General Motors Options Activity on February 03 – General Motors (NYSE: GM)

The financial giants have taken a clear step for General Motors. Our analysis of General Motors options General Motors 22 unusual deals revealed.

After going into the details, we found that 40 % of the merchants were optimistic, while 54 % showed declining tendencies. Among all the deals that we allocated, 11 were set, at a value of 1017,669 dollars, and 11 calls, at a value of $ 680,912.

Expected price goals

When analyzing the size and open interest in these contracts, it appears that the big players are looking for a price window from $ 42.0 to $ 60.0 for General Motors during the past quarter.

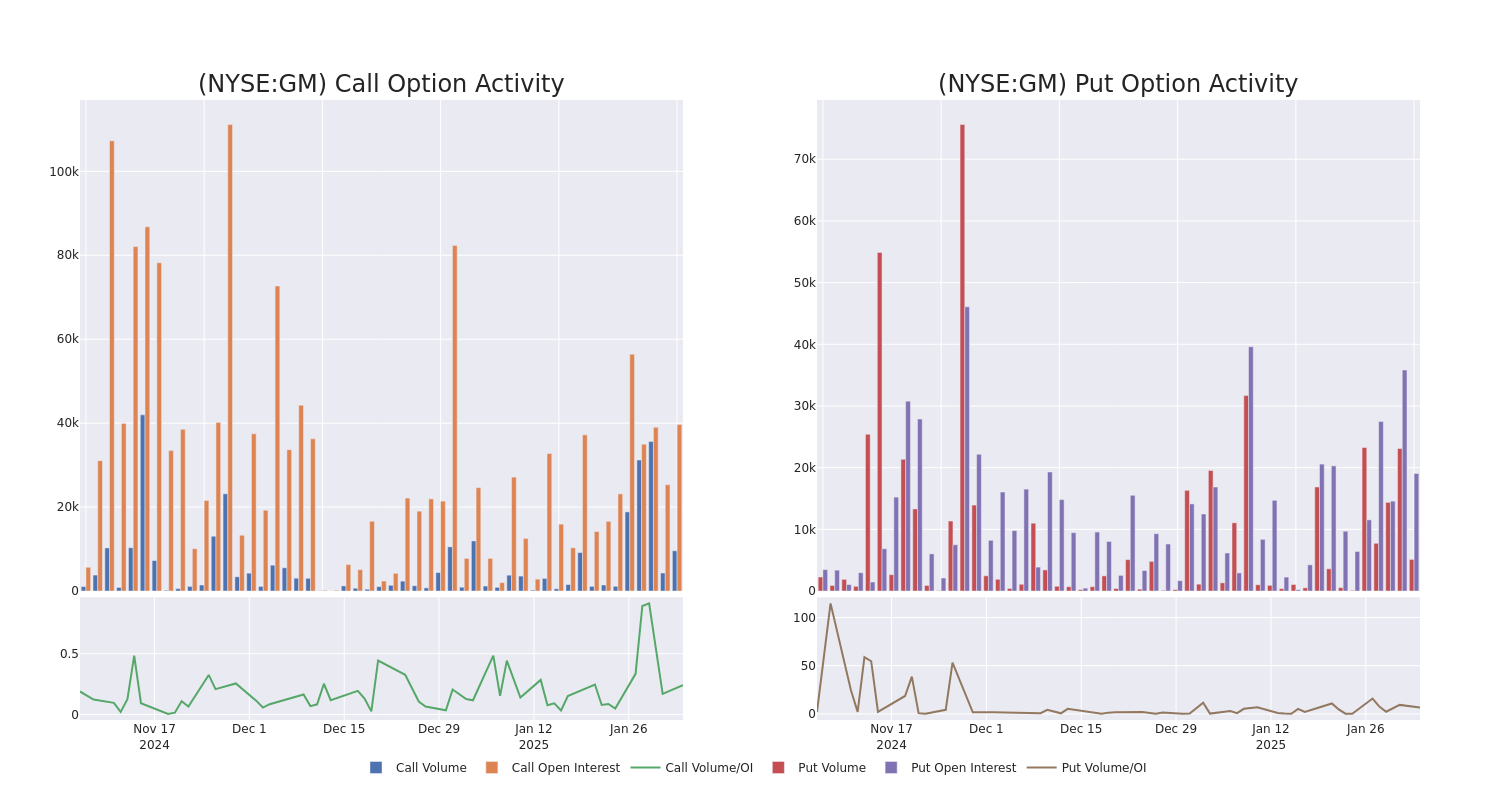

Size and develop open attention

Looking at the size and open benefit is an insightful way to perform the due care of the stocks.

This data can help you track the liquidity and benefit of General Motors options at a specific strike.

Below, we can notice the development of the size and the open interest of calls and the performance, respectively, for all the activity of General Motors whale within the limits of the strike price between $ 42.0 to $ 60.0 in the last 30 days.

GENERAL MOTORS Activity Analysis: The last 30 days

Warning options activity:

| code | Set/call | Trade type | Feelings | Earn. date | Asking | tender | price | Strike price | Total trade price | Open attention | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| General Motors | Put | Sweep | Climb | 03/21/25 | 4.6 dollars | 4.0 dollars | 4.6 dollars | $ 50.00 | 460.0 thousand dollars | 5.3k | 4 |

| General Motors | Call | Sweep | Climb | 02/21/25 | $ 1.25 | $ 1.09 | $ 1.25 | $ 50.00 | 181.6 thousand dollars | 7.6K | 332 |

| General Motors | Put | Sweep | bearish | 09/19/25 | $ 3.15 | $ 3.05 | $ 3.15 | 43.00 dollars | 171.6 thousand dollars | 241 | 545 |

| General Motors | Call | Sweep | Climb | 03/21/25 | $ 1.34 | $ 1.2 | $ 1.2 | $ 50.00 | 120.0 thousand dollars | 4.1K | 11 |

| General Motors | Put | Sweep | bearish | 03/21/25 | $ 0.8 | 0.75 dollars | $ 0.8 | 44.00 dollars | 80.0 thousand dollars | 442 | 1.0K |

About General Motors

General Motors appeared from the bankruptcy of General Motors (the old) in July 2009. General Motors has eight brands and managed by four sectors: General Motors in North America, General Motors International, Cruz, and GM Financial. The United States now has four brands instead of eight brands under General Motors. The company recovered the American session in 2022, after it lost it to Toyota due to the lack of chip in 2021. The 2023 share was 16.5 %. AV Robotaxi, which did not complete the driver of the AV Robotaxi company that was not operated in GM in San Francisco and other cities, but after the 2023 accident, General Motors decided in December 2024 that it would focus on AVS in personal vehicles. General Motors should own 100 % of cruises by 2025. GM Financial became the company’s captive financing arm in October 2010 by buying Americaredit.

After a comprehensive review of General Motors, we move to check the company in more detail. This includes an assessment of the current market condition and its performance.

The current market location in General Motors

- With a trading volume of 13,656,700, General Motors fell by -1.74 %, to $ 48.6.

- Current RSI values indicate that the arrow is currently neutral between the peak of purchase and increase.

- The next profit report is scheduled for 85 days from now.

The opinions of experts on General Motors

Last month, 3 assessments of this share issued an average target price of 53.66666666666664.

Transfer 1000 dollars to $ 1270 in only 20 days?

TRADER Pro Options for 20 years reveal the technique of one line that shows the time of purchase and sale. Copy his deals, which amounted to 27 % profit every 20 days. Click here to arrive. * In accordance with their evaluation, an UBS analyst maintains a purchase on General Motors at a targeted price of $ 64. * Wells Fargo analyst decided to maintain their lower weight loss on General Motors, who is currently sitting at $ 37. * Deutsche Bank analysts his procedures to purchase with the price goal of $ 60.

Options are more dangerous assets compared to stock trading only, but they have higher profit potential. Dangerous options are managed by this risk by educating themselves daily, expanding the scope of trading and outside, following more than one indicator, and following the markets closely.

If you want to stay up update on the latest General Motors trading options, Benzinga Pro It gives you options in the actual time alerts.

Overview Classification:

Speculation

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.