Prediction at ETHEREUM price: Is eth a good purchase in February?

The price of ETHEREUM remained under pressure on Sunday morning when Bitcoin crashed and most of Altcoins were broken. ETH decreased to $ 3,000, a decrease of approximately 25 % from its highest levels in 2025. So is it safe to buy ETHEREUM in February where the graph sends mixed signals?

Why ethereum price collapses

On Sunday morning, Al -Atheer crashed amid a constant feeling of risk in the encryption industry. Bitcoin fell below the main support level of $ 100,000. Most Altcoins move simultaneously with Bitcoin’s performance.

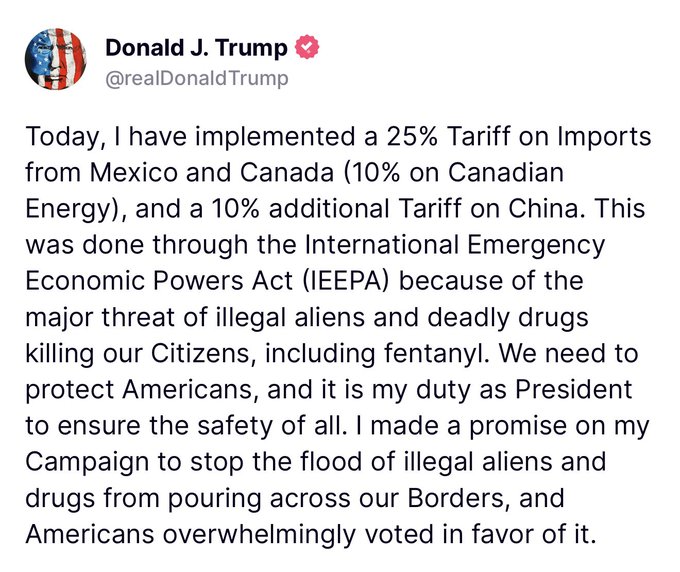

One of the main factors is that the market expects the market to be afraid of the effects of American definitions on imported goods. The United States has started implementing Donald Trump’s tariff for imports, a step that will lead to inflation in the country.

Introducing a 25 % tariff on Canadian and Mexican goods, and 10 % on that tray. In response, Canada announced a 25 % tariff for Canadian goods, which are worth more than $ 107 billion. Mexico also pledged mutual definitions even when the government called for cooperation in trade.

Trump hopes that these definitions will lead to more trade activity in the United States, which will reduce his large trade deficit. However, analysts expect to expand the deficit, reduce commercial activity, and pushes the federal reserve to maintain the view of sincerity.

The Ethereum price has also been disrupted as the ecological system data showed a possible weakness in the network. according to Davi LamaThe total closed value (TVL) in its DEFI ecological system decreased by 6.45 % at the last 30 days to $ 63 billion. TVL physical TVL amounted to $ 216 billion, while Stablecoins value for the network is 117 billion dollars.

Ethereum dex size and fees

The Ethereum price also decreased with the decrease in the size of the DEX in its network sharply. In the past 24 hours, the DEX protocols in the network treated more than $ 2.35 billion in size, much lower than BSC and Solana $ 4.4 billion and $ 4.39 billion, respectively.

These protocols have dealt with $ 18.9 billion in the past seven days, while Solana and Ethereum treated $ 41 billion and $ 24 billion, respectively. Solana DeX in the last 30 days reached $ 253 billion compared to Ethereum $ 84.7 billion.

These numbers mean that Ethereum loses its market share in the main industries it has controlled. As a result, its fees were exceeded by other networks in the encryption industry such as Tether, Jito, Tron, Solana and Circle. It has made $ 150 million of fees this year, while Circle achieved $ 151 million.

Ethereum Etf’s flows were also weak, which affects its price. Several months after ETF approval, these funds attracted $ 2.76 billion in flows, up to total assets to more than $ 11 billion. On the other hand, Bitcoin funds accumulated more than $ 40.5 billion in flows this year.

Ethereum prices analysis

The weekly graph shows that the ETH price found strong resistance at $ 4100 twice: one in March last year, and another in December last year. This means that the currency formed a dual plan, a common landmark located the neckline at $ 2,136.

On the positive side, the ETH price shaped a reverse and shoulder head and remained higher than the moving average for 50 weeks. This is a sign that the distinctive symbol may still represent a strong upward outbreak in February. If this happened, the next point was to watch $ 4,100. The step above this level will indicate more gains, and may reach $ 5,000.

Post -ETHEREUM Prices: Is eth a good purchase in February? First appeared on Invezz