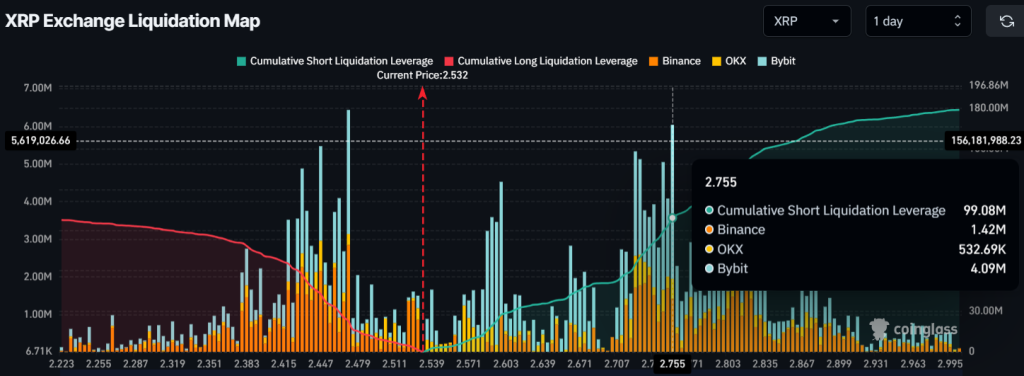

Main filter areas

With declining price momentum, traders who occupy long jobs appear to describe. As of now, the pioneer Filter areas It approaches $ 2.47 on the bottom side and $ 2.75 on the upper side, with the number of merchants in these points increased.

If the current market morale remains unchanged, the price will be reduced to the level of $ 2.47, approximately $ 22.68 million will be filtered from long positions. On the contrary, if the feelings turn and the price rises to a level of $ 2.75, approximately $ 99 million will be filtered from short centers.

When combining these scales on the chain and technical analysis, it seems that the bulls have exhausted, and that short sellers currently dominate the origins, which may lead to a further decrease in prices.